According to analytics company Lookonchain, Worldcoin (WLD) may have regained the attention of major investors, including individual whales and institutions. The reason for this claim was a new wallet withdrawing WLD worth $6 million from OKX and Binance exchanges.

Massive Transfer in Worldcoin!

During the same period, Amber Group, a liquidity provider, asset management, and trading platform, also sent 500,000 WLD from OKX. Amber sent the tokens to a wallet that cannot be traded after withdrawal. Leading trading firm GSR also did not stay out of the picture as it has been accumulating WLD since August 29.

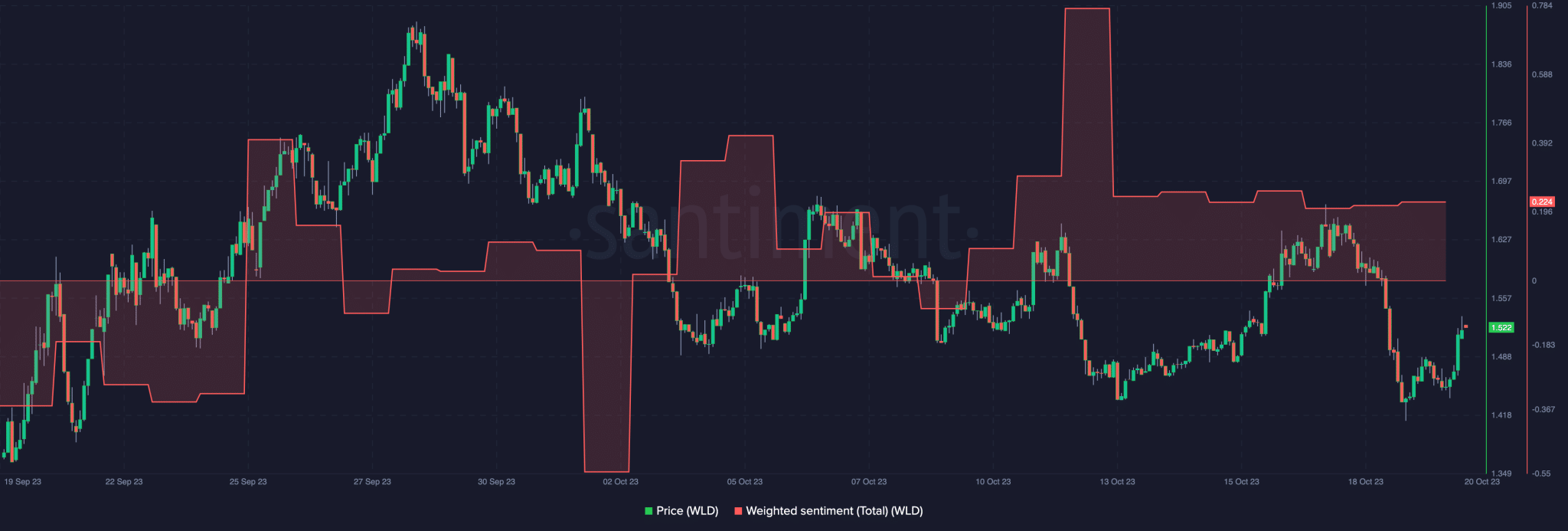

Although the reasons for widespread withdrawals are largely unknown, such actions may indicate a possible assumption that the token is worth holding in the long term. Unlike most altcoins, WLD has shown a 9.49% increase in its 30-day performance. Additionally, according to on-chain data, the weighted sentiment is at 0.224 level. Weighted sentiment combines positive and negative comments about a project by examining unique social volume to reach a score. Crypto Traders Are Rushing to This App – Here’s Why You Should Too

WLD Metrics!

This measurement rises when the majority of messages are positive and falls when some of the messages are negative. The sentiment score for WLD has been flat since October 13, which may indicate that market investors are currently neutral about the token’s performance.

In addition to short-term sentiment and whale withdrawals, it is observed that the individual group is also becoming bullish on Worldcoin in the long term. This could be due to the state of address balance. According to data analytics company Santiment, the 1-10 million group has the highest WLD holdings. This group has also increased its balance in the last 30 days. Additionally, the individual segment with 10-100 tokens was not left behind and its share increased by 6.17%.

However, activity on the Worldcoin network has been somewhat quiet. At the time of writing, the number of active addresses had dropped to 17,800. This measurement assesses the number of different addresses involved in transactions on the blockchain.

Türkçe

Türkçe Español

Español