Despite the stagnant market conditions, Bitcoin (BTC) holders have taken advantage of the opportunity to add to their savings. Here is the critical report from analytical firm Santiment!

Anticipated Report from Santiment!

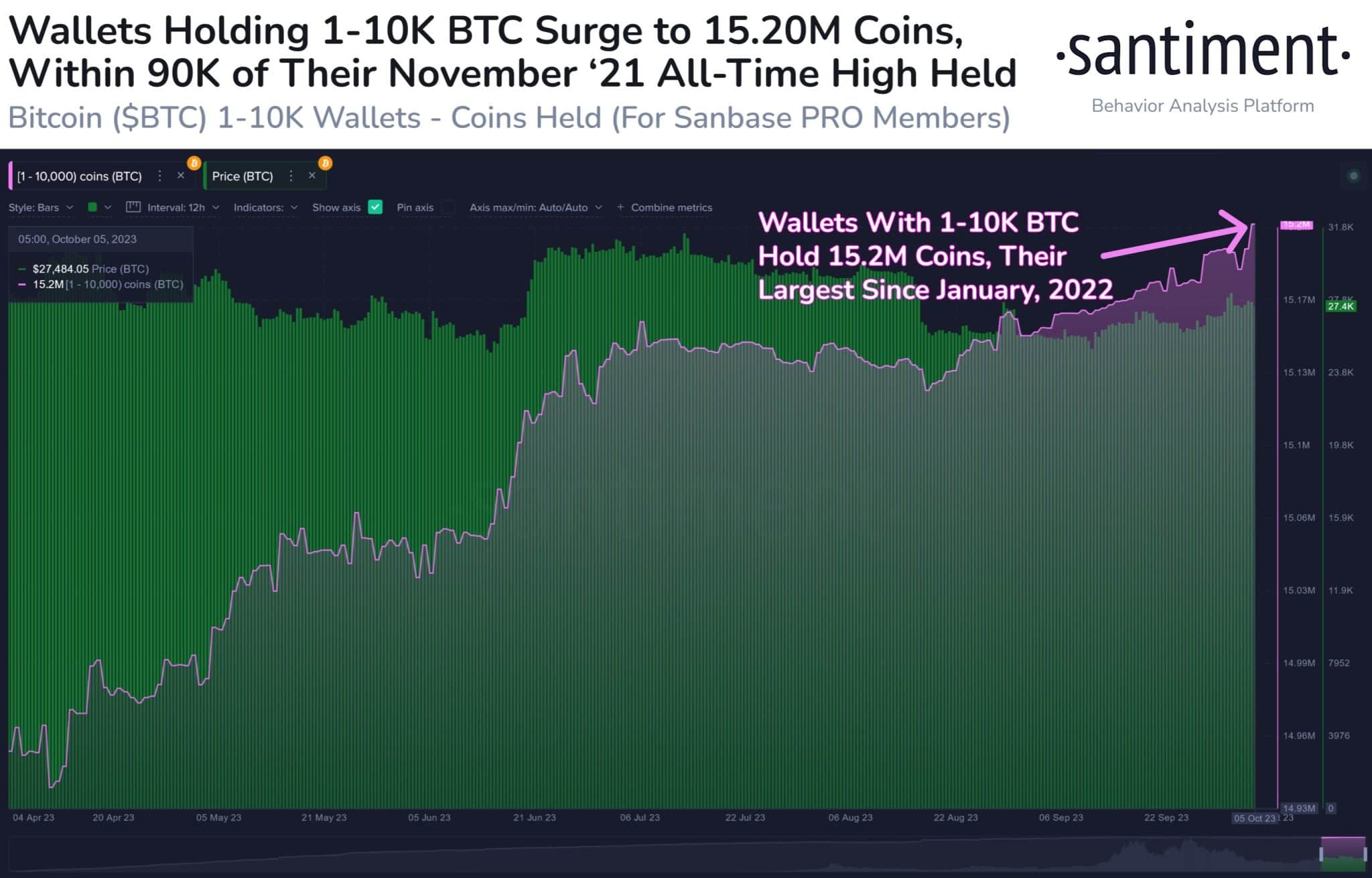

According to on-chain analysis firm Santiment’s data, wallets holding 1 to 10,000 BTC have increased their accumulations in the past six weeks. During this period, more than 71,000 crypto wallets were added by the medium and large-scale user group.

With the latest additions, the total supply controlled by this group has reached 15.2 million, the highest number since January 2022. In fact, the holdings were very close to the all-time high of 15.29 million set during the bull market peak in 2020.

Furthermore, it is a well-known strategy for long-term investors to use the lowest levels of the bear market to accumulate strong tokens. This trend can be argued to primarily represent relatively large investors who have enough resources to easily buy Bitcoins. However, this may not be accurate.

ETF Enthusiasm in BTC!

Data obtained from Santiment revealed that addresses between 0 and 0.1 BTC owned by individual investors have been steadily growing since the beginning of 2023. This highlights the tangible confidence in Bitcoin holders.

At the time of writing, according to Santiment, BTC changed hands at 27,649.03 dollars, a marginal increase from its value 24 years ago. Throughout the week, the leading cryptocurrency surpassed $28,000 for the first time in over six weeks.

However, this excitement was short-lived as BTC retraced towards the $27,000 region after a few hours of trading. Most market investors are hoping that developments around spot Bitcoin ETFs will have a significant impact on the price. Meanwhile, in line with previous observations, the Supply on Exchanges for BTC continued to decline. Only 5.74% of the circulating supply of approximately 1.12 million BTC was available for trading.

Türkçe

Türkçe Español

Español