Worldcoin (WLD) has recently experienced significant volatility due to the dismissal and rehiring of its founder, Sam Altman. What will be the effect of this turmoil on the price of this popular cryptocurrency?

Decline in WLD Momentum

According to data obtained from 21milyon.com, when news of the technology entrepreneur’s dismissal was announced to the public last week, WLD experienced a decline of more than 15%. However, as speculation about his return continued, the cryptocurrency began to recover.

The situation became even more intriguing when OpenAI announced an agreement that could pave the way for Sam Altman’s return to the AI research company. Considering how strongly the token has reacted to such developments recently, it is suggested that a sharp upward surge is possible, even though WLD is currently trading at $2.4.

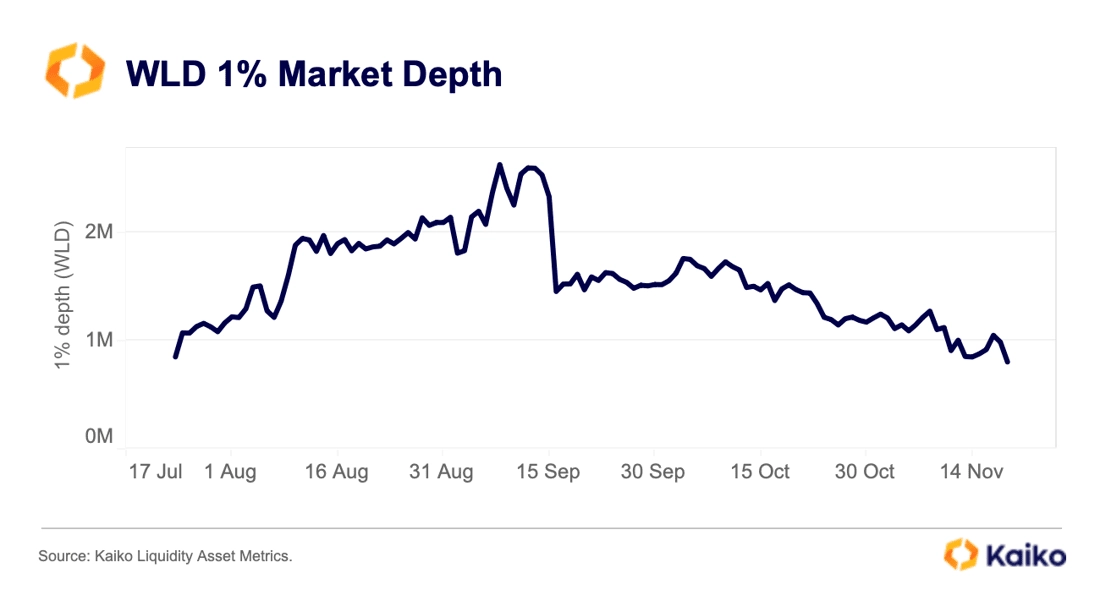

According to data provider Kaiko, the decline in WLD’s market depth may have significantly contributed to the token’s volatility. The data shows that market depth has been decreasing since mid-September. Market depth is the ability of an exchange to fulfill relatively large market orders without significantly impacting the token’s price. In simpler terms, it is a measure of liquidity in the market.

Worldcoin Developments

Market makers provide the majority of liquidity in exchanges. During the launch of Worldcoin, the creators provided approximately 100 million credits to five market makers. However, as part of changing agreements, the credit amount was reduced to 75 million as Worldcoin offered market makers the option to return 25 million WLD or buy them at a specific market price.

It was found that the price of WLD on October 24th was much lower than the agreed purchase price, at $1.67. As a result, market makers started returning the borrowed amount. The circulating supply of WLD, which was over 134 million at the time of the launch, has slightly decreased to just over 116 million at the time of writing, strengthening the aforementioned findings.

Türkçe

Türkçe Español

Español