Friend.tech‘s largest airdrop recipient sold all their tokens just hours after the airdrop event, raising concerns about the token’s price movement. According to blockchain data, just a few hours after the Friend.tech airdrop went live on May 3rd, the largest whale known as Murphys1d sold over 55,000 newly issued Friend assets.

Growing Reactions to Friend Tech Team

Beyond the sale, some users including crypto investor Luke Martin, who wrote in a May 3rd post, were unable to claim their tokens during the airdrop event, raising the issue with the following statement:

“While trying to refresh the page, I see the airdrop value drop from seven figures to five in two hours. I still can’t claim my rights.”

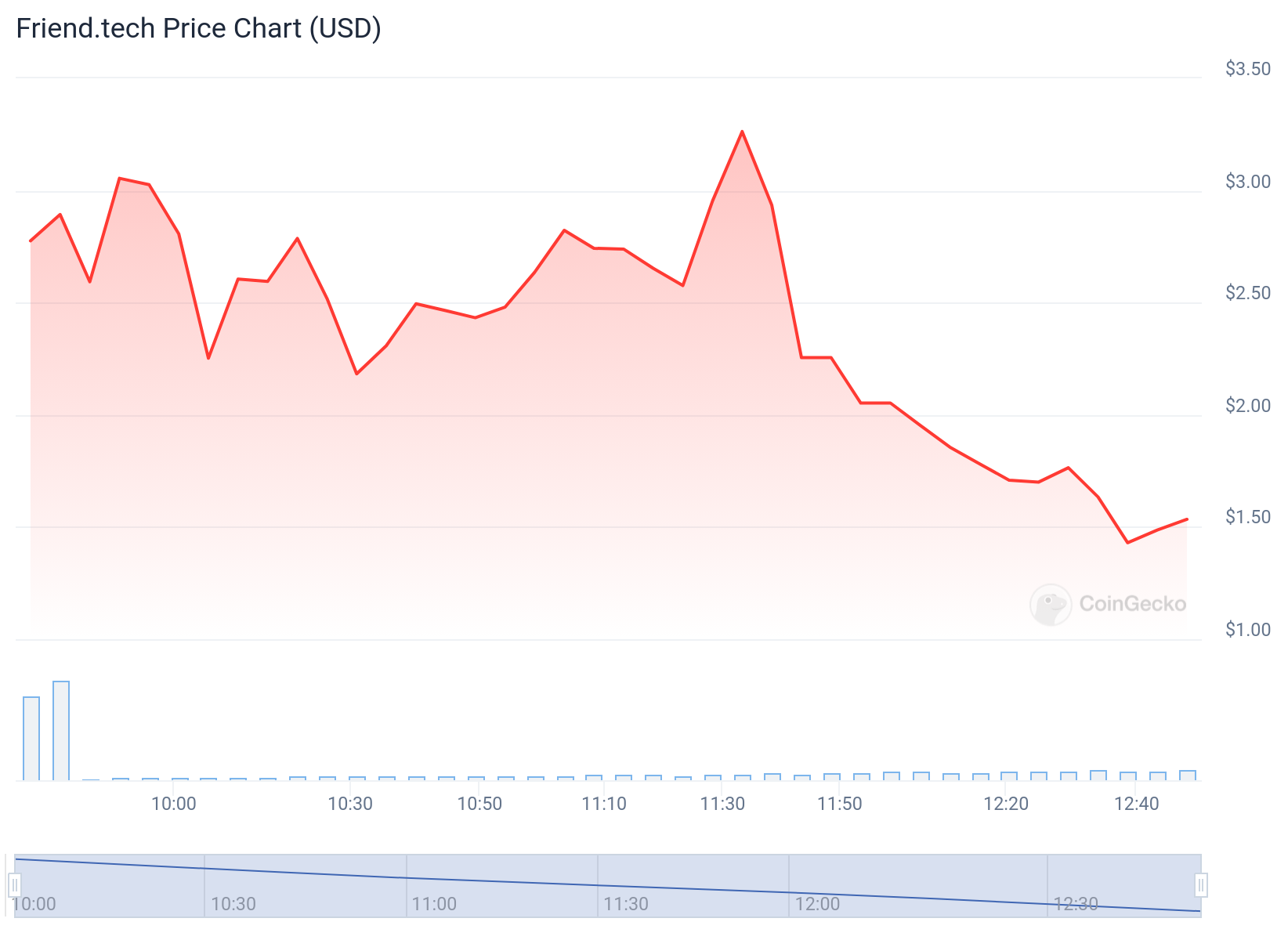

Martin added that the whale’s wallet appeared to be linked to a fake X account with no activity, which allowed for the risk-free collection of over 500,000 Friend.tech points. Since the launch of the new Friend.tech (FRIEND) token, it has shown a decline of over 52.5%, falling from $3.26 to $1.32. According to CoinGecko data, the price of the token fell by over 32% in the last hour before publication.

The sale by the largest Friend.tech whale could impact the market in the short term, but according to intergovernmental blockchain expert and author of NFT: From Zero to Hero, Anndy Lian, this does not necessarily determine the long-term trajectory of a token. Lian commented on the matter:

“While the increased supply and potential panic selling may cause a short-term price drop, it does not always mean a long-term downward trend. In my opinion, this is a good thing as it implies a more decentralized distribution of tokens. A broader distribution reduces the risk of a single organization having excessive control over the project.”

However, Lian noted that the token’s value will primarily depend on the community’s trust in Friend.tech and how the team manages the current situation.

Airdrop Events and the Crypto Market

The mysterious Friend.tech whale is another example of a professional airdrop farming operation that interacts with protocols only for airdrop rewards and often uses multiple wallets to consolidate rewards. A fundamental problem in the airdrop farming space is the tendency to sell all tokens in the market during airdrop events, creating significant selling pressure and leading to more panic selling by legitimate protocol users.

An example of this occurred at the end of April when Omni Network’s OMNI token lost more than half of its market value, dropping 55% in less than 18 hours following an airdrop event. In March 2023, it was revealed that airdrop hunters controlled $3.3 million worth of tokens from Arbitrum’s ARB airdrop event in just two wallets.