Arbitrum’s (ARB) price falling below $1 might have provided a rare opportunity. At the time of writing, the token’s price was $0.94, a 56.90% drop over 90 days. However, based on on-chain data and technical perspective, ARB might recover some of these losses.

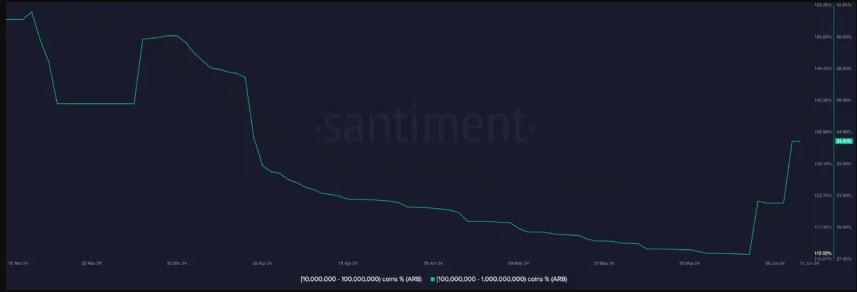

Santiment’s Whale Report

One metric fueling the bullish outlook could be whale activity. Whales are entities or individuals holding large amounts of tokens. Due to this large token supply, whales can significantly impact market prices.

According to the on-chain analytics platform Santiment, addresses holding between 100 million and 1 billion ARB have been accumulating more since June 5. For instance, this group’s supply was 27.19% on the mentioned date. However, the rate increased to 34.40%. Overall, whales purchased 251.79 million Arbitrum on June 10. This supply difference indicates that Arbitrum’s price might start a slow upward movement on the charts.

Experts had reported a few weeks ago how ARB gave a buy signal. However, indicators at that time showed that the timing was wrong. Therefore, the bullish trend could not be confirmed. This time, the situation might be different. The reason cited is the concentration of large holders in Arbitrum.

Holders in ARB

Data from IntoTheBlock shows that 88% of ARB holders are losing money at the current price, with only 4% of total holders making a profit. Additionally, 83% of holders possess a large number of tokens. The high concentration of ARB among whale addresses could mean that increased accumulation might lead to higher prices.

On the other hand, widespread selling in these addresses could cause significant price increases. Considering the increase in buying pressure, ARB might approach the key resistance level it reached on May 21. From a technical perspective, the daily chart shows the money flow index (MFI) reading dropping to 12.69. MFI uses price and volume to measure the buying and selling pressure around a cryptocurrency.