Bitcoin recently experienced a pullback to the $25,000 level and even below, which many expected. However, this retreat has deterred investors from taking new positions and kept them away from the market. The significant reversal of the upward trend in BTC‘s price is causing further negativity in the deteriorating cryptocurrency market. The lack of active participation usually seen in investors after declines resulted in Bitcoin rising above $26,000 and staying above this level. The attempt to climb to $27,000 faced resistance at $26,282, with bulls piling up towards the $25,000 level, anticipating a downward movement.

Bitcoin Bulls in Extreme Fear

Enthusiastic investors in the cryptocurrency market typically act based on their awareness of Bitcoin cycles tied to the upcoming halving of block rewards, which will occur in April 2024. These cycles are characterized by periods of excitement and fear, which respectively indicate the beginning of pullbacks or bull runs. According to experienced cryptocurrency analyst DrProfitCrypt, the last bull run at the end of 2020 was triggered by the absolute fear that arose during the Coronavirus (COVID-19) period.

The selling pressure triggered by COVID-19 propelled Bitcoin into a parabolic climb, reaching an all-time high of $69,044. DrProfitCrypto added that “Bull markets always start with extreme fear, while bear markets always start with excitement.”

However, what sets apart smiling investors during bull runs from those who buy with excessive excitement is timing. Although buying during market downturns has proven to be one of the best strategies for increasing the value of cryptocurrencies over time, very few investors have the confidence to buy in the midst of ongoing declines, such as the current market downturn.

Crypto analytics platform Santiment reported that investors who want to buy are staying away from the market out of fear that the price will drop further and provide a real opportunity for discounted prices.

What’s Next for BTC Price?

Bitcoin is seen to have found a balance in the midst of expectations that it will drop to $20,000 and is hovering around the $26,000 support level. Investors fear that these declines will put them at risk, and the lack of a guarantee that the decline will not continue below $20,000 fuels this fear.

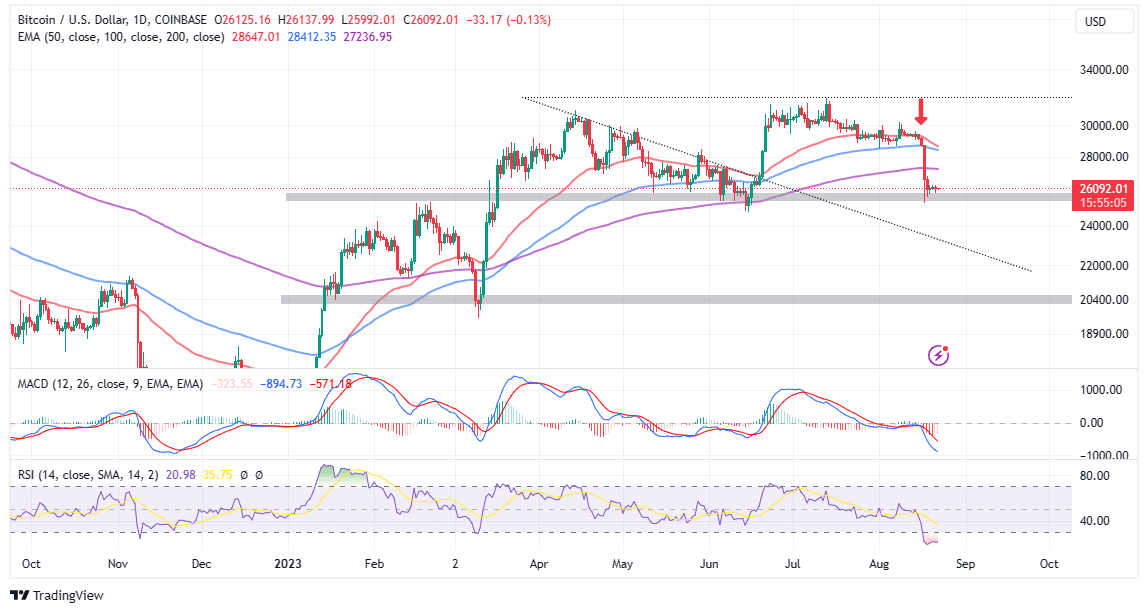

The positive inclination of the Moving Average Convergence Divergence (MACD) in the negative zone on Bitcoin’s price chart encourages investors to hold their positions. The selling signal that came when the blue-colored MACD line crossed below the red-colored signal line at the beginning of July was confirmed again last week, leading to increased selling pressure.

On the other hand, if bears continue to hold BTC at the $26,000 level and there is no upward bounce, another decline is inevitable. As shown on the price chart, support from the descending trendline could allow bulls to recover the price from $22,000 and avoid a deeper drop to $20,000. It is worth noting that recoveries tend to occur during the most uncertain periods, despite the weakening structure of the cryptocurrency market.

Additionally, Bitcoin’s Relative Strength Index (RSI) is currently much lower than the level reached during the significant COVID-19 crash in 2020. The oversold condition on the price chart indicates that Bitcoin is trading below its true market price, which usually results in more significant price recoveries. In this case, caution should be exercised, and quick decisions should be made as dictated by the current situation.

Türkçe

Türkçe Español

Español