Bitcoin price was continuing its negative performance at the time of writing this article, following the recent hack news. The price was at $25,850, and altcoin investors were nervous. Investors on edge know that a possible test of $23,500 could lead to massive losses in altcoins. On the other hand, whales have started buying a popular DeFi altcoin.

The price of Uniswap (UNI) had dropped due to the SEC case surrounding Binance and Coinbase and the recent negative developments. On-chain readings show that a group of strategic whales bought the dip, which usually indicates a price increase. The SEC’s lawsuit against Binance and Coinbase, filed in June 2023, caused a fluctuation in the crypto markets.

However, Uniswap (UNI), one of the leading DEXs, quickly climbed the highest earners list after its daily trading volumes surpassed $800 million. This increase in volume was not necessarily a good signal for the market. It was caused by orders from sellers inflating the volume.

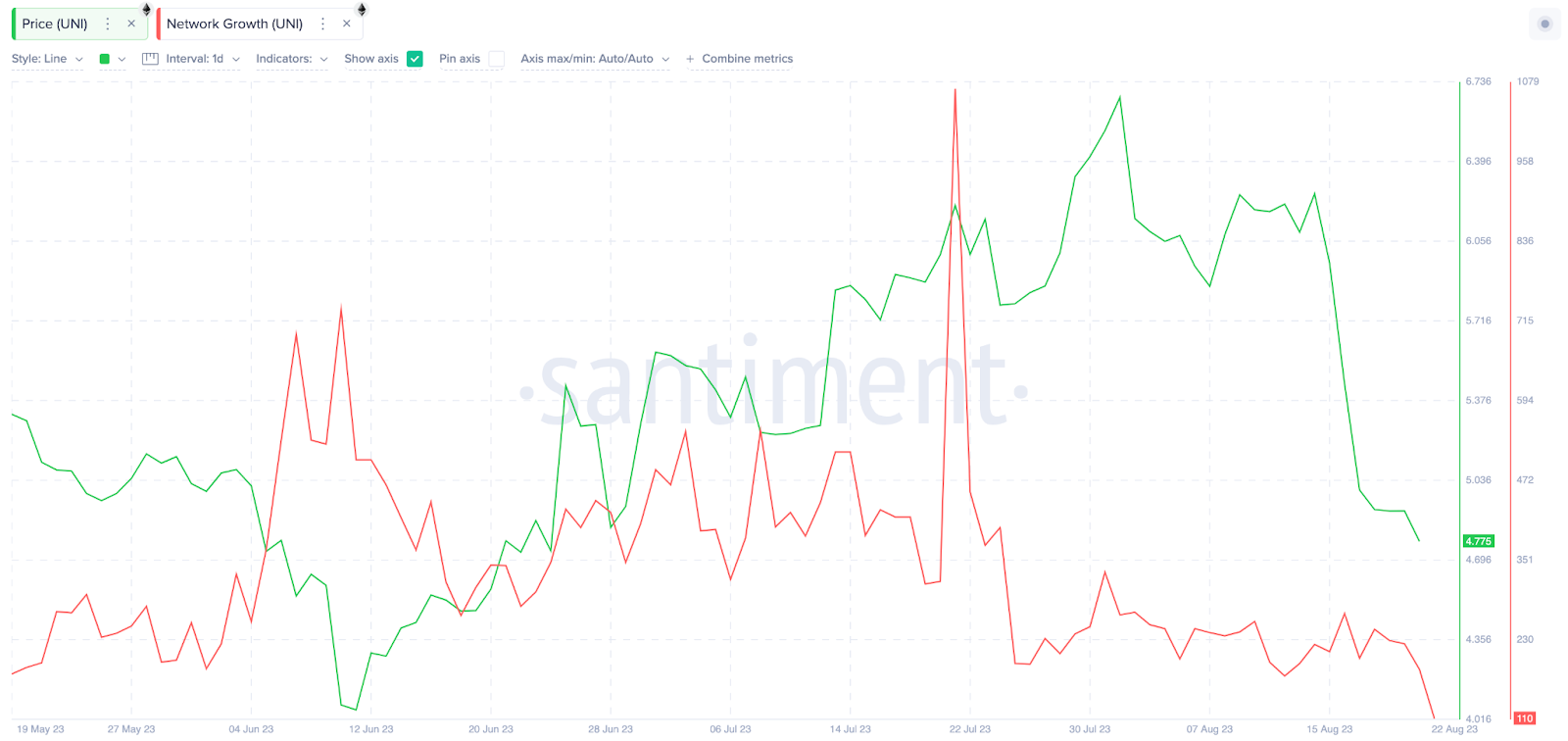

According to on-chain data compiled by Santiment, Uniswap’s user acquisition rate has recently hit its lowest level in two months. As shown below, Uniswap only recorded 185 new addresses on August 21.

