Bitcoin‘s price fell to $36,715 as the US stock markets opened. Over the weekend, sellers were strong. After exceeding $38,400, the price encountered selling pressure and lost the key resistance area. Is there cause for concern? What does the similarity to 2020 signify?

Bitcoin (BTC)

Since the beginning of October, the leading cryptocurrency has entered a steady upward trend. The price, surpassing the 530-day trend line, has pulled its annual peaks to higher levels. On November 24th, Bitcoin reached $38,437, setting its last peak for 2023, but even after some profit-taking, it maintained above $36,500.

The continuation of the upward movement was further encouraged by the sixth week of the candle remaining green. This was last observed in October 2020, when the previous bull cycle began. Similarly, after the announcement from PayPal, the price did not immediately hit record levels but rather experienced a similar process to what we are seeing today.

Potential ETF approval, the conclusion of concerns regarding the Binance case, and many other significant developments suggest a possible repeat of the year 2020.

Will Cryptocurrencies Ascend?

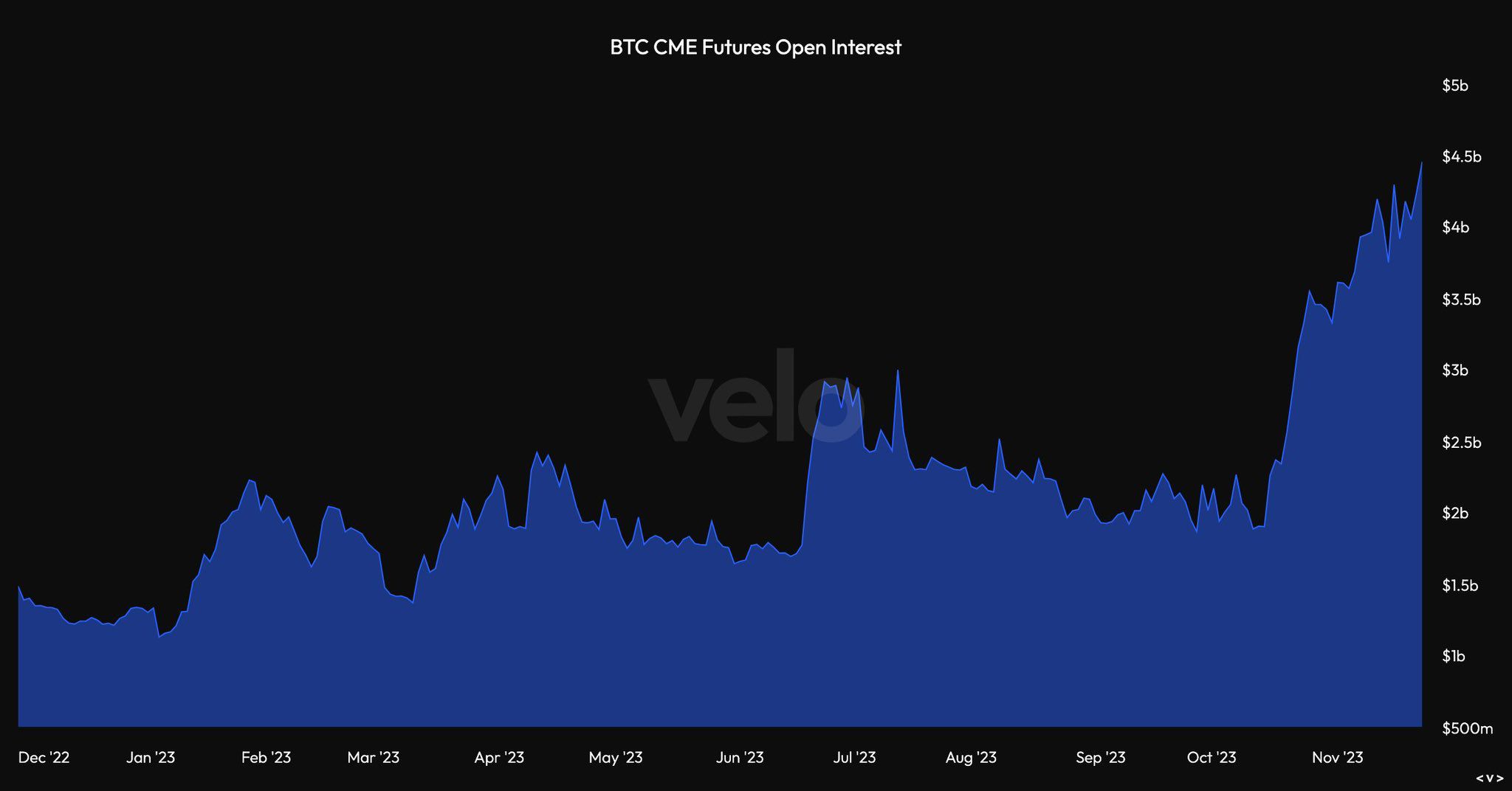

The rise in Bitcoin’s price could also enable new peaks for altcoins. Crypto commentators named JJCycles and Bob Loukas pointed to the increase in the size of CME open positions, claiming that the BTC price recovery will continue. CredibleCrypto, on the other hand, expects a drop before BTC continues its rise.

The Elliot wave chart can be useful for interpreting long-term price movements. The most likely count indicates that BTC is in the third leg of the five-wave movement that started in September. If this count is correct, the price should achieve new and strong peaks during this movement.

Sub-wave counts suggest that, after the last correction, the price could rise to $41,000. If a downward break from this triangle occurs, a sell-off to $35,000 is likely. However, the latest CoinShares report indicates that institutions continue to enter at record levels.

As of this article’s preparation, the Bitcoin price is finding buyers at $36,890, while the cumulative volume of cryptocurrencies continues to hover annoyingly around the $50 billion mark.

Disclaimer: The information in this article is not investment advice. Investors should be aware of the high volatility and risk associated with cryptocurrency assets and carry out transactions based on their research.

- Bitcoin mirrors 2020’s patterns amid uncertainties.

- Key technical indicators suggest ongoing bullish momentum.

- Institutional engagement remains strong despite volatility.

Türkçe

Türkçe Español

Español