During the preparation of this article, the king of cryptocurrencies, Bitcoin, dropped below $35,000 and briefly touched $34,800. The losses for altcoins were even greater. Today’s drop was surprising for investors, and there was no significant development on the macro front that triggered the decline. Just like the rapid test of $38,000, we are witnessing a surprising drop.

Bitcoin’s Decline – What’s the Reason?

The inflation data was positive, and the expectation of a rate cut in July increased from 25bp to 50bp. The expectation of the first rate cut in the May meeting increased by more than 10%. But why is Bitcoin falling? The first reason for this could be related to the expectation that the decision on the spot Bitcoin ETF this week will be postponed. It is normal for a decline to occur with the ETF postponement decision, and investors may be taking early positions for this reason.

User anlcnc1 on account X drew attention to the positions on Deribit exchange.

“Despite the market‘s decline, someone on Deribit entered at 1 PM and did not exit. There are still entries at the level where Bitcoin touched. There is a possibility of a long position. It seems that new levels are about to unlock on the Bitcoin side. I hope Deribit doesn’t deceive me twice.”

He made this post about 3 hours ago and announced that the positions were closed without a further acceleration of the decline 1 hour ago.

This also indicates that the institutional demand quickly diminished and the price dropped due to spot selling. Since we are accustomed to speculative movements, there may not be a clear reason for this trend. It may be related to the cooling of the rally that gained momentum with the story of collective approval until November 17th.

Bloomberg ETF Analyst James Seyffart said the following on November 8th;

“We give a 90% probability to the approval of spot Bitcoin ETFs by January 10th. If the institution approves all 12 applications at once, we may see a decision by November 17th. If it approves all of them, it will be the first opportunity since the approval of Grayscale’s court victory.”

Where Will the Decline Stop?

Many experts point out that the decline in Bitcoin may pause between $34,400 and $34,200. This support level is important for a rally. If we see closings below $32,000, the expectation of a rapid medium-term rise can be significantly undermined, and we may see more selling.

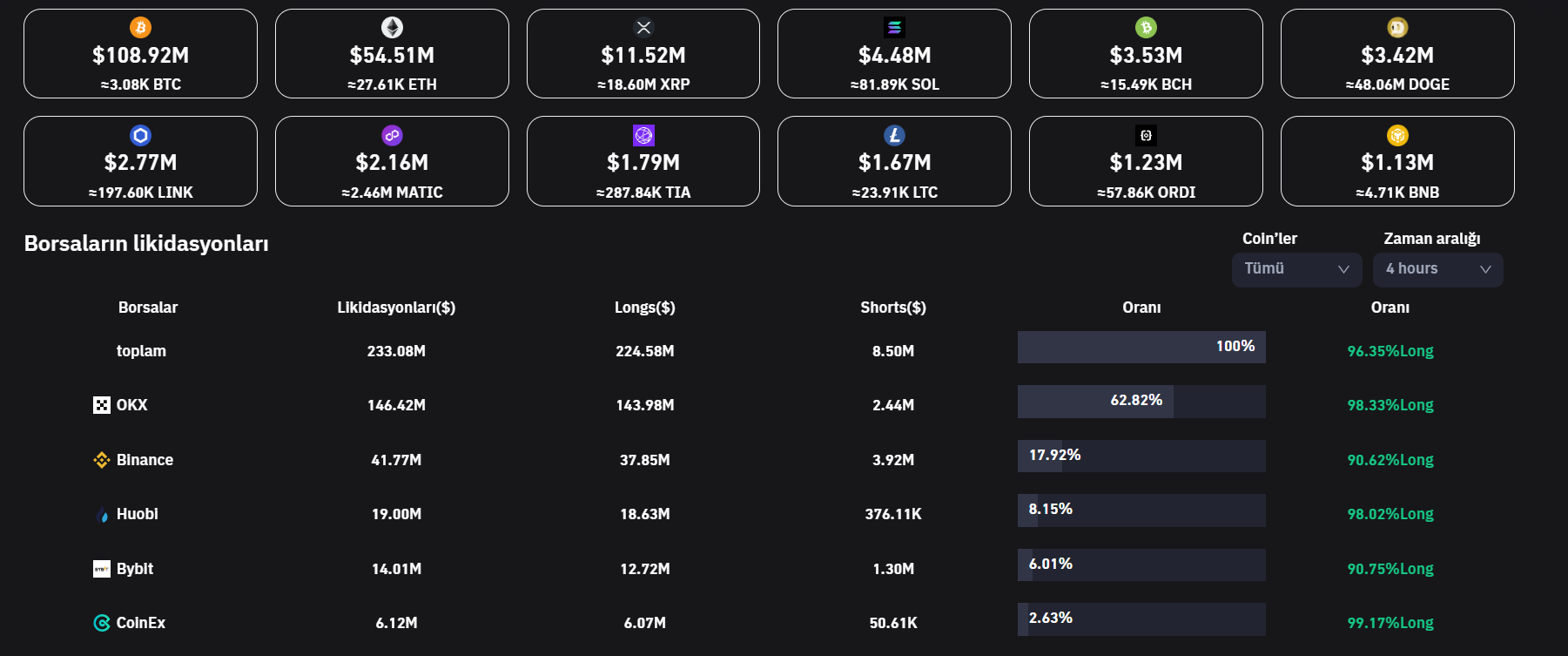

The cumulative value of cryptocurrencies has dropped to $1.35 trillion, and if BTC does not recover quickly, the support level of $1.25 trillion can be tested. In the past 4 hours, $224 million worth of long positions were liquidated in the BTC and altcoin decline.

Türkçe

Türkçe Español

Español