The halving did not surprise the old Litecoin investors. The price is steadily dropping and BTC is supporting it. The negative sentiment in the king cryptocurrency, supported by LTC’s historical halving performance, caused the decline. The price was at $82 at the time of writing. So what will happen next?

Litecoin Price Analysis

The price of Litecoin (LTC) remained in the range of $81-85 throughout last week. When we take a closer look at on-chain data, the possibility of LTC price dropping below $65 in the coming weeks comes to mind.

Halvings are significant events for every Proof of Work network. They greatly affect price movements and, more importantly, mining activities. On-chain data shows that mining activity has started to slow down since the last Litecoin halving event on August 2nd. This situation will concern whale investors, intensify the ongoing decline in transaction activity, and trigger a larger price drop. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Is it Worth Buying LTC Coin?

The halving on August 2nd caused miners’ revenue to decrease from 12.5 LTC (~$1000) to 6.25 LTC (~$500). Due to relatively stable mining costs and rapidly depleting reserves, some miners have started to quit. Data from IntoTheBlock shows that the LTC Hash Rate was around 826 TH/s on July 30th, a few days before the halving. However, it dropped by approximately 8% to 767 TH/s at the closing on August 12th, within two weeks after the August 2nd halving.

The observed decline indicates that miners are less willing to operate the Litecoin network. This move, which is one of the consequences of the historical decline pattern, also supports the price drop like a vicious cycle. Although the current LTC Hash Rate is still healthy, it has dropped below the 30-day average of 769 TH/s, indicating that the decline may continue. If this happens, the price of Litecoin may fall below the $80 support level.

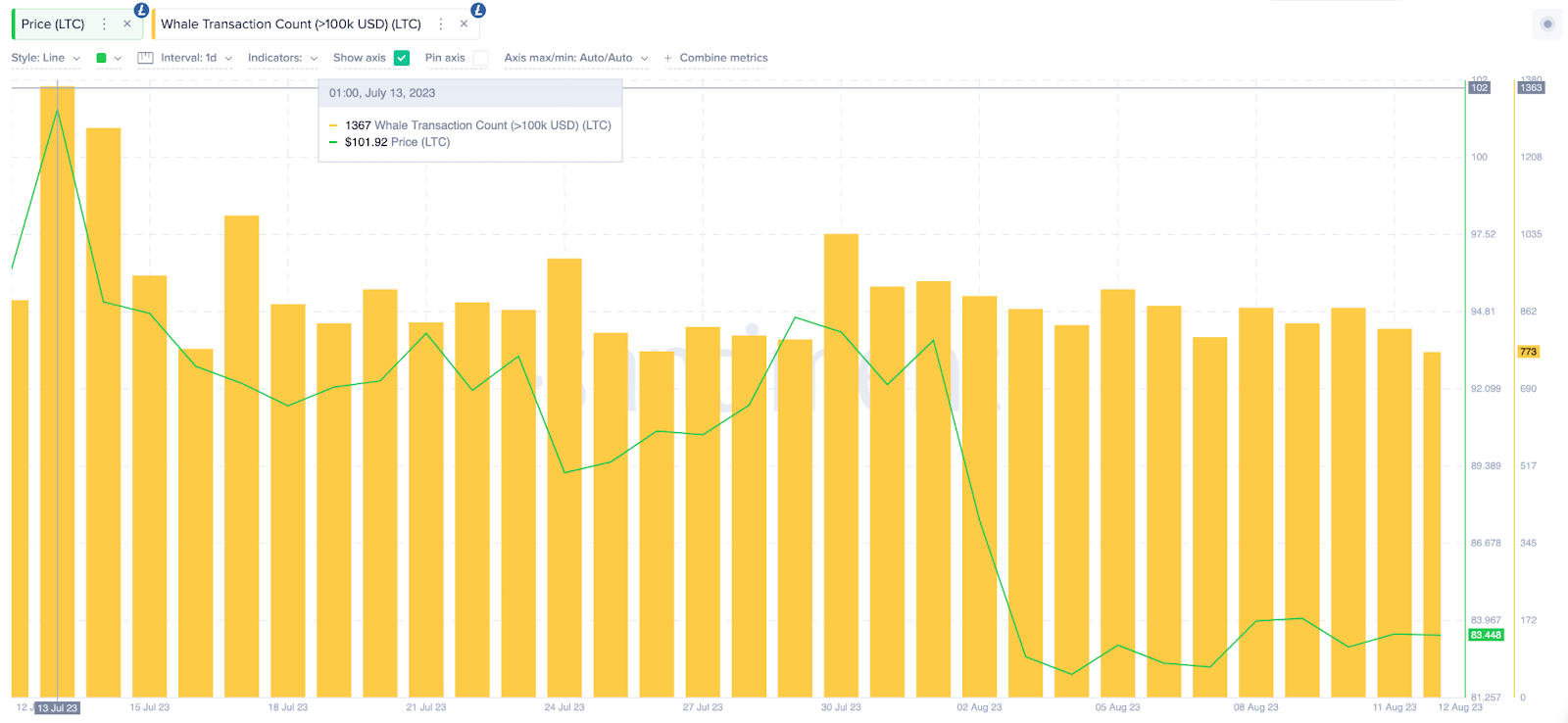

Litecoin is often praised for its high trading volume and low transaction fees compared to Bitcoin. However, worryingly, it has also halved. Whale investors who perform high-volume transactions have decreased by half.

If on-chain readings do not reverse, the LTC price could test the levels of $80, $65, and $60.

Türkçe

Türkçe Español

Español