ProShares Bitcoin Strategy ETF (BITO), VanEck Bitcoin Strategy ETF (XBTF), and Valkyrie Bitcoin Strategy ETF (BTF) reached an all-time high daily trading volume of $2 billion yesterday.

A Milestone in BTC

According to the data obtained, this milestone was achieved just one day after the previous record of $1.4 billion. ProShares Bitcoin Strategy ETF, the first Bitcoin ETF product launched in the US, dominates the daily trading volume of Bitcoin futures ETFs, comprising $1.97 billion or 97% of yesterday’s record $2 billion. Bloomberg ETF analyst Eric Balchunas commented on the matter:

BITO broke the all-time volume record with $2 billion in trades on this historic day.

The expert also noted that on January 8th, ProShares Bitcoin futures ETF reached an all-time high with over $2 billion in assets. BITO grew by 10% from $1.8 billion on January 2nd and by 18% from $1.7 billion on December 9, 2023, in the last month. According to Balchunas, BlackRock is leading among the 11 newly approved products that started trading yesterday with over 700,000 transactions and a total trading volume exceeding $4.5 billion, according to the data obtained.

Record Volume in Bitcoin ETF Trading!

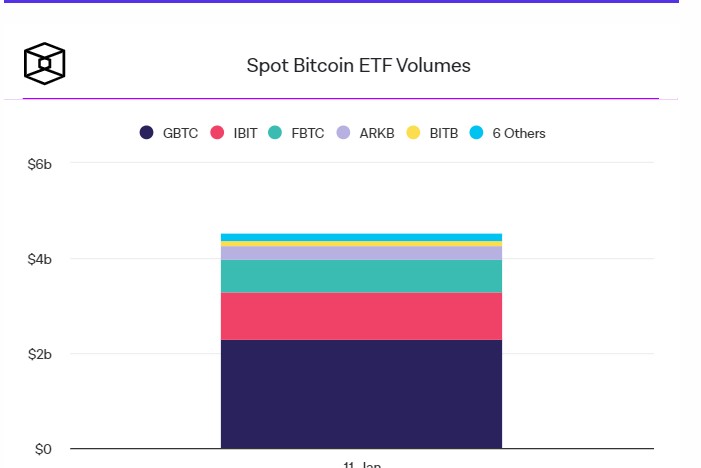

BlackRock’s spot Bitcoin ETF (IBIT) surpassed BITO’s first-day trading volume of $1 billion, reaching $1.05 billion and outperforming the futures Bitcoin ETF volume. Fidelity’s FBTC ETF reached approximately $685 million. Grayscale’s converted spot Bitcoin ETF product (GBTC) generated more trading volume than the sum of these two, reaching approximately $2.3 billion.

Considering that both BlackRock and Fidelity’s ETFs are new, the majority of their trading volume could likely consist of capital inflows. ARK 21Shares Bitcoin ETF achieved a trading volume of $278 million on its first day, while Bitwise (BITB) reached a value of $122 million. The remaining ETFs, including Franklin Templeton (EZBC), Invesco Galaxy (BTCO), and VanEck (HODL), reached trading volumes below $100 million.

Türkçe

Türkçe Español

Español