Bitcoin experienced a sharp decline over the past few days, which may have triggered concerns among those expecting a post-halving rise. Since the fourth Bitcoin halving event on April 20, the price has dropped by 11%. On the date of the halving, Bitcoin was trading around $64,000. Shortly after the halving event, it saw a brief rise, reaching over $67,000 on April 22.

Why Is Bitcoin Falling?

During this period, according to CoinGecko data, Bitcoin has gradually sold off, falling below $57,000 on May 1. At the time of writing, Bitcoin is trading at $57,362, down about 7% in the last 24 hours and over 17% in the last 30 days.

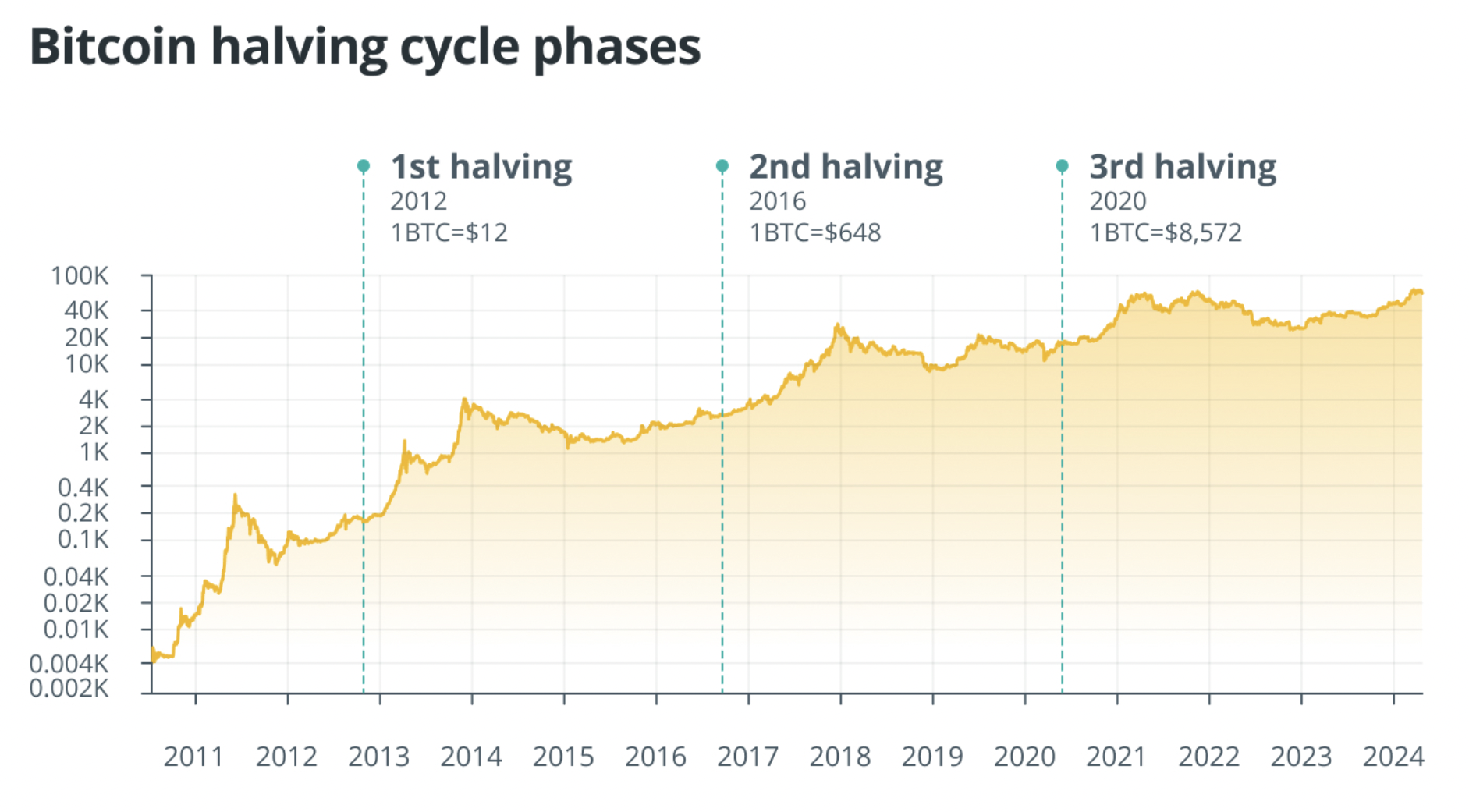

The post-halving drop in Bitcoin’s price may have surprised someone expecting it to start rising soon after the halving, as had happened in some previous halving-related cycles. As previously mentioned, Bitcoin halving events are historically associated with post-halving rallies, usually occurring over about a year or longer. For example, after the 2016 halving event, Bitcoin showed an approximate 3000% increase over 17 months, reaching a milestone of $20,000 in December 2017.

However, the ongoing cycle was very different in terms of Bitcoin halving characteristics. One difference was Bitcoin’s extraordinary bull run prior to its fourth halving event and reaching an all-time high just before the event. Such a price trajectory had never been seen before in Bitcoin’s history.

Comments on Bitcoin from Prominent Figures

Quantum Economics‘ founder Mati Greenspan commented that despite this recent pullback, Bitcoin has still shown a 35% increase since the beginning of the year. Greenspan noted that the current price drop in Bitcoin was somewhat expected given the stock market downturn and economic conditions:

“Considering another Fed pivot and ongoing stock market events, Bitcoin’s current price movement is not surprising. However, we will be wiser about this later today.”

Some crypto analysts had previously predicted that Bitcoin would fall after its fourth halving event. In March 2024, Bitcoin analysts from JPMorgan forecasted that Bitcoin could drop to $42,000 after the halving event.

According to Markus Thielen, CEO and chief analyst at 10x Research, Bitcoin could drop to $52,000 after the halving event. The analyst believes that the main driving force behind the recent Bitcoin rally was the significant slowdown in Bitcoin exchange-traded fund inflows last month. According to some analysts, including investment researcher Lyn Alden, there are many reasons for Bitcoin to reach new highs in 2024, beyond the halving and U.S. Bitcoin ETFs.