According to the latest data shared by crypto analysis platforms, addresses referred to as “whales” in the crypto ecosystem, holding large amounts of crypto assets in their portfolios, have been increasing their holdings again in recent times. Santiment, a crypto analysis platform, shared updated data on the transactions made by addresses holding at least 100 BTC in their portfolios in the last 12 weeks.

Crypto Analysis Platform Shares Updated Data

Despite the downward trend in the crypto market, addresses classified as “whales” who hold significant amounts of crypto assets in their portfolios have continued to add substantial amounts to their holdings in recent weeks. Addresses holding at least 100 BTC in their portfolios have added over 27,000 BTC according to the latest data.

Santiment, the crypto analysis platform, reported that addresses holding at least 100 BTC in their portfolios have added over 27,000 BTC in total in the last 12 weeks. Santiment shared the updated data on its Twitter account and included the following statement: Crypto Traders Are Rushing to This App – Here’s Why You Should Too

“There are currently 15,870 Bitcoin addresses holding at least 100 BTC. These addresses collectively hold 11.5 million BTC, which accounts for over half (%59.2) of the total circulating supply. The BTC holdings in these addresses have increased by 27,755 BTC in the last 12 weeks.”

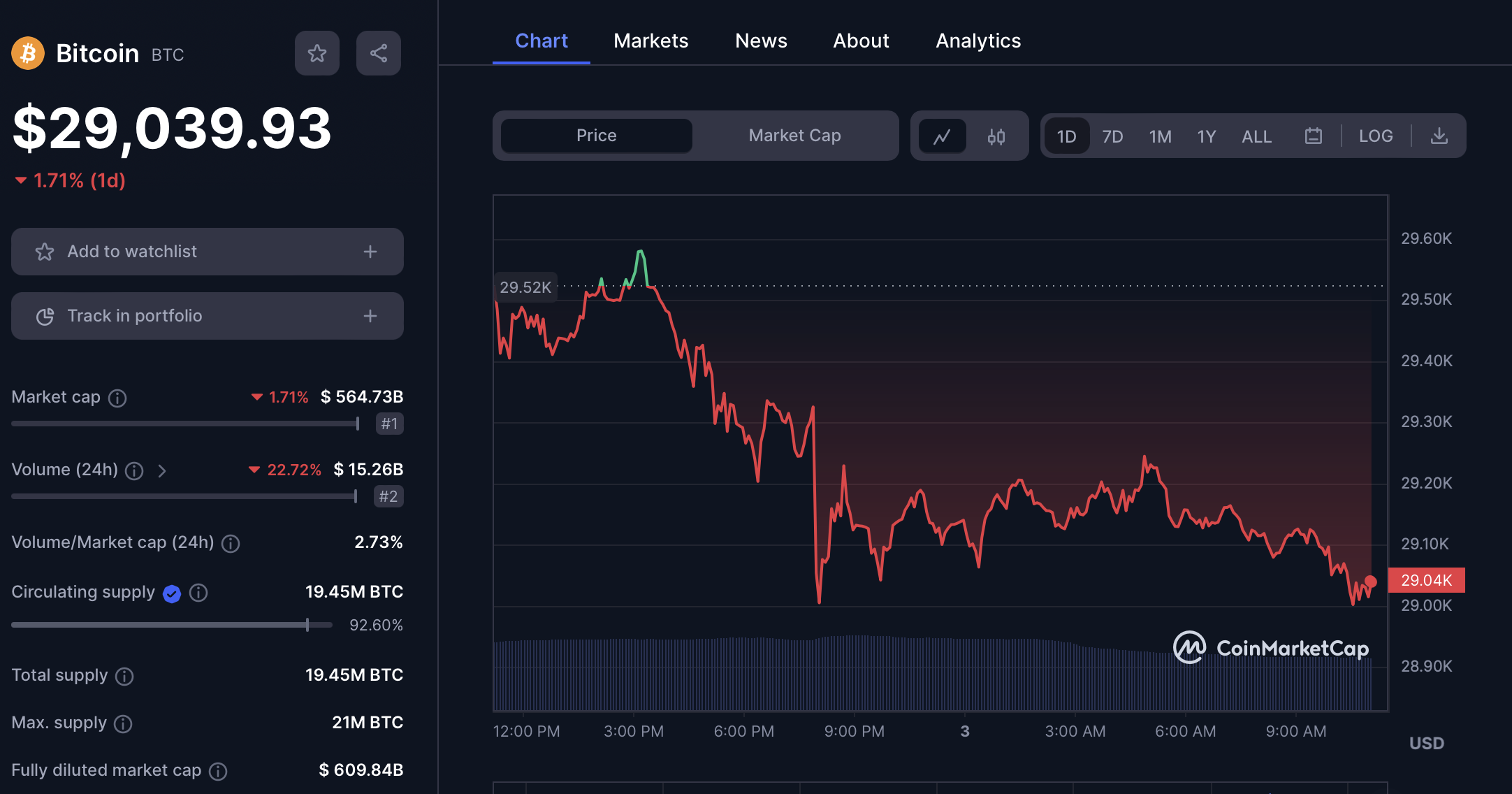

Bitcoin (BTC) Starts the Day with a Drop

The leading cryptocurrency Bitcoin (BTC) started the week with a drop. Although it approached the $30,000 price levels with the rise it recorded yesterday, it started the day with a decline and fell to the $29,000 price levels. With BTC losing more than 1.5% in the last 24 hours and dropping to the $29,000 level, many high market cap cryptocurrencies experienced losses.

Especially due to the downward trend in the market, Compound (COMP), Sui (SUI), Chainlink (LINK), Litecoin (LTC), Stellar (XLM), and XRP recorded significant losses during the day.

Türkçe

Türkçe Español

Español

Nice