As Bitcoin (BTC) aims for the $28,000 mark, some altcoins have started to rise again. Solana (SOL) is one of them. At the time of writing, BTC is at $27,900. The cumulative value of cryptocurrencies has reached $1.1 trillion. However, the cumulative market cap remains at $26 billion, experiencing a 6% decrease.

Solana (SOL) Analysis

Since September 28th, Solana (SOL) has experienced a 20% increase in price, which goes beyond the fluctuations in BTC price. There have been some significant developments that have contributed to the positive performance of SOL Coin. In particular, the approval of FTX’s $1.3 billion sales permission (including future unlockable sales) has caused fluctuations in the SOL price.

On September 11th, the SOL Coin price dropped to its lowest point in 2 months, reaching $17.34. However, the recovery of the $20 support on September 29th increased investor confidence. This coincided with the upgrade to version 1.16 of the network, which was one of the biggest supporters of the current positive trend.

SOL Coin Predictions

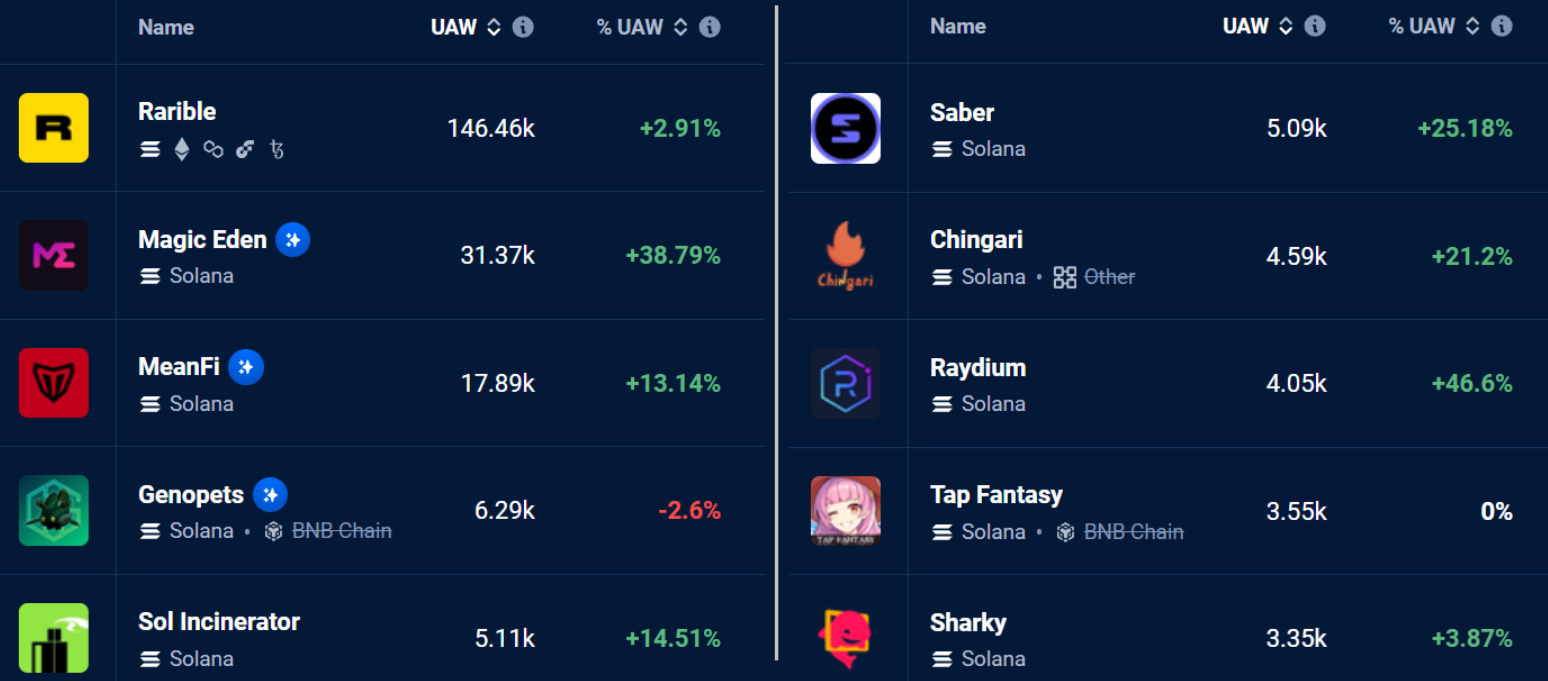

Alongside the increase in BTC price, another factor that supported the SOL Coin price was the increase in activity on the network. The increase in NFT and Dapps volume strengthened the community’s morale. The list below shows the growing interest in applications operating on the Solana network. The significant and consistent increase in all sectors was important for the recovery of the SOL Coin price.

Furthermore, Solana’s active addresses interacting with Dapps have surpassed Ethereum’s limited 55,230 addresses during the same period.

Since a significant part of the crypto community is not fond of paying transaction fees worth tens of dollars, there will always be a need for cheap and fast networks like Solana.

Moreover, the latest network upgrade enhances privacy and reduces costs for validators. To set up a Solana node, you used to have to pay thousands of liras per month for server rental. With this latest network update, it has dropped below 80. The device used to require over 120 GB of RAM, but that has been reduced.

Another significant development that we highlighted this month and could support the continuation of the rise is the increase in TVL. The total locked value (TVL) on the Solana network has reached its 2023 peak, indicating signs of a rebound. However, the current TVL of $326 million is significantly below competitors such as Arbitrum, with $1.73 billion.

If the increase in active users, TVL growth, and network development activities continue, the SOL Coin price can continue its upward trend.

Türkçe

Türkçe Español

Español