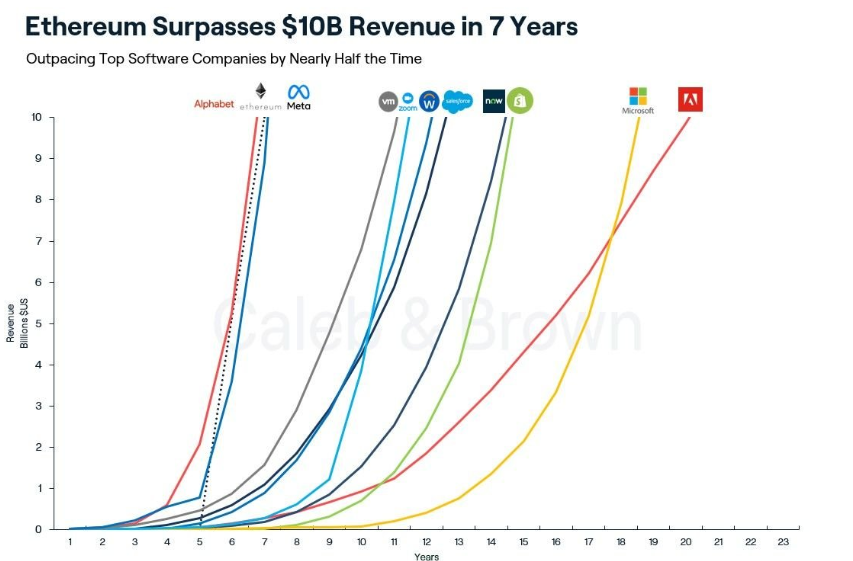

Ethereum, known as the most valuable smart contract platform in the world, has generated over $10 billion in revenue in a record time of seven years. With this rapid pace, Ethereum has reached this milestone faster than even the top technology companies, excluding Alphabet.

Ethereum Reaches $10 Billion

According to data revealed by Token Terminal, an analysis platform, it took approximately seven years for Ethereum to generate $10 billion in revenue based on its spot ETH rates, overshadowing Alphabet, which took about six years.

This performance demonstrates that Ethereum is quickly accepted and its solutions are adopted faster compared to other technology companies such as Microsoft. It took approximately 19 years for Microsoft to reach this milestone, and Adobe took about 20 years.

The graph also reveals that platforms still in the development stage, like Zoom, have reached this point relatively faster. Zoom, a communication platform that enables audio and video online meetings, took approximately 11 years to generate $10 billion in revenue.

Zoom gained popularity from the end of 2019 until 2020, as companies preferred online meetings to continue their operations during the COVID-19 pandemic. Since then, the platform has increased its popularity and is currently valued at over $20 billion by the end of September 2023.

The rise of Ethereum is partly due to its distinctiveness. Unlike Bitcoin, which introduced the first reliable and functional transaction network, Ethereum is known for enabling the use of more complex protocols in various sectors, including finance, gaming, and art. As of September 25th, Ethereum’s cryptocurrency ETH was trading at approximately $1,570, with a market value of over $191 billion.

The Future of Ethereum

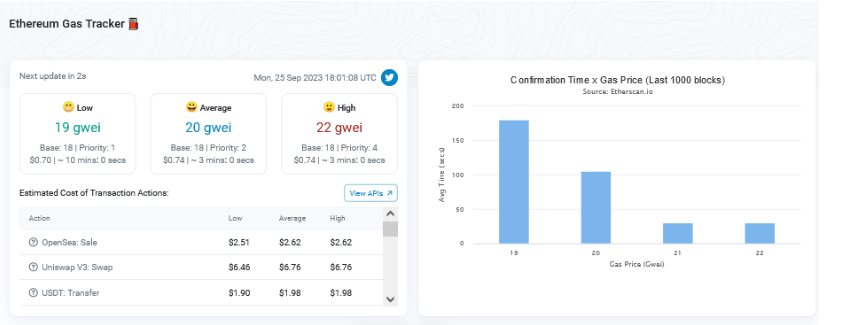

Ethereum’s most significant revenue comes from the transaction fee measured as gas. Depending on the complexity of the transaction, the network demands different gas or fees. Simple transactions that do not affect the execution of smart contracts are relatively cheaper. On the other hand, transactions supported by smart contracts will be more expensive. The fees vary depending on the complexity of the transactions.

These revenues are distributed to validators who are responsible for securing the network and verifying transactions. This task is compensated through block rewards and transaction fees added to each block.

However, the generated revenue is also dependent on network activity. The more complex the processed transaction is, the higher the fee added to each block. Generally, increased network activity can raise gas fees due to increased demand for block space. According to Etherscan data, over 1.93 million transactions were processed on Ethereum on December 9th. By September 24th, over 883,000 transactions were processed, indicating a decrease. Currently, the average transaction fee on the Ethereum network is around $0.74.

Türkçe

Türkçe Español

Español