Specifically, the date when Uniswap Network Growth last dropped to this level was just a few days before the announcement of the SEC’s lawsuits against Binance and Coinbase. It seems that the decline in UNI Network Growth to its lowest level in 2 months may be associated with the decrease in user acquisition due to the resurgence of CEXs in August. If this trend continues, UNI could continue to decline.

UNI Coin Whales

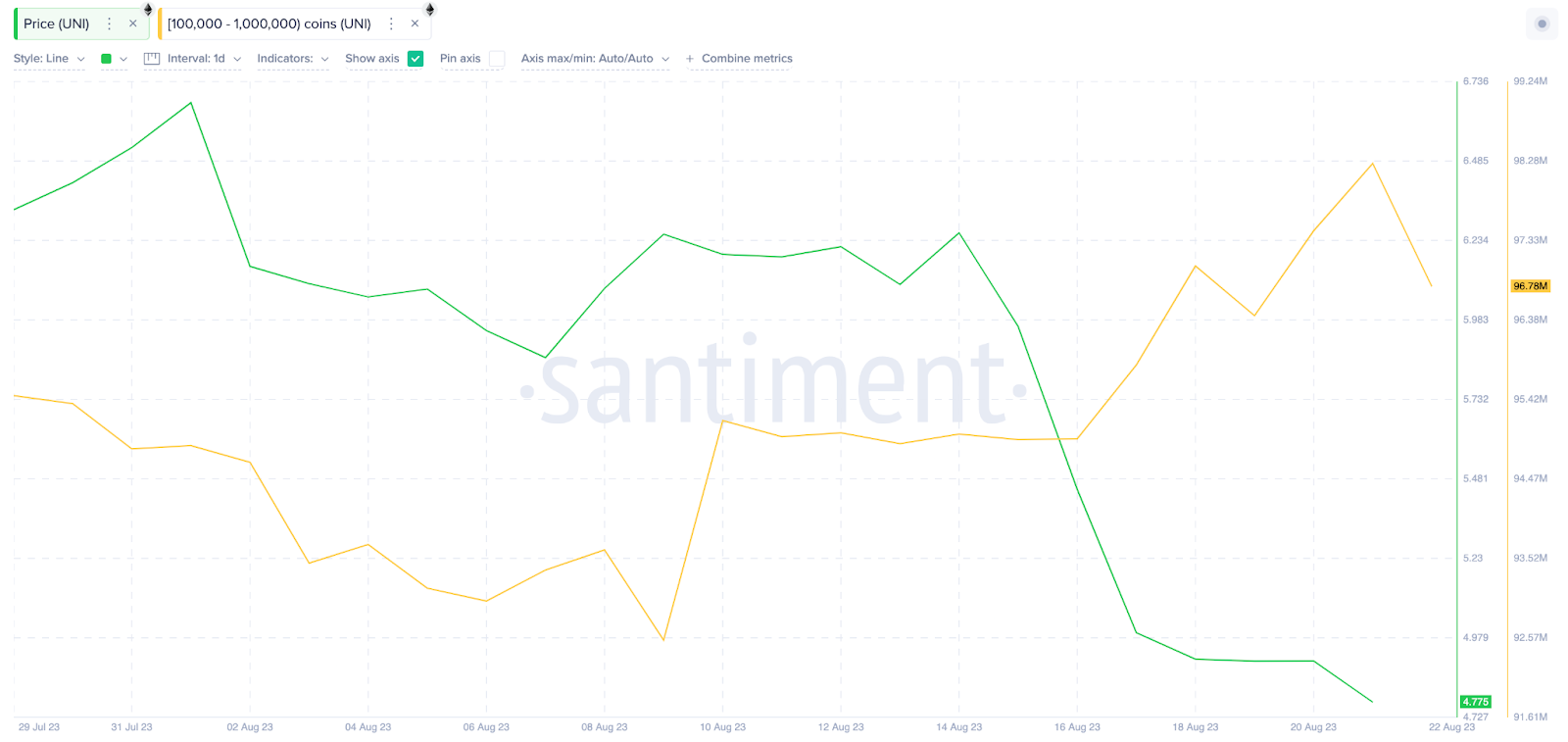

Despite the headwinds faced by the popular altcoin, a strategic cluster of whales showed resistance. On-chain data suggests that a group of crypto whales holding between 100,000 and 1 million UNI tokens bought the dip between August 13 and August 21. While the price eroded by 25%, the whales increased their holdings by 3.25 million UNI.

At the current price of $4.7, it appears that the whales made a total of $15.5 million in purchases. The fact that whales invested such a large amount during the price drop also shows their confidence in Uniswap’s medium and long-term performance.

If the BTC decline continues, we may see the price drop to $4. On the other hand, market sentiment recovery and whale interest could push the price to the $5.4 resistance level. The medium-term bullish target is around $7.

Türkçe

Türkçe Español

Español