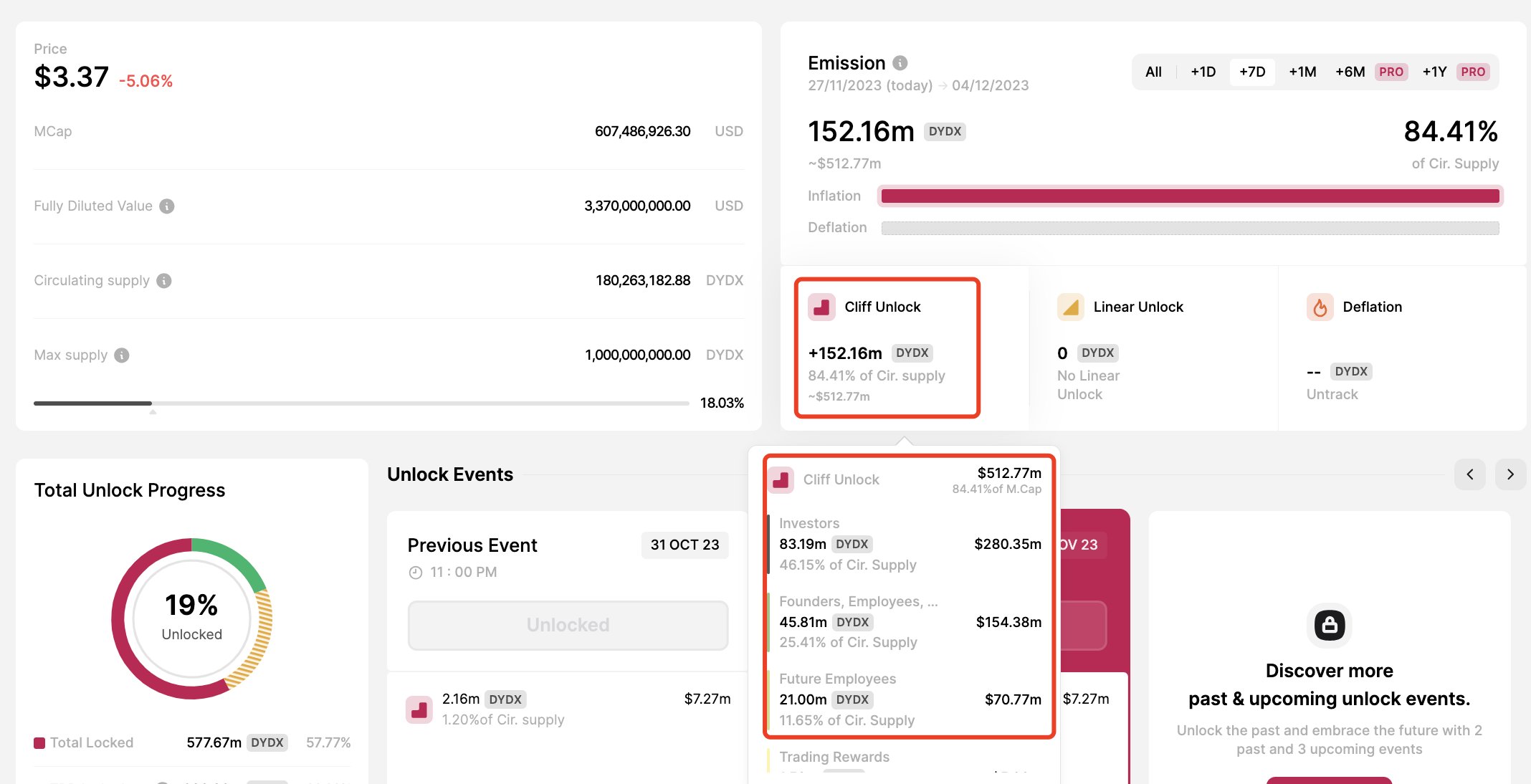

Unlocking a significant amount of tokens can often trigger speculations and market movements. In the case of Dydx, the unlocking of 150 million DYDX tokens on December 1st has the potential to bring both opportunities and challenges. Let’s examine the key issues and see if this unlocking will create significant selling pressure.

