Social trading is an approach that enables several individuals to duplicate the transactions of successful cryptocurrency investors. It allows investors to connect, interact, and learn from each other through an online platform or community. This investment method has gained popularity in recent years due to the rise of bitcoin and cryptocurrency platforms.

Social trading takes place on specialized platforms that serve as a hub for investors to interact, share trading ideas, experiences, and strategies. These platforms typically include social networking features such as profiles, news feeds, and messaging systems to facilitate communication and collaboration between users. Social investing platforms often provide tools for users to analyze and evaluate the performance of other investors. These tools may include rankings, historical performance data, risk assessments, and other relevant metrics, allowing users to identify and follow successful investors based on their past performance and strategies.

Advantages of Social Trading

One of the main features of social trading is the ability of users to automatically copy the transactions and strategies of other successful investors. Copy trading enables users to allocate a portion of their trading capital to implement the decisions of a selected successful investor and copy their transactions in real time.

Social trading can simplify the trading process for beginners or those with limited time and resources. In social trading, users can take on the role of leader or follower. Leaders are typically experienced and successful investors who share their trades, strategies, and forecasts with the community. Followers are users who choose to benefit from the expertise of the leaders by learning from them and potentially copying their trades.

While social trading offers various advantages such as simplified decision-making, access to successful investment strategies, and a supportive community, it also comes with risks and potential disadvantages.

Disadvantages of Social Trading

Copying the transactions of other investors may not always meet an individual’s risk situation, financial goals, or investment expectations. It is important for users to understand the associated risks and manage them accordingly.

Past performance may not be an indicator of future results, and there is no guarantee that following a successful investor or strategy will yield profits. To reduce these risks and make the most of social trading, users should adopt a balanced approach by conducting their own research, developing their investment skills, and carefully selecting the successful investors or strategies they choose to follow.

Social Trading Platforms

TraderWagon is a social trading platform that fills the gap between experienced and novice investors. If you are new to crypto trading or don’t have time to monitor the markets, TraderWagon allows you to explore, follow, and copy trades made by the best investors from around the world. If you register on TraderWagon through this link, you can benefit from a lifetime discount.

TraderWagon is a social trading platform that fills the gap between experienced and novice investors. If you are new to crypto trading or don’t have time to monitor the markets, TraderWagon allows you to explore, follow, and copy trades made by the best investors from around the world. If you register on TraderWagon through this link, you can benefit from a lifetime discount.

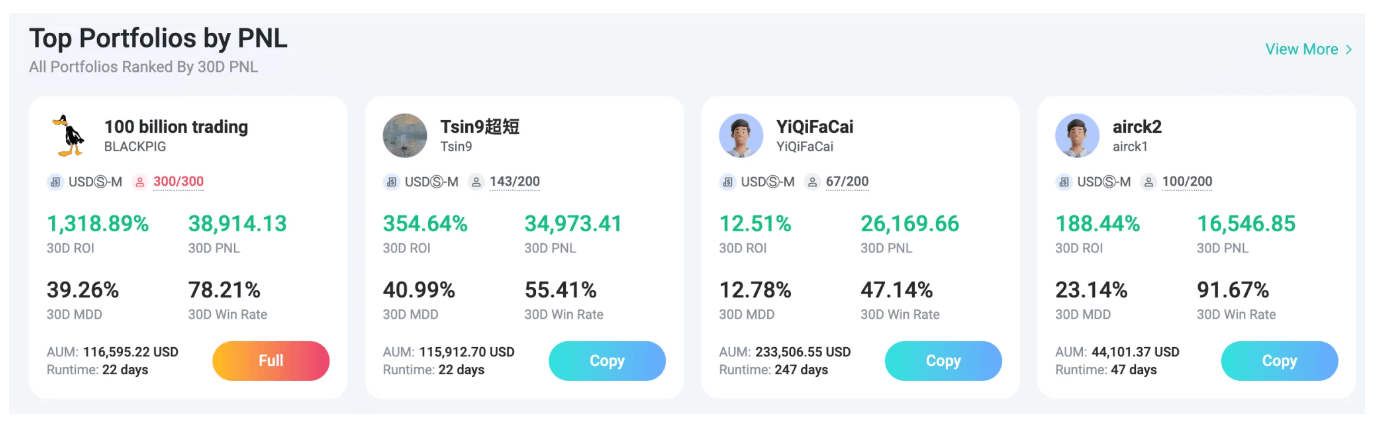

TraderWagon also enables you to do Social Trading. The idea of Social Trading is simple: It automatically copies the real-time crypto transactions of experienced and profitable investors. As can be seen in the screenshot below, the profit percentages (ROI) and profit and loss status (PNL) can be seen for the last 30 days. For example, it can be seen below that the user named Tsin9 made a profit of 354% from trading transactions in the last 30 days. The TraderWagon platform, supported by Binance, displays the trading results of investors based on transaction data supported by Binance.

There are two types of users on TraderWagon, Leader Investors and Copy Investors. Leader Investors are investors who manage their portfolios and allow other investors to follow and copy their portfolio. Copy Investors are investors who follow and copy the transactions of Leader Investors. On TraderWagon, it is possible to make a profit by copying the trading strategies of successful investors.