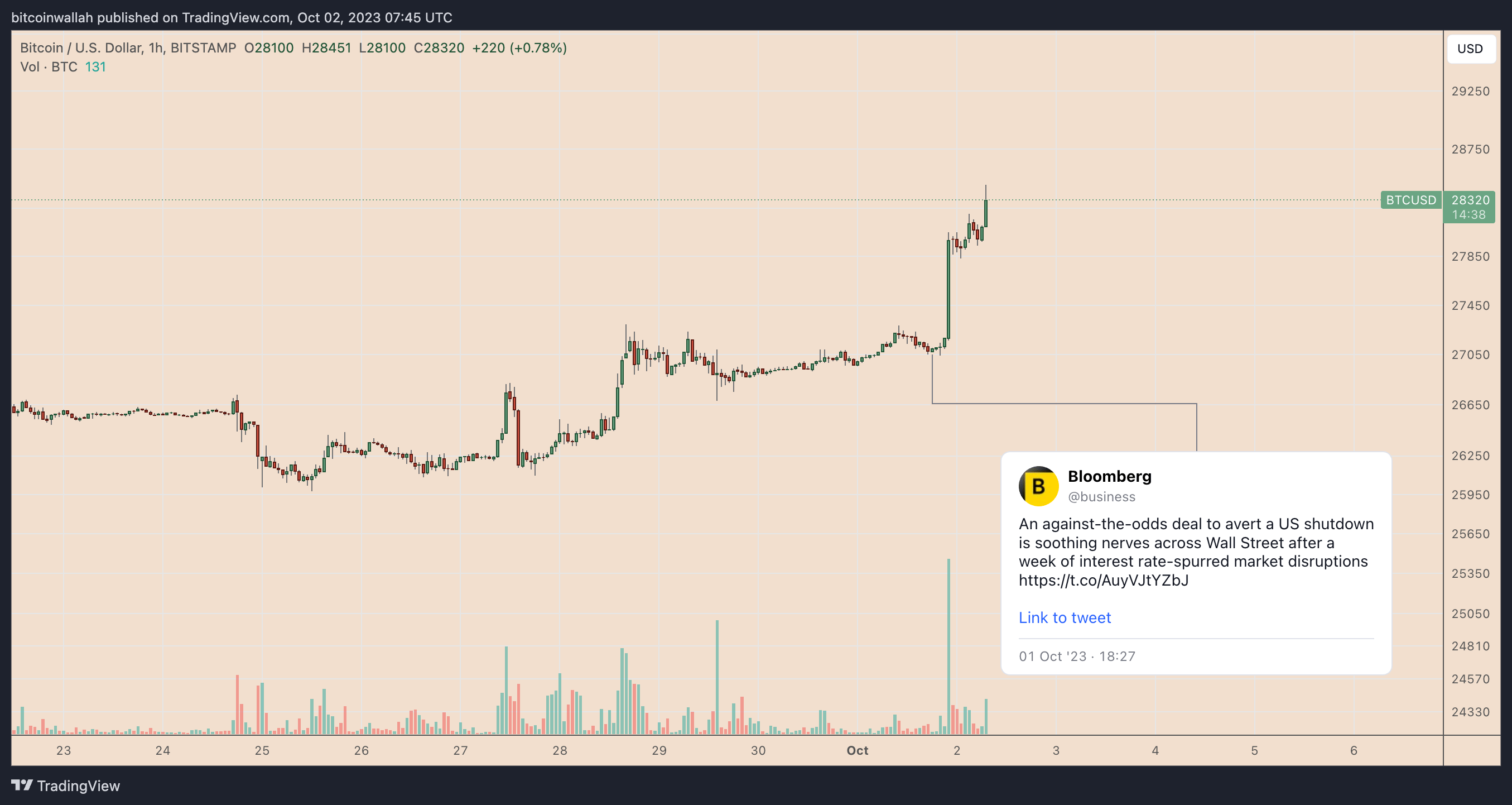

The cryptocurrency market has finally ended the days of stagnant trading volume. Bitcoin, which experienced the largest daily increase since August 29, rose 4.79% to $28,289 in the past 24 hours. Developments in the United States have led to the rise in Bitcoin prices. However, all eyes are now on the decision to be made by the SEC.