Token Unlocking Dynamics and Investor Allocations

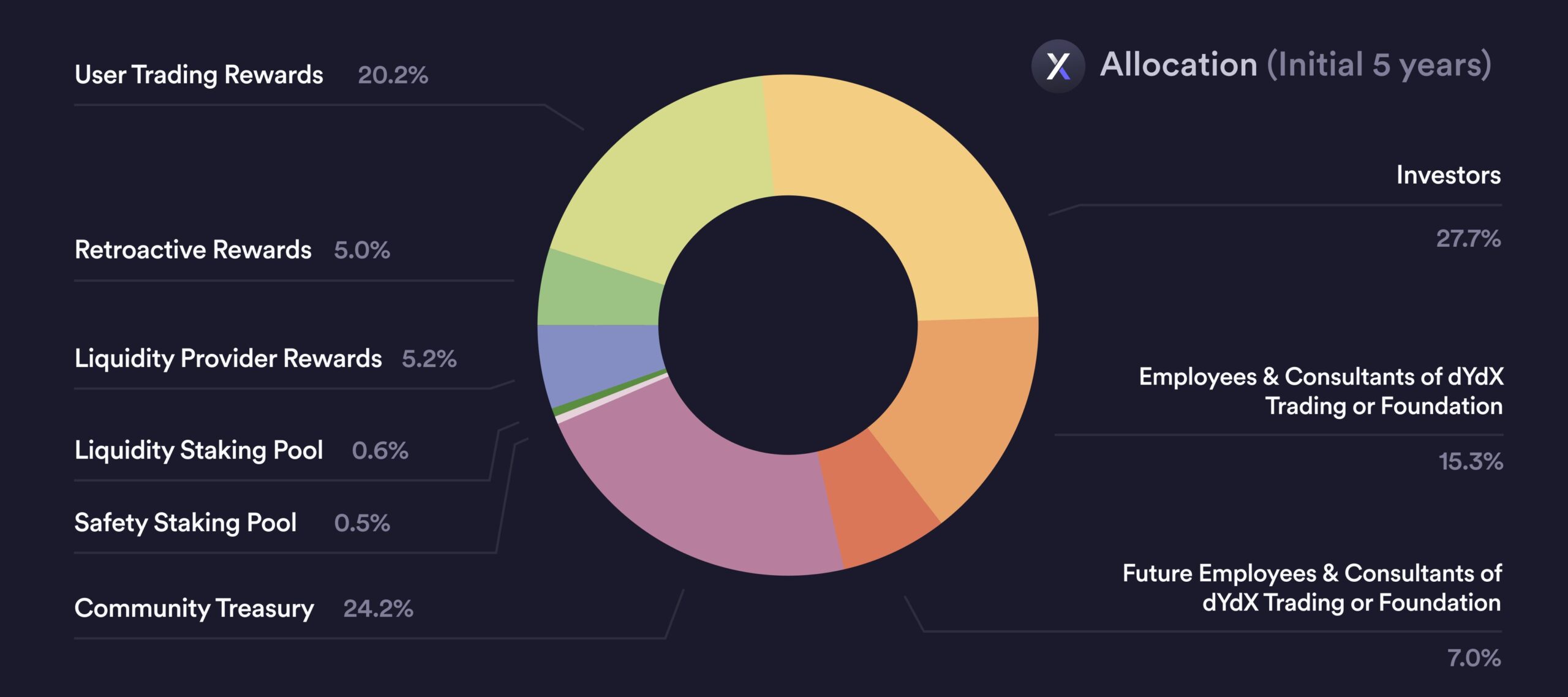

If we delve into the details of the token, DYDX allocated 50% of its total supply, which is 500 million DYDX, to various stakeholders including investors, founders, employees, and advisors. 30% of this allocation, which is 150 million DYDX, will be unlocked on December 1st.

This move raises questions about the potential impact on the market, especially considering that 83 million 190 thousand DYDX will become accessible to investors. This figure corresponds to 46.15% of the circulating supply.

