As Bitcoin crossed over $40,000 in the world of cryptocurrency, warnings began to emerge. Metrics indicated that the rally could be overheating. This situation also triggered comments that the crypto market might be overheated. Analyst Julio Moreno made significant cautions at this very point.

Bitcoin’s Overheating Concerns

As Bitcoin surpassed $40,000, according to analyst Julio Moreno, key metrics pointed to potential overheating in the market, creating concern. Investors and analysts are closely monitoring indicators to gauge the current state of the leading cryptocurrency.

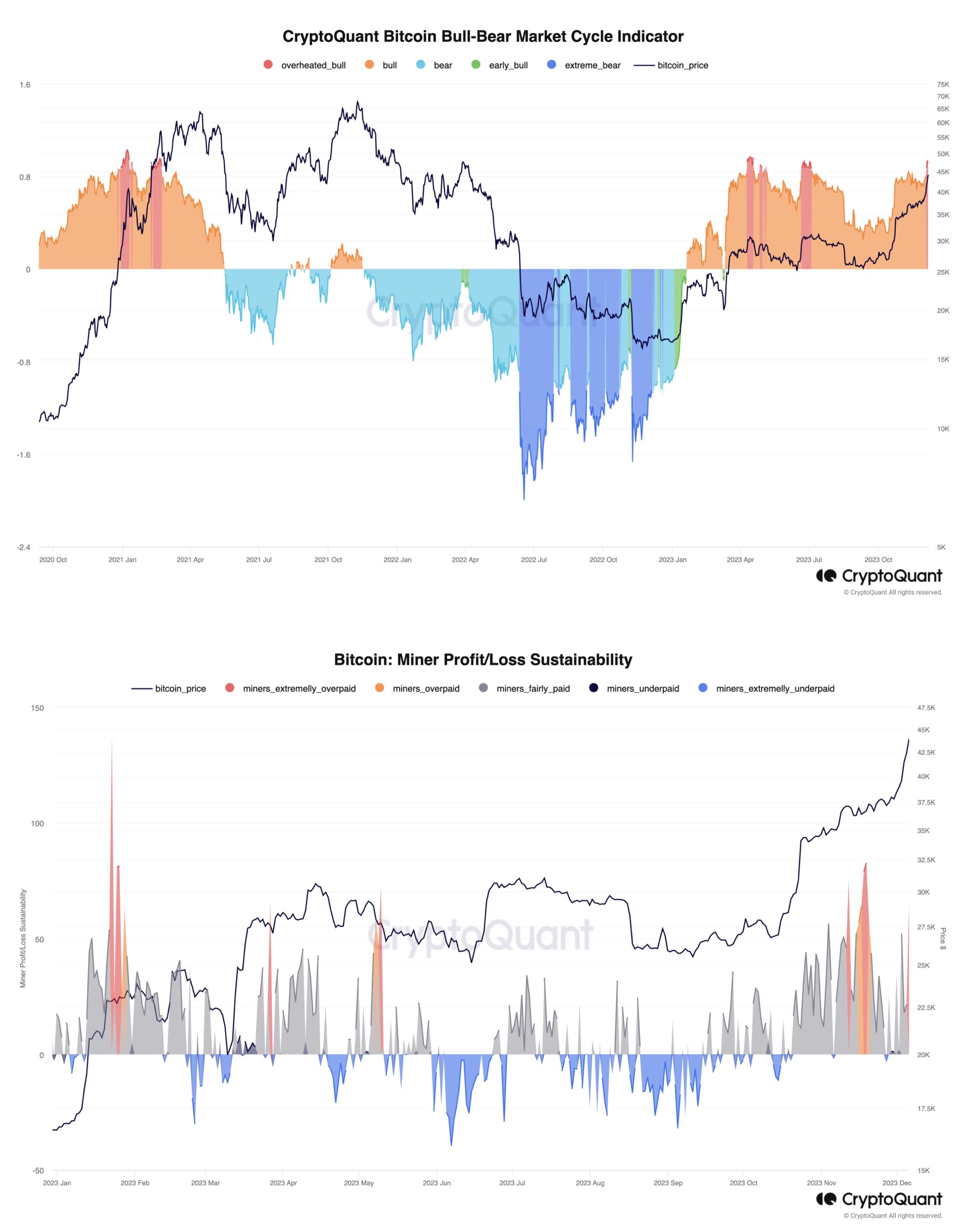

The Bull-Bear Market Cycle Indicator, a metric widely followed in the crypto space, has sounded the alarm. The indicator has pointed to an overheated bull phase for the first time since July. This could suggest that Bitcoin has entered a zone where a correction or cooling period could be on the horizon.

Traders and crypto enthusiasts are closely following the development of this indicator in the coming days, as it provides valuable information about the overall market sentiment and potential changes in Bitcoin’s price trajectory.

Miner Profit/Loss Sustainability: A Disturbing Imbalance

An additional critical metric to this cautionary tale is the sustainability of miner profit/loss. The current scenario reveals that block rewards have grown significantly faster than mining difficulty. This imbalance has led to concerns about the sustainability of miner profits.

The imbalance between the growth rates of block rewards and mining difficulty suggests that miners may face difficulties in maintaining profitability at the current rate. Historically, such imbalances have preceded corrective phases in Bitcoin‘s price.

Navigating the Bitcoin Environment: A Call for Caution

While Bitcoin enthusiasts celebrate the impressive BTC rally, a note of caution emerges from these fundamental metrics. Investors and crypto enthusiasts need to approach current market conditions with caution, taking into account the signals provided by these indicators.

Understanding the dynamics of the Bull-Bear Market Cycle and closely monitoring miners’ profit/loss sustainability can enable market participants to make informed decisions in the face of potential market corrections.

In conclusion, while Bitcoin’s journey above $40,000 is met with excitement, paying attention to the signals from these fundamental metrics has become increasingly important. As the world of cryptocurrency evolves, a strategic approach that includes insights from indicators such as the Bull-Bear Market Cycle and the sustainability of miners can provide a balanced perspective for navigating the twists and turns of the market.