According to DeSpread Research, South Korean cryptocurrency investors prefer some popular altcoins and small-cap altcoins. This finding is supported by the low trading volume of major cryptocurrencies such as Bitcoin (BTC) and Ethereum (ETH) in the country, indicating that investors are looking to capture higher profit potential in altcoins.

According to a research conducted by DeSpread Research, active cryptocurrency investors and local cryptocurrency exchanges in South Korea outperform their global competitors in terms of volume. The research shows that South Korean investors are primarily interested in popular altcoins and small-cap altcoins.

The report states that according to the survey conducted by the South Korea Financial Intelligence Unit (KoFIU), the number of cryptocurrency investors in the country has reached approximately 6 million or 10% of the population this year, stating that “The majority of these investors engage in investment activities primarily concentrated around centralized cryptocurrency exchanges, which makes the influence of centralized cryptocurrency exchanges significant in South Korea’s cryptocurrency market.”

Since March, centralized cryptocurrency exchanges worldwide have seen significant drops in trading volume due to Bitcoin’s sideways movement. Local cryptocurrency exchanges such as Upbit, the largest cryptocurrency exchange in South Korea, managed to reverse this trend with an increase in trading volume that surpassed market leader Binance until July. One of the reasons for the significant increase in trading volume of cryptocurrency exchanges in the country was the positive decision in the case filed by the U.S. Securities and Exchange Commission (SEC) against Ripple, which led to an increase in the price and trading volume of XRP.

DeSpread Research, in its report prepared for the study, noted that “South Korean cryptocurrency exchanges responded explosively to news about Ripple. The volume generated by the four major South Korean cryptocurrency exchanges was recorded as $27 billion in June, and the trading volume recorded in July increased by 37% compared to the previous month, reaching $37 billion.”

The report states that South Korean investors show great interest in altcoins, but their interest in Bitcoin and Ethereum is limited, stating that “The majority of individual investors on Upbit show interest in altcoins with high profit potential and accept the associated high risks. This is seen as one of the reasons why altcoin trading is high in the South Korean market.”

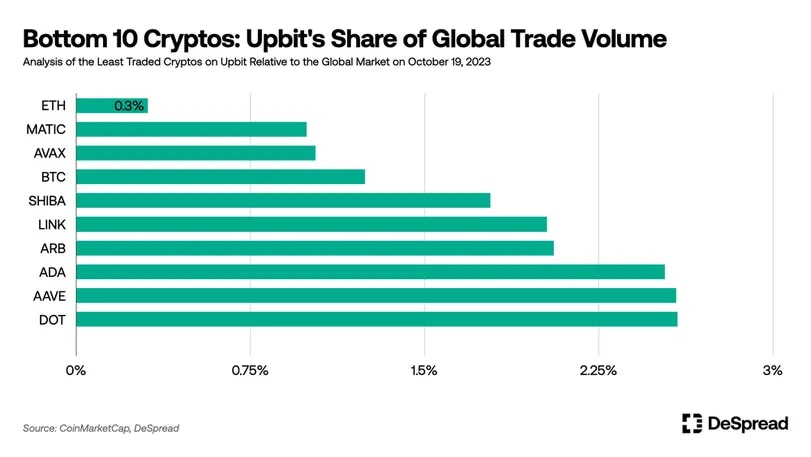

According to the research, cryptocurrencies that dominate the global market such as Bitcoin, Ethereum, and Polygon (MATIC) have large trading volumes worldwide, but their trading volumes on Upbit are surprisingly low. According to DeSpread Research, this phenomenon reflects the unique characteristics of Upbit compared to the global market, reflecting regional differences in investor preferences and investment strategies.

Favorite Crypto Network of South Korean Investors: Tron

On the other hand, the networks preferred for transactions in South Korea are quite different. Due to relatively lower transaction fees, the majority of transactions are carried out on the network of Tron.

Furthermore, although cryptocurrency exchanges in the country have seen a significant recovery in volume, South Korean investors still prefer overseas platforms to store their assets. A report published by the country’s national tax service in September shows that South Koreans hold $99 billion worth of cryptocurrencies overseas.