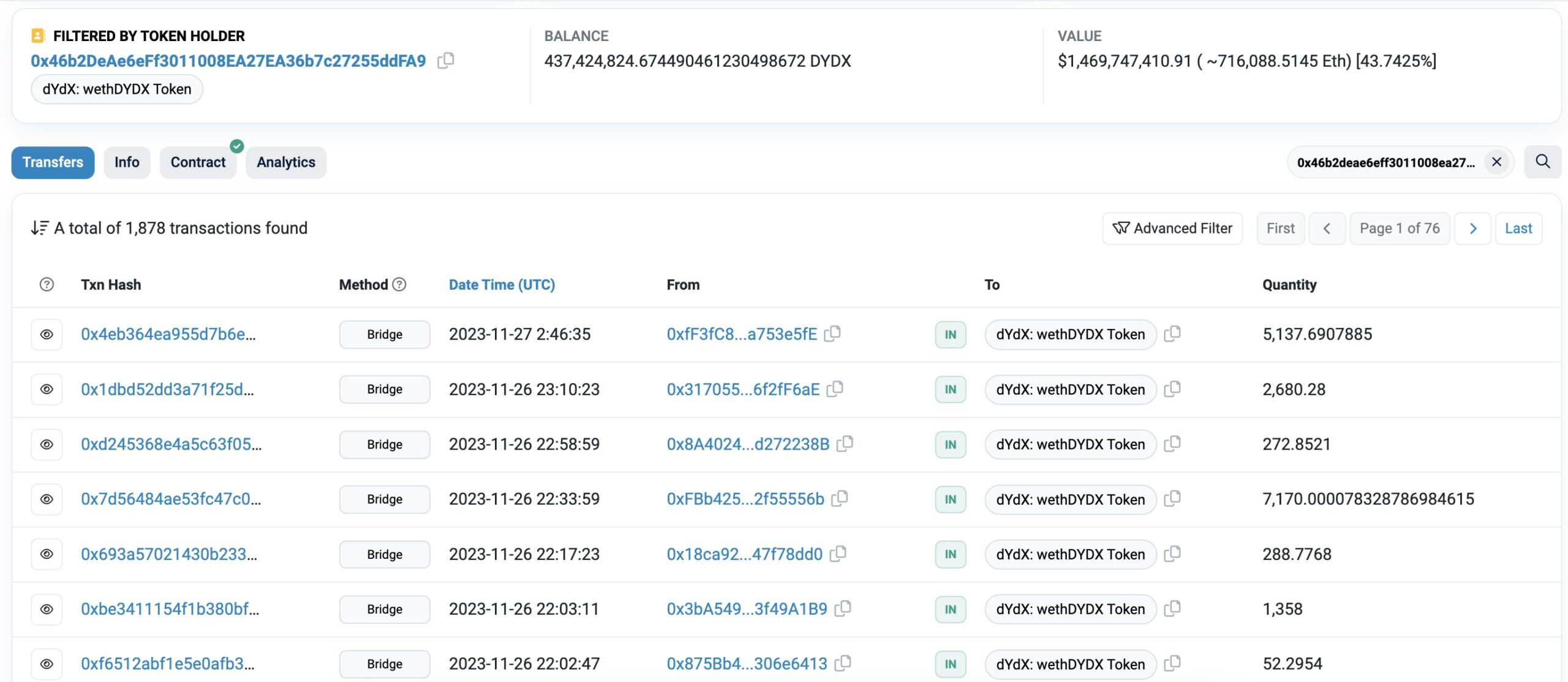

The analysis of on-chain data provides valuable insights into DYDX token movements. Important investor addresses such as a16z crypto, Defiance Capital, and Polychain Capital received tokens from the dydx Foundation. Interestingly, several investors chose to bridge their DYDX assets, with a16z crypto alone bridging 42.69 million DYDX worth $143.87 million.

