Spot Bitcoin ETF products were introduced to investors on January 12. During the first trading session, investors had no idea about the data related to the products, and market makers faced issues with liquidation timelines. However, the $4.66 billion volume in Bitcoin-focused ETF products managed to break records in the traditional finance sector. So, how will this situation affect the Bitcoin price? Let’s examine together.

What’s Happening in the ETF Sector?

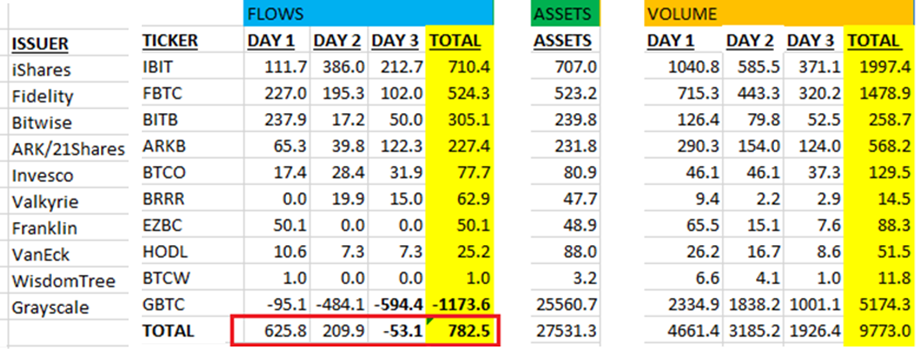

Before the ETF process, there were some criticisms about Grayscale GBTC, which existed as a trust fund holding over $27 billion in Bitcoin under management. In just the first three trading days, there was a net outflow of $1.17 billion from this instrument. Most of this movement occurred on January 13 and 16, balancing 86% of the entries into other spot Bitcoin ETF products.

Data presented by senior Bloomberg ETF analyst Eric Balchunas showed that most of the $782 million net inflow occurred during the first trading session. Analysts concluded that the majority of spot Bitcoin ETF inflows were matched with outflows from Grayscale GBTC. Even excluding the first trading day, products issued by BlackRock, Fidelity, Bitwise, Ark/21 Shares, Invesco, and other ETF issuers experienced a total net inflow of $157 million in two days.

So, assuming that while GBTC experienced a net outflow of $11.3 billion, other spot ETF products captured a net inflow of $13 billion, what is the expected price effect of the $1.7 billion growth in U.S.-listed spot Bitcoin funds? From a trading perspective, since only on January 16, there was a total of $1.9 billion in trading in these ETF products, this figure seems quite insignificant.

Bitcoin Ecosystem and the ETF Space

In every financial market, buyers and sellers always complete their transactions successfully, so investors tend to confuse volumes and flows. However, it is not possible to know whether the seller closed a position taken early in the day or whether the buyer made a reverse transaction in futures markets or different exchanges to take advantage of arbitrage opportunities. Considering that Grayscale GBTC’s commission fee is 1.5% while other competitors offer a fee of 0.25% or lower, it seems likely that investors will gradually move their assets.

User Byzantine General asked this exact question on January 17, suggesting there is ongoing real demand for spot Bitcoin ETF products. At current price levels, Bitcoin miners become owners of new Bitcoin worth $76.1 million every two days, so the recent spot ETF net inflows are just over twice this value. Moreover, regardless of the emerging price effect, this situation will change significantly after the Bitcoin halving event in April.

Türkçe

Türkçe Español

Español