Uniswap (UNI) has been one of the most dominant Decentralized Exchanges (DEXs) in the DeFi sector for the last couple of years. Despite its growing dominance, its token has seen large price fluctuations, falling victim to the ebbs and flows of the crypto market.

Whales Flock to UNI

However, UNI might also experience a surge in its price due to recent whale activity. According to Lookonchain, a significant whale deposited 2.57 million Tether (USDT) into Binance (BNB), and subsequently, approximately 467,825 UNI tokens worth around $2.48 million were withdrawn.

This interest by whales could positively reflect on UNI’s price. As of writing time, UNI was trading at $5.44, a 50% increase after testing the $3.61 support level on June 10. The token price surpassed previous lower peaks indicated by the previous bearish price movement from the $3.613 level. A large part of this price surge can be attributed to the behavior of the whales.

Whether the price will surpass the $5.67 resistance level and continue to grow remains to be seen. Since the price began to rise after June 10, it consistently showed higher peaks and higher troughs, sufficient to form a change in the trend.

The diminishing network growth of the UNI token indicates that new addresses continue to lose interest in UNI. Therefore, the ones driving the price by accumulating more UNI might be the old owners. The excitement around Uniswap’s v4 could also be a reason for the same.

Latest Updates and Comments on Uniswap

According to Uniswap’s founder, Hayden, the gas price required to distribute liquidity pools in Uniswap will decrease by 99%. In addition to cost savings, Uniswap V4 will reintroduce local ETH support.

These announcements and other updates could encourage existing addresses to buy more UNI. It might also attract new users to the Uniswap ecosystem.

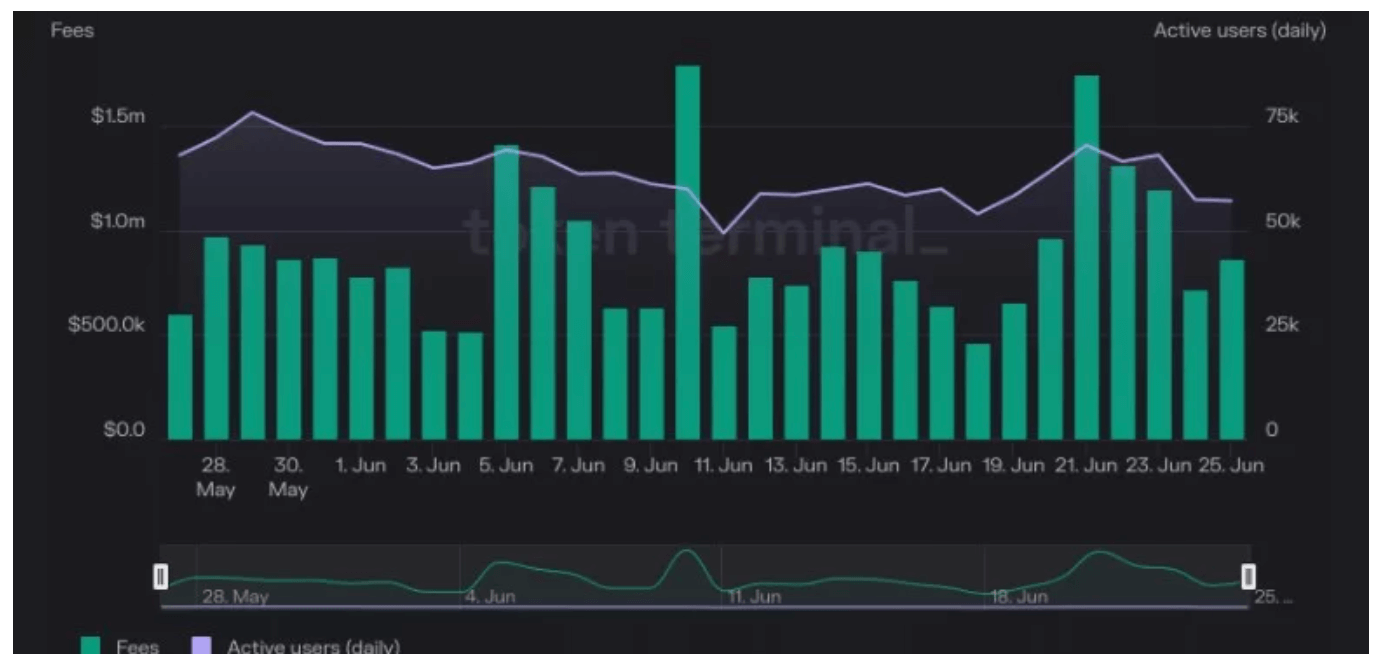

At the time of writing, active users on the network were declining. According to data from Token Terminal, the number of active addresses dropped by 16.1% last month. As a result, fees generated by the Uniswap protocol fell by 55.7% over the same period.