The XRP–SEC case, which has become so complex that it could go down in world history, continues to witness new developments every day. The United States Securities and Exchange Commission (SEC) has made a new move before the appeal process.

Current State of the XRP-SEC Case

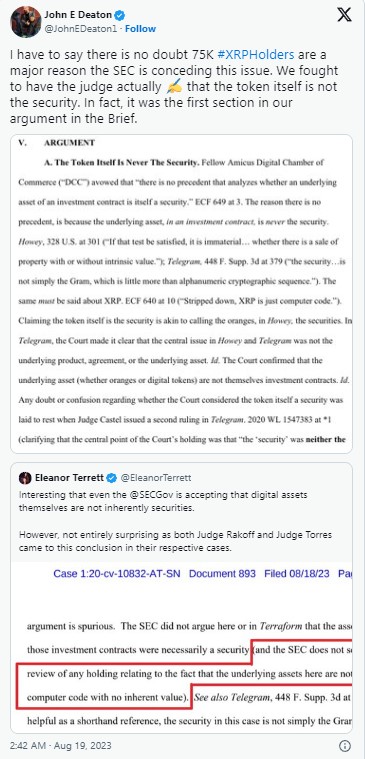

As a significant development, the United States Securities and Exchange Commission (SEC) publicly confirmed the non-securities status of crypto assets, including XRP. This announcement came as part of the regulatory body’s request to appeal against the victory decision of Ripple.

In the newly filed motion, the SEC stated:

The SEC does not seek any determination regarding the attitude that these underlying assets are nothing more than computer code with no inherent value.

SEC’s recognition that crypto assets are not securities by nature received enthusiastic reactions from the crypto community, especially XRP supporters. Attorney John Deaton stated in a tweet that SEC’s acceptance could be attributed to the overwhelming support of over 75,000 XRP holders participating in the ongoing case. Deaton emphasized the following:

We fought for the judge to write that the token itself is not a security. In fact, this was the first part of our argument in the filing.

SEC Initiates Temporary Appeal Application

Meanwhile, the US regulatory agency took a significant step in its legal dispute with Ripple Labs. The agency officially requested the US District Court for the Southern District of New York (SDNY) to document its temporary appeal application. Interestingly, SEC’s request closely followed a decision by Judge Analisa Torres overseeing the case. The judge approved the institution’s request for permission to appeal.

In its application, the SEC aimed to focus on Judge Torres’ decision regarding Ripple’s programmatic XRP sales and other distributions. It is worth mentioning that the US court confirmed on July 13 that none of these transactions were classified as securities. It should also be noted that Ripple is required to respond to the SEC’s motion by September 1.