Latest on FTX

Since filing for Chapter 11 in July 2022, the embattled crypto lending provider has started a token recall and rebalancing process to ensure sufficient liquidity to meet its obligations during bankruptcy proceedings. Celsius added that the unlocking event is expected to take place in the coming days. It was also noted that eligible creditors will receive in-kind Bitcoin (BTC) and ETH distributions according to the approved restructuring plan.

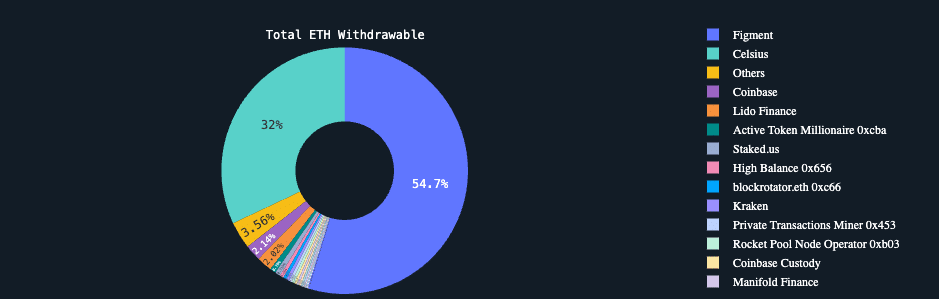

According to Nansen’s data, 32% of the ETH tokens awaiting withdrawal are currently linked to Celsius. This corresponds to approximately 206,300 ETH, valued at about $468.5 million based on the current price of the leading altcoin. The presence of such a large amount of tokens ready to be released has led some to believe it could exert downward pressure on the price of ETH, while others think that the completion of Celsius’s restructuring efforts could benefit the ETH market.

Ethereum Price Analysis

At the time of writing, ETH is trading at $2,250. According to CoinMarketCap, the altcoin witnessed a 5% decrease in value last week. The cryptocurrency’s momentum indicators on the 24-hour chart have been showing a downtrend since the beginning of the year, indicating a decline in buying momentum. At the time of writing, ETH’s relative strength index (RSI) was 48.82, and the money flow index (MFI) was 54.74.

The Chaikin money flow (CMF) detected below the zero line confirms that investors are increasingly withdrawing liquidity from ETH markets. Fears that the SEC would generally reject Bitcoin ETFs could be causing this capital withdrawal. There is a significant positive correlation between BTC and ETH. Therefore, a possible rejection could lead to a fall in BTC prices, which in turn might cause a pullback in ETH prices. The cryptocurrency’s negative direction index was above the positive direction index at the time of writing, which could have indicated that the selling pressure exceeded the crypto accumulation. In line with the decrease in demand, these lines have been positioned this way since January 3rd.

Türkçe

Türkçe Español

Español