Bitcoin Starts October with Great Momentum

The decision that not only the cryptocurrency market but also the whole world has been eagerly waiting for has boosted the price of Bitcoin. The possibility of a government shutdown in the United States has been a topic of frequent discussion and has caused great concern. After the possibility of a shutdown was postponed until mid-November, the price of Bitcoin saw its biggest green candle since August.

The elimination of the possibility of a government shutdown also means that the Securities and Exchange Commission (SEC) will be able to evaluate Bitcoin ETF applications in the coming days. This is the focal point for investors.

A published report revealed that if Bitcoin ETF applications are approved, up to $600 billion in capital could be withdrawn from traditional markets. However, the SEC has postponed its decision on several Bitcoin ETF applications, including BlackRock’s application.

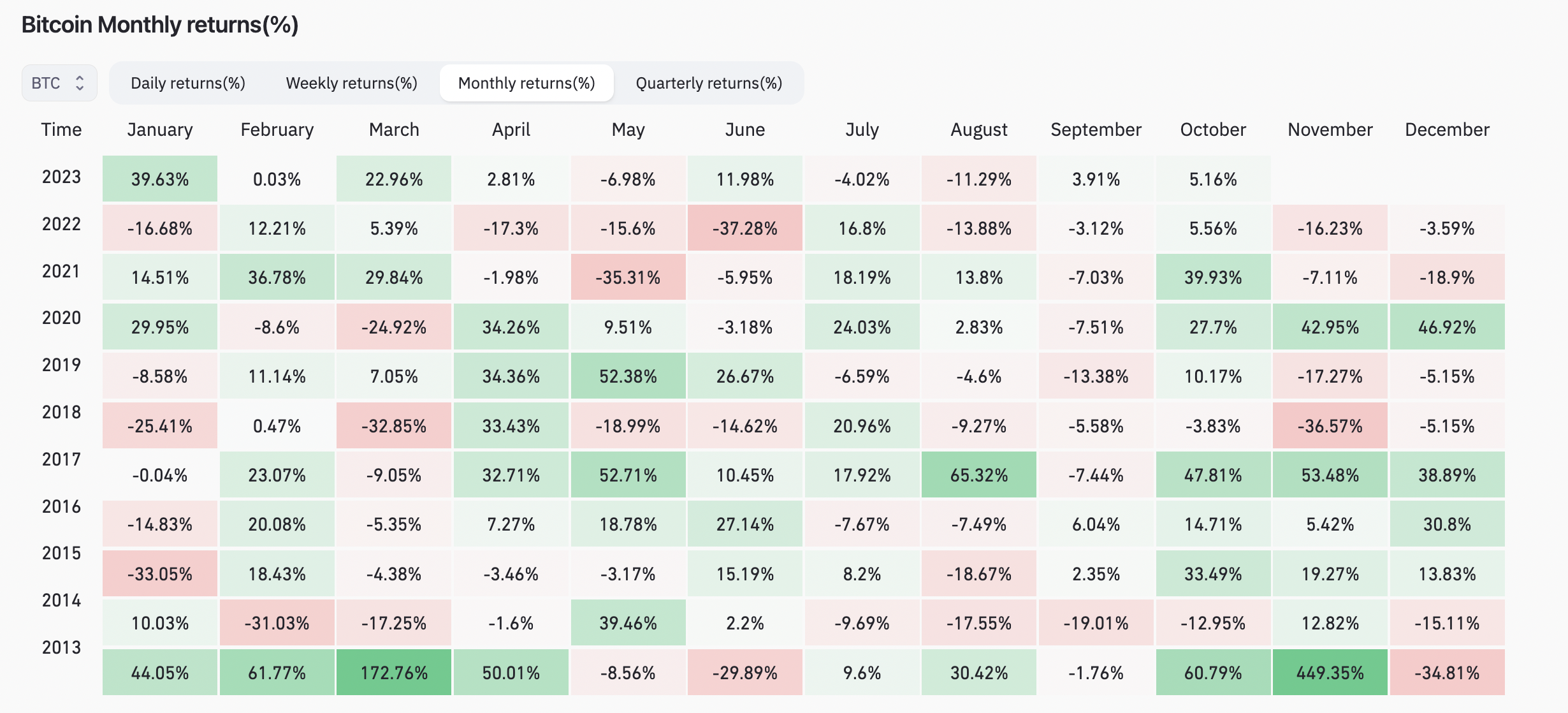

Bitcoin investors believe that October is one of the best months in terms of price performance and refer to it as “Uptober.” According to data since 2012, the average increase in Bitcoin price in October is 20.82%, although exceptions were observed in October 2014 and 2018.