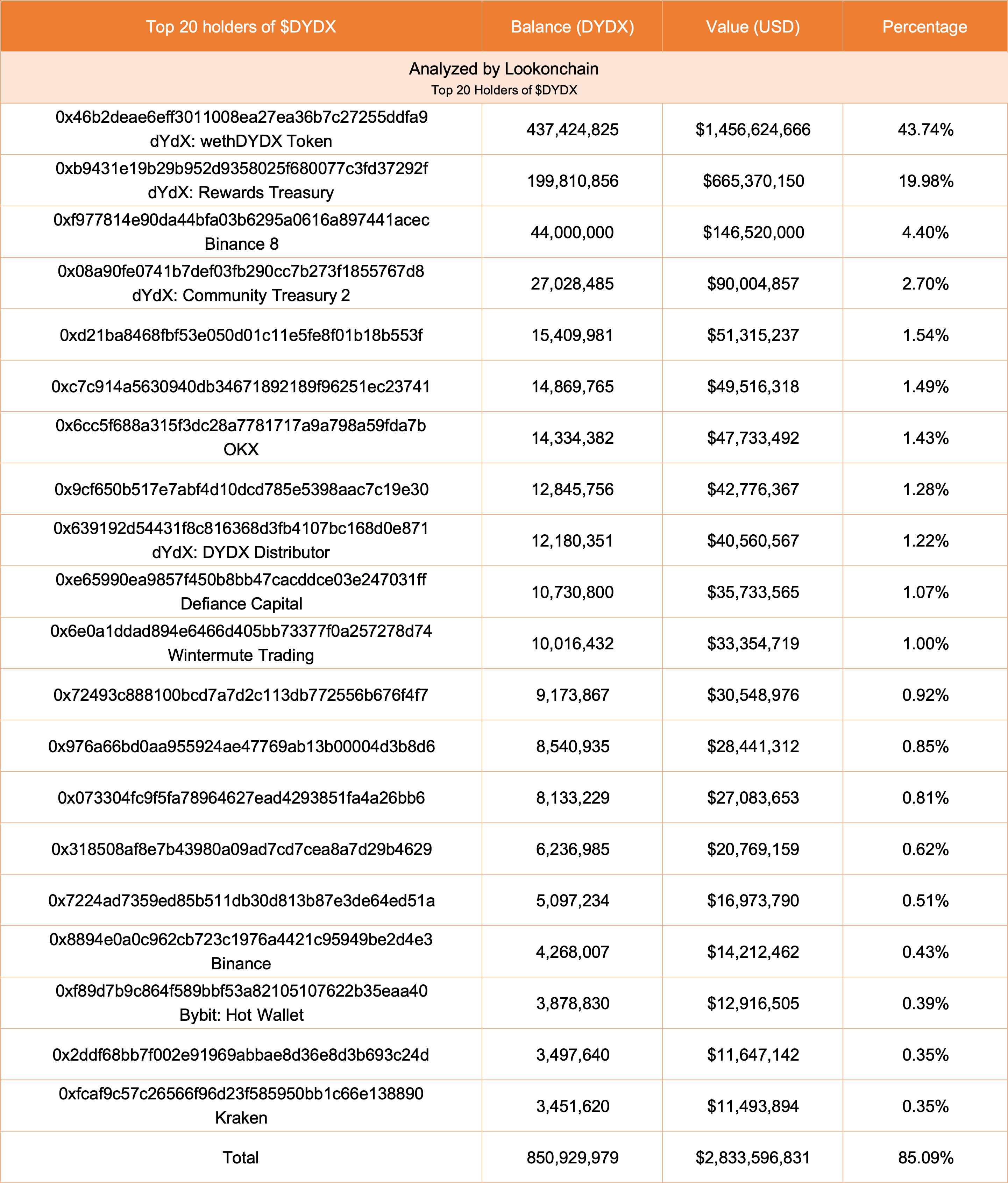

Currently, 437.4 million DYDX, which is 43.74% of the total supply, is permanently locked in the wethDYDX smart contract due to the one-way bridging mechanism.

Top 20 Holders and Recent Whale Activities

When we examine the token distribution, we see that the top 20 holders have a total of 850.93 million DYDX, which accounts for 85.09% of the total supply.

