Bitcoin savings wallets have surged to a value of $68 billion despite negative price movements. After Bitcoin fell below the $39,000 level at the beginning of last week, it climbed back above the $42,000 level. The recent surge in optimism has led investors to turn their attention back to Bitcoin. Let’s examine why investors continue to accumulate Bitcoin.

Bitcoin Accumulation Gains Momentum

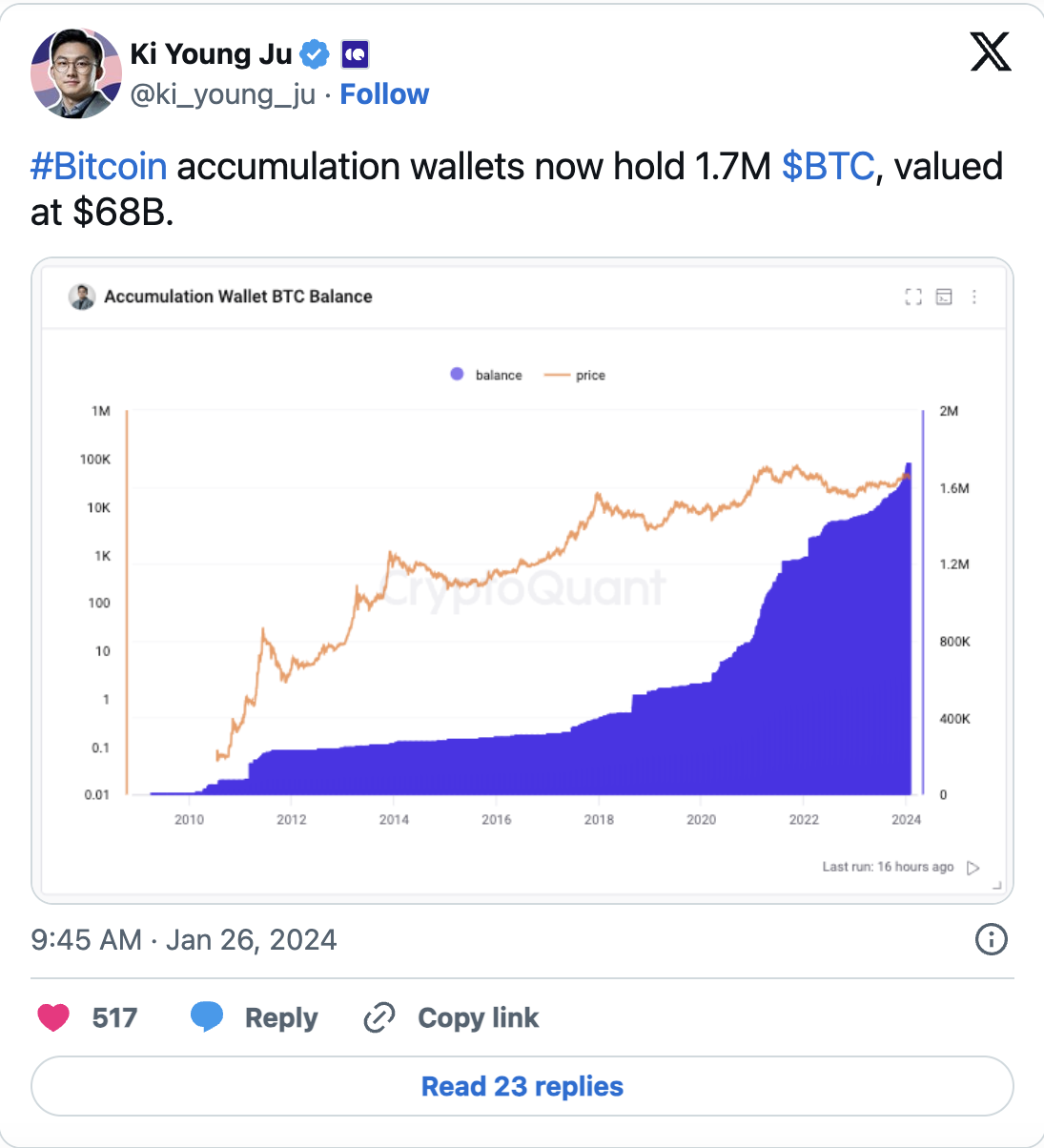

Despite the increasing selling pressure on Bitcoin reaching concerning levels, the overall sentiment among investors still appears to be bullish. According to Ki Young Ju, CEO of the blockchain data analysis