Bitcoin and altcoins are currently on hold as they await the Federal Reserve’s interest rate decision today. The market sentiment has shifted towards risk aversion due to the upcoming decision by the Federal Open Market Committee (FOMC), facing significant selling pressure. Current data shows Bitcoin struggling to maintain above the $60,000 mark with a decline of over 5%.

What Will the Fed Do?

As is known, there has been a notable change in market expectations regarding the Fed’s interest rate adjustments. At the beginning of the year, it was predicted that the Fed would make multiple rate cuts throughout the year, but this forecast has changed, and now only one rate cut by December is expected.

Leading Wall Street banking institutions have differing views on the timing of the Fed’s first rate cut. JPMorgan and Goldman Sachs predict the first rate cut in July, while Wells Fargo expects it in September. Conversely, Bank of America predicts that the first rate cut will not occur until December. Amid these varying forecasts, some Fed policymakers are even bringing up the idea of a rate increase, further complicating the situation.

Analysts believe strong inflation data will push the Fed to maintain a high interest rate environment for a long time, but they are concerned that this approach could potentially lead to stagflation and reduce GDP growth.

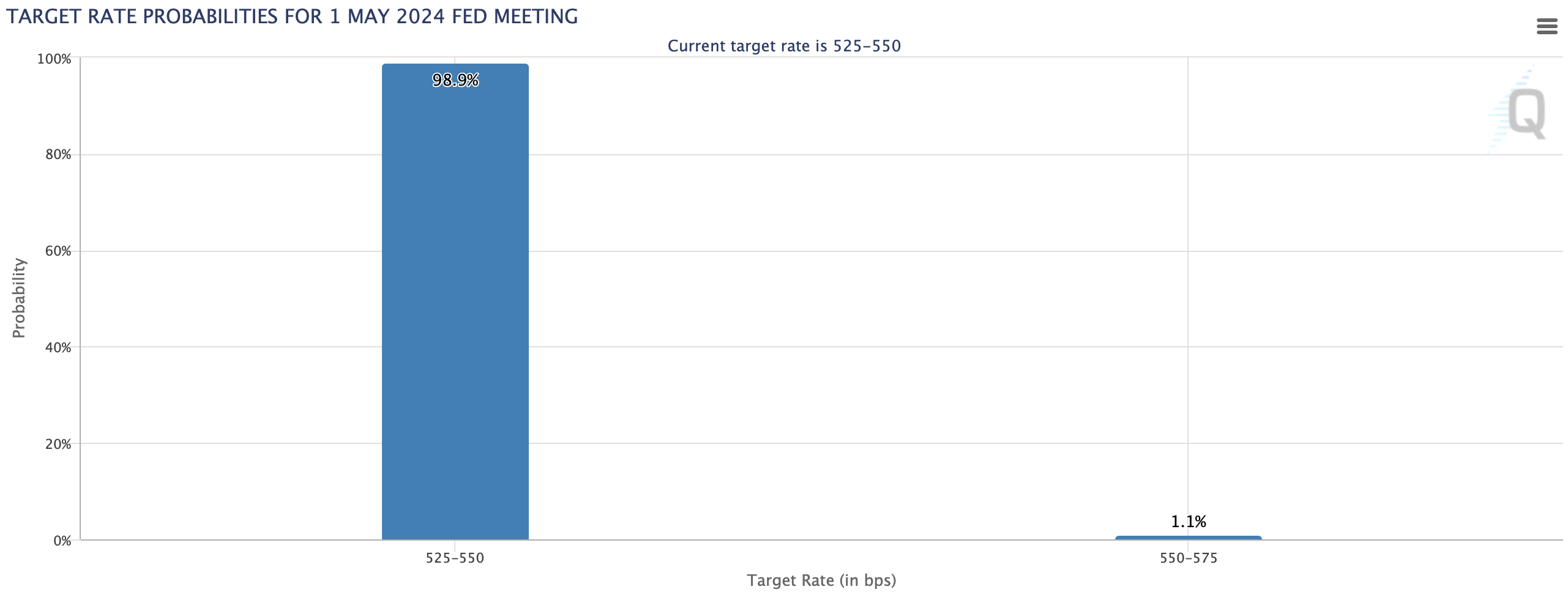

The Fed’s interest rate decision will be announced today at 21:00 TSİ, and according to the CME FedWatch Tool, there is a 98.9% probability that the interest rate will remain fixed at 5.50%. Following the announcement of the interest rate decision, all eyes will be on Fed Chairman Jerome Powell‘s press conference starting at 21:30 TSİ.

What Could Happen to Bitcoin and Altcoins After the Fed’s Interest Rate Decision?

Financial advisor Kurt. S. Altrichter emphasized that the Fed is focused on two scenarios: either keeping interest rates steady at current levels or lowering them. Altrichter assesses that if interest rates remain unchanged, stocks will find limited support and rise. In the opposite scenario, if the Fed adopts a dovish stance, he predicts a drop in US Treasury yields and a rise in Bitcoin and altcoins along with the S&P 500.

The cryptocurrency market is currently facing downward pressure on altcoins amid increasing concerns about the Fed’s stance on interest rates ahead of the FOMC meeting. The rise in the US dollar index contributes to the uncertainty in the market, indicating a flight from risky assets. However, the medium and long-term outlook for the cryptocurrency market finds a balance with expectations that assets like Bitcoin and altcoins will perform well under high interest rates and persistent inflation.