There are thousands of altcoins in the cryptocurrency markets, but most of them have been decimated in bear markets. Altcoins that are not good enough in terms of utility cannot go beyond short-term speculative gains. On the other hand, there are those who have ambitious goals like being the “computer of the internet” such as Ethereum and are running towards these goals.

Which is the Best Altcoin?

Ethereum (ETH) is not only the largest altcoin in terms of market capitalization but also the best in terms of utility and investor interest. Most popular smart contracts operate on the Ethereum network, and this is the largest ecosystem for smart contract platforms.

According to a Chainalysis report, Ethereum (ETH) wallets make up the majority of crypto participants as of July 2023. While the number of Bitcoin (BTC) wallets reached 50 million, the number of ETH balance-holding addresses increased to 79 million. Moreover, this increase is happening in bear markets where interest in NFT and DeFi has weakened. This data, which shows that the activity on the Ethereum network will continue to increase, is quite important. The more transactions there are on the network, the more burning there will be, and ETH’s negative inflation will grow.

With 4,500 wallets holding 50% of the Bitcoin asset supply, it faces the lowest volatility risk. On the other hand, ETH offers the highest price fluctuation chance because only 131 wallets make up half of its supply.

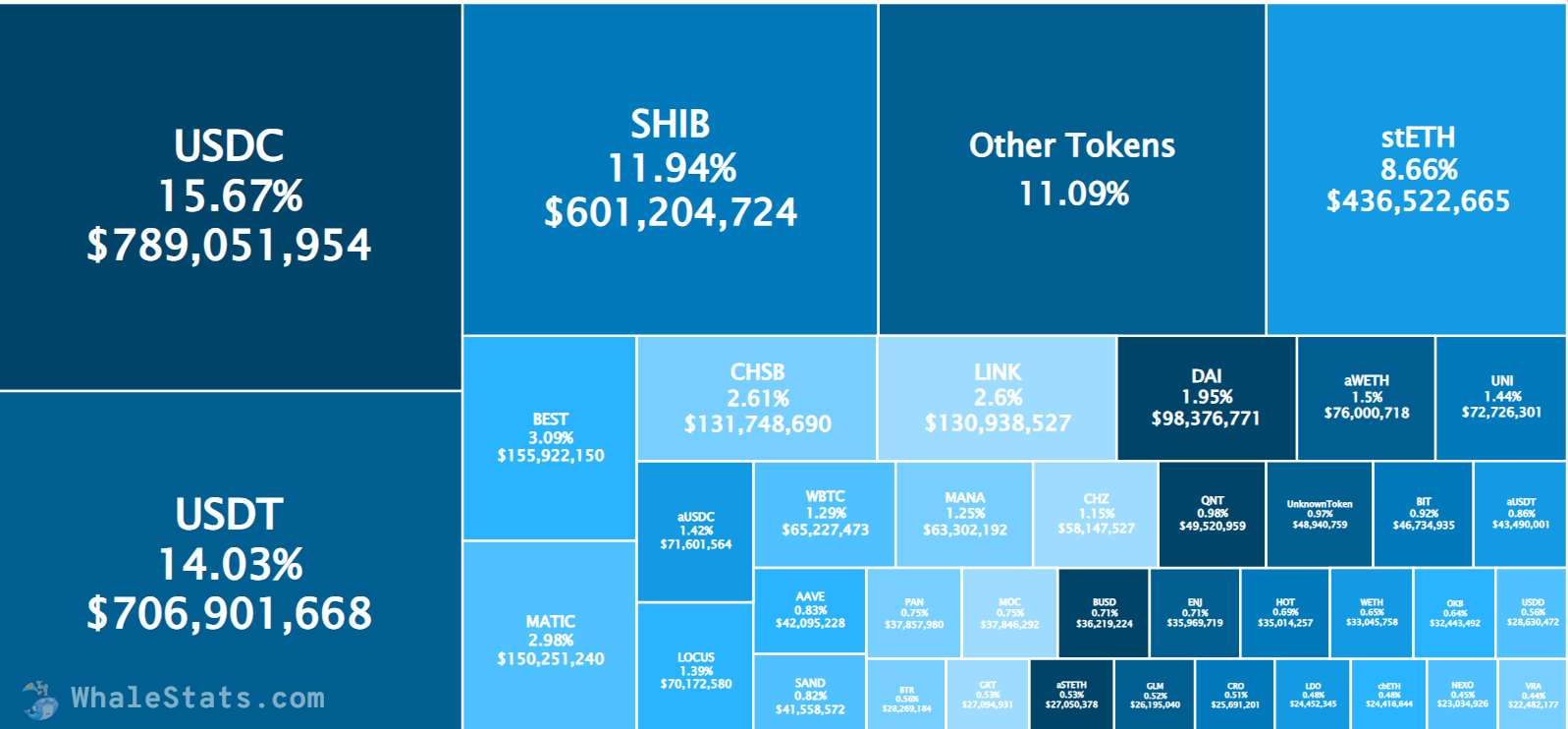

Most Bought Cryptocurrencies

As of July 2023, active wallets hold about two-fifths of USDC supply and almost half of all ETH. ETH and USDC activity is likely related to the widespread use of the pair in decentralized finance (DeFi). Investors often convert the US dollar to stablecoins like USDC to use them in decentralized financial services.

You can see the altcoins bought by the top 100 Ethereum wallets below. This group of investors mostly represents the oldest and wealthiest investors in the market.

Ethereum is one of the assets preferred by long-term investors. Negative inflation, the steps it plans to take in terms of scalability, and the expectation that it will be the center of the multi-chain world fuel this motivation.

Türkçe

Türkçe Español

Español