After Bitcoin‘s price dropped to $38,555, it climbed back above $40,000. Altcoins have become more active. Although some altcoins have achieved double-digit gains, they are still far from the peaks during the days when ETF pricing was present. So, what does the current outlook for the cryptocurrency markets indicate?

Will Cryptocurrencies Ascend?

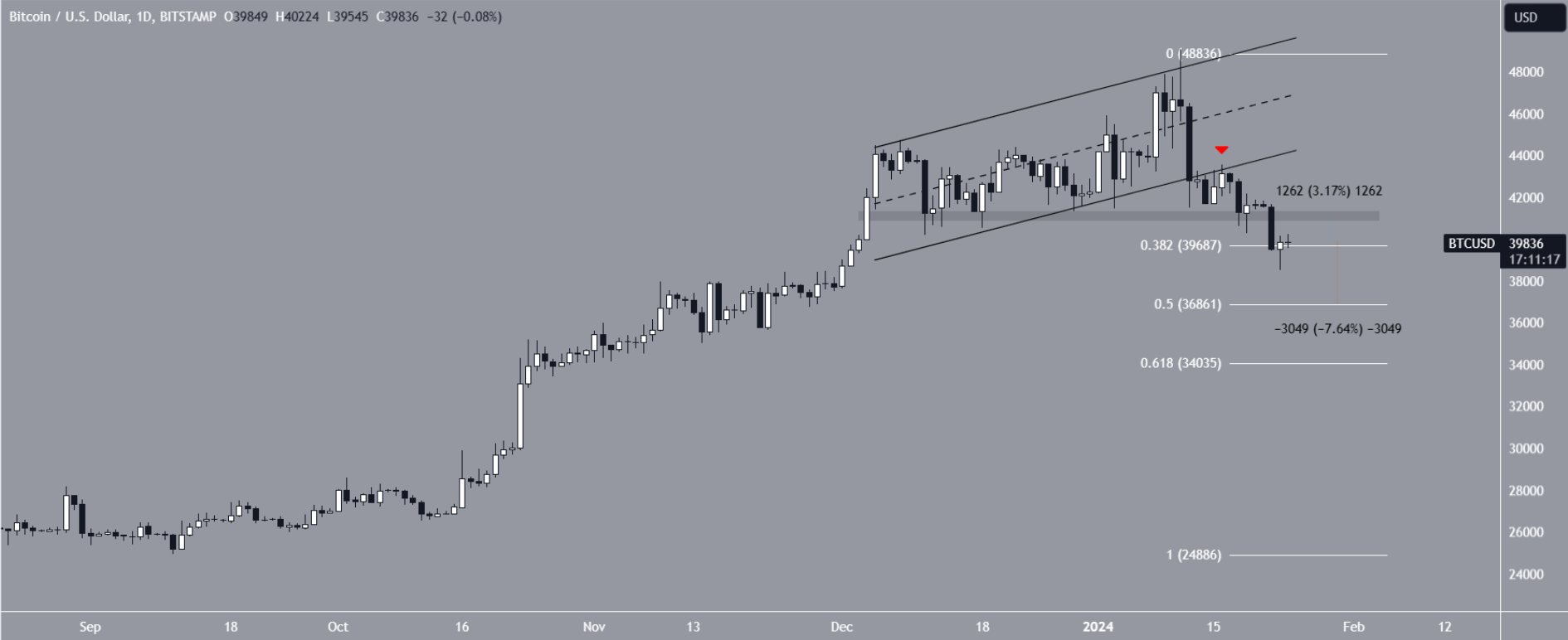

Last week, we mentioned that the price of BTC could fall to $38,500 due to the breaking of the rising parallel channel with the drop on January 12. Then the leading cryptocurrency accelerated its decline. Now, the price has rebounded from $38,555 and is above $40,000. It’s too early to celebrate because the agenda in the coming days is very busy. Moreover, optimism about interest rate cuts on the macro front is weakening with the rise of DXY.

The cumulative value of cryptocurrencies reached a peak of $1.81 trillion on January 11 within the rising parallel channel that started on December 9. Later, the support area of $1.61 trillion was lost, and the price exited the channel.

Yesterday, TOTALCAP fell below the support area of $1.52 trillion. Despite the recent jump, since the horizontal support area was not reclaimed, we might see the decline continue to the support region of $1.39-1.4 trillion.

Will Bitcoin Ascend?

While Bitcoin’s price was trading within a rising parallel channel since December, it broke below this on January 12. This development, indicating the end of the upward movement, also laid the foundation for yesterday’s bottom.

The decline accelerated with the rejection of the channel’s support trend line on January 16. If BTC sellers continue to remain strong, the next support to visit is $36,950. For the opposite scenario, the horizontal support of $41,000 (like the cumulative value graph of cryptocurrencies in the first section) needs to be reclaimed.

BTC price is currently in limbo, and the $41,000 region will be crucial in the upcoming hours. The advantage is that after an initial concentration of GBTC sales, a balance was expected. If sales continue to weaken (with the opening of the US market in a few hours), the current negative sentiment could reverse.

The reversal of short-term oversold conditions might be easier than expected with the growth of spot BTC ETF issuers’ reserves and the weakening of GBTC sales. For now, it is difficult to speak of a clear direction.