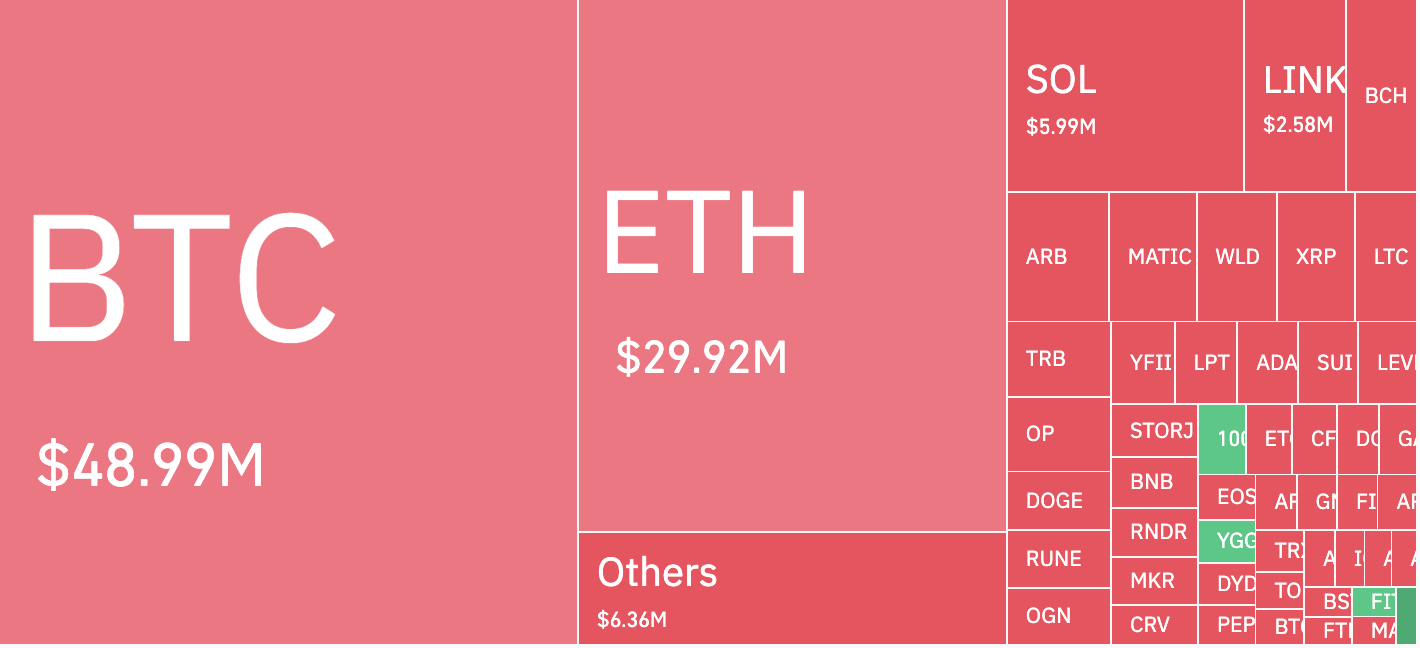

$43 Million Worth of Liquidation Occurred

The increase in the price of Bitcoin has caused significant losses for some investors. While many short positions were liquidated in the futures market, this helped the price of Bitcoin rise.

Within 24 hours, $43 million worth of short positions were liquidated in the Bitcoin market. Only $6 million of long positions were liquidated. A similar situation occurred on September 12-13, and it ignited a 5.5% increase in price until September 19.

To carry out the liquidation of short positions, Bitcoin needs to be bought. This situation supports the rise in the BTC/UST pair as new buyers and short positions come together.

Türkçe

Türkçe Español

Español