After a few days of falling below $25,000, the king of cryptocurrencies is closing above $26,000 again. Although the price briefly rose above $26,500 in the early hours of the morning, sellers pocketed their short-term small gains. Additionally, the small short liquidity in this region has also been cleared. So how much longer will the price of BTC, stuck in a narrow range, keep them worried?

When Will the Bitcoin Price Rise?

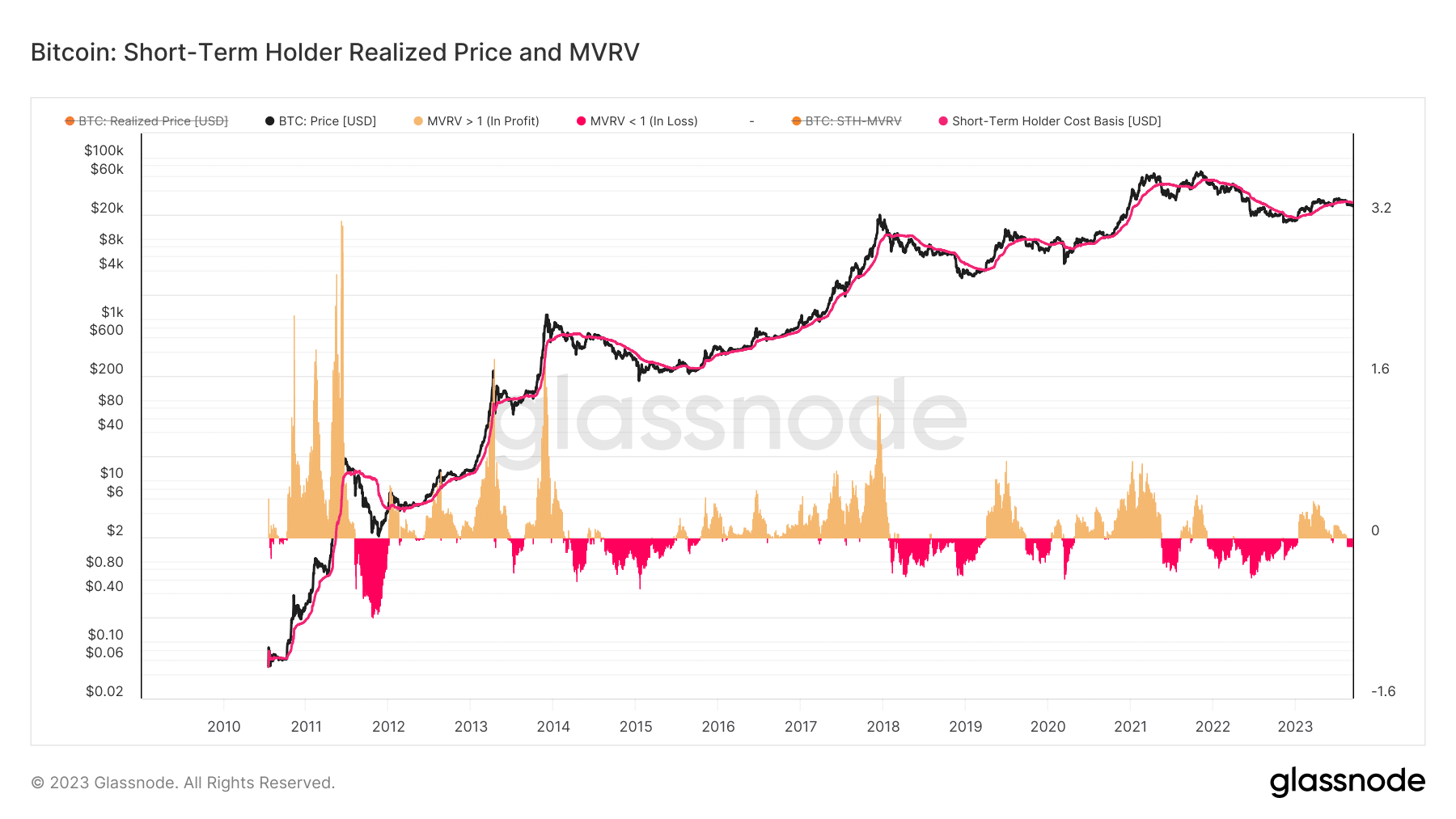

CryptoQuant analyst SignalQuant wrote in a new report that sentiment among Bitcoin investors could soon improve. We may be able to break out of this vicious cycle when BTC (LTH) exceeds the realized price of short-term investors. The realized price of BTC represents the average price at which all Bitcoins have been moved throughout their lifetimes. When the realized price is above the market price, it means that market participants are, on average, in profit.

The average cost of acquisition for short-term investors over the past 6 months is taken into account. Data from Glassnode shows that as of September 12, the realized price of BTC for short-term investors was $27,975. According to the analyst, this price range was an important resistance and support level in this year’s rally.

“BTC needs to stay above the realized price of LTH and then surpass the realized price of STH in order for the “short and long-term investor sentiment” to truly improve.”

When Will the Bull Market Begin?

For now, the price of Bitcoin continues to stay below the critical threshold. However, the consolidation of $25,800 is important as it helps postpone a deeper dip scenario. On the other hand, there is also an improvement in BTC network activity. There is a 5% increase in the number of newly created addresses. The number of new addresses created on September 9 was at a five-year high. Data from IntoTheBlock also showed an 11% increase in daily active addresses during the same period.

There is also a noticeable 8% increase in transactions in small and large groups for BTC. Although the optimism of high inflation undermines market sentiment, the necessary conditions for crypto to diverge positively in risk markets are beginning to form. Approval of a future ETF could eliminate all regulatory pressure and macro threats and revitalize the cryptocurrency markets.

Türkçe

Türkçe Español

Español