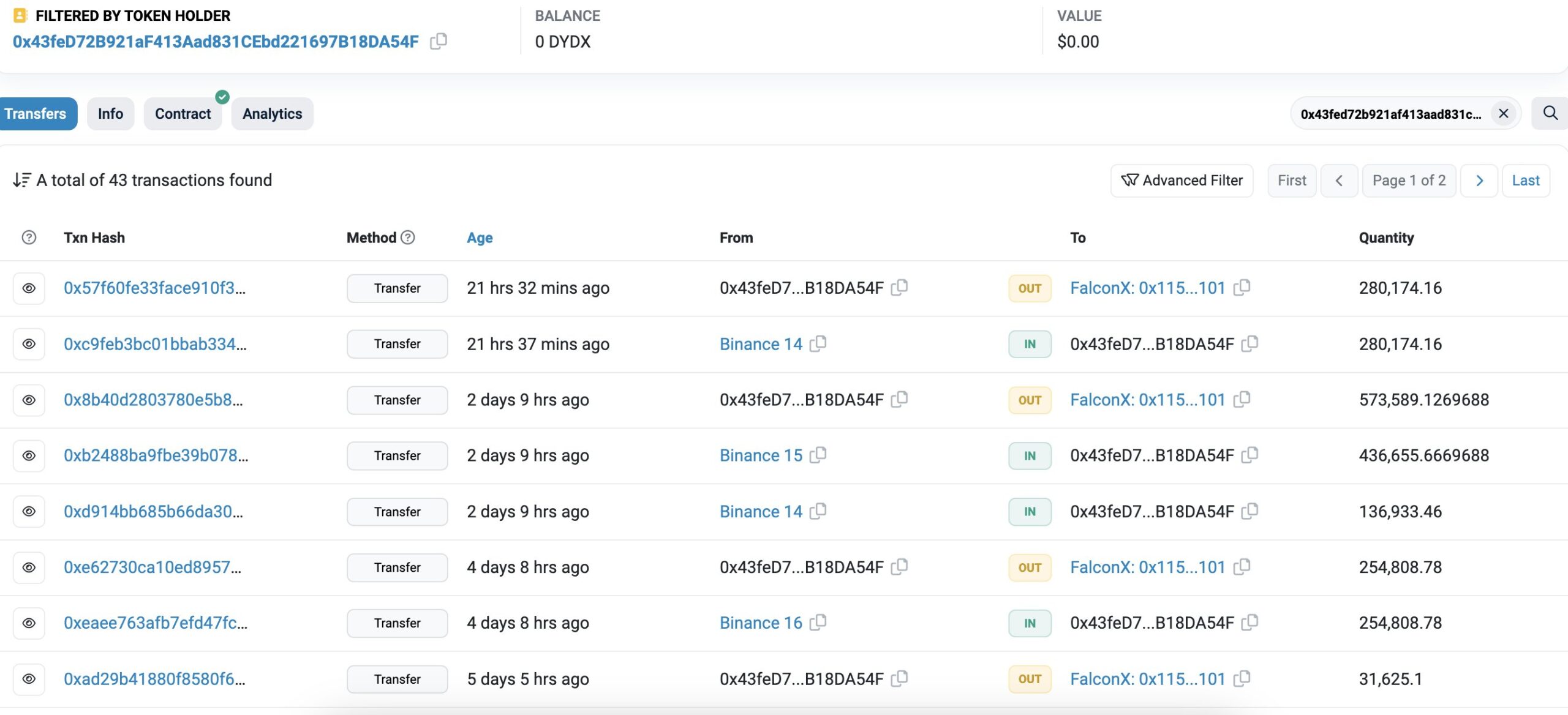

Notable recent activities include FalconX withdrawing 1.14 million DYDX worth $3.84 million from the Binance cryptocurrency exchange within the last five days.

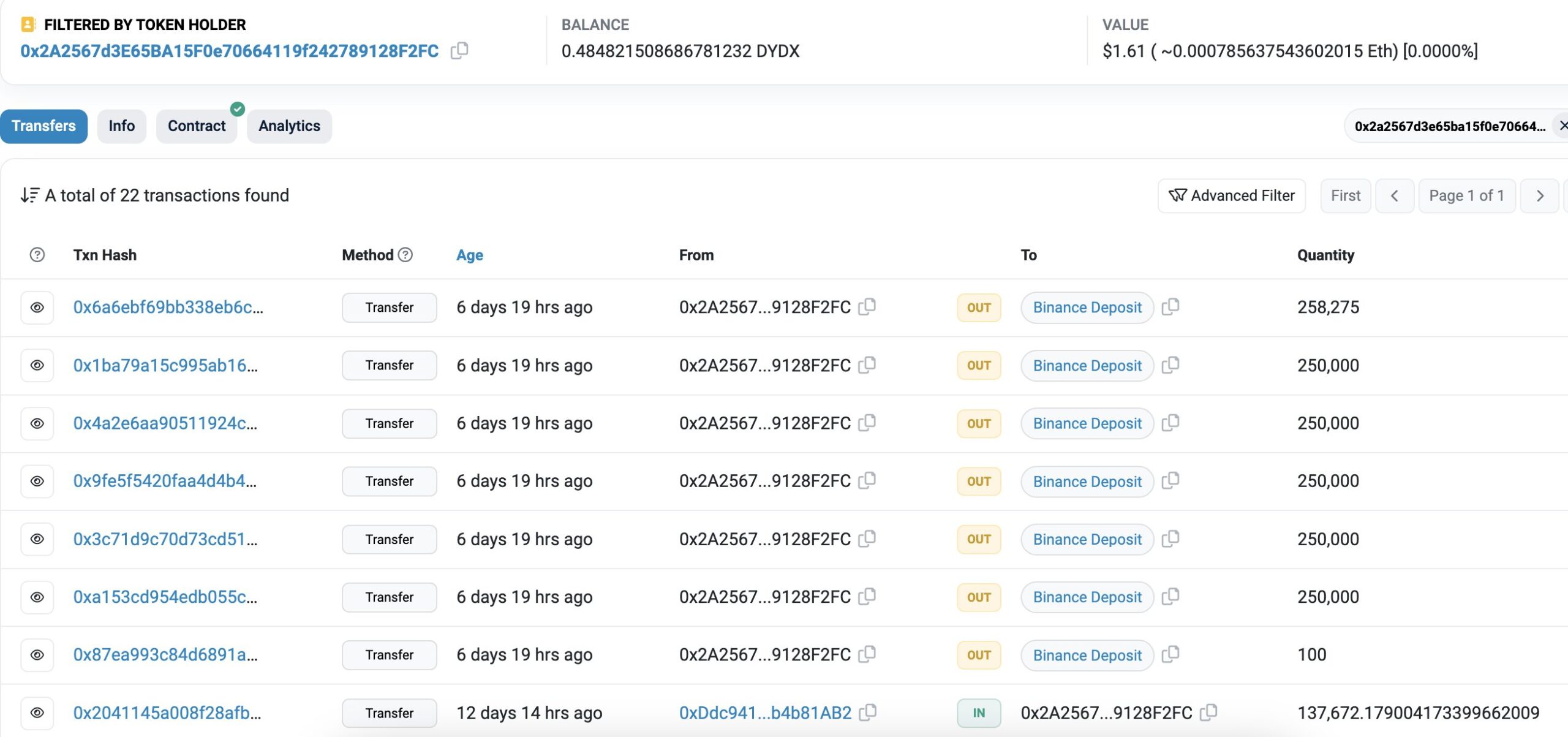

Additionally, a whale with the address “0x2A25” deposited 1.5 million DYDX worth $5.08 million from dYdX: DYDX Distributor to Binance six days ago.

As the unlocking date approaches, market participants are eagerly watching for any signs of selling pressure and whether whales or smart money are making strategic moves. Any potential downward movement in DYDX price in the coming days will clearly indicate the occurrence of a sell-off after the token unlocking.

Türkçe

Türkçe Español

Español