The bear market has started to make itself felt to cryptocurrency investors as of the end of 2021, and it has been going on for 2 years. Altcoins have experienced massive losses in the extreme selling environment that has been going on for almost 2 years. Even worse, we have seen dozens of crypto giants go bankrupt. So when will this downturn period finally end?

Historical Data of Bitcoin

Predictions for bull and bear seasons are based on 4-year cycles, so impressive rises are expected to occur in 2025. However, the markets that have been constantly faced with sales except for the short period of rise in the first quarter of 2023 need to experience some interim recoveries at some point. On-chain data can provide us with some insights about the trajectory of the price.

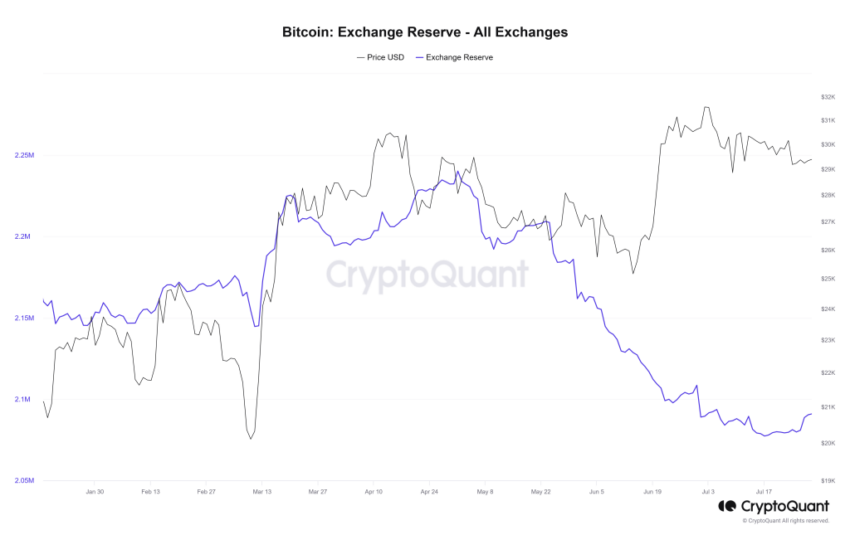

According to the data of the analysis platform CryptoQuant, the balances of Bitcoin (BTC) in leading crypto exchanges such as Coinbase, Binance, and Kraken are close to the lowest level in six years. The fact that the balance on the exchanges has melted to such an extent suggests that there is less available assets for sale and investors are transferring their long-term accumulations to their wallets.

This decline gained momentum with the sales in August and September. According to CryptoQuant, there are approximately 2.09 million BTC in exchanges, and by the end of the year, the circulating cumulative BTC supply will be at the level of 19.7 million. The difference between the circulation and exchange supply is approaching historical highs when compared.

Will Cryptocurrencies Rise?

The supply in exchanges has declined throughout 2022. The thing that initiated this decline was the problems experienced in many centralized exchanges, especially FTX. Investors started to think more about the possibility of not being able to access the exchange when they wake up in the morning. This led them to turn to self-custody wallets.

Although the outflow of the exchange supply slowed down during the first quarter of this year’s rise and banking bankruptcies period, it continued to decline later on. This trend accelerated in June when the US Securities and Exchange Commission targeted exchanges.

Despite all this, the exchange supply approaching the bottom of 6 years does not promise us a definite short-term rise. There is still uncertainty on the macro front. There is a risk of the US Department of Justice filing a lawsuit against Binance, and the possibility of the government continuing to sell SilkRoad BTCs is worrying investors.

Türkçe

Türkçe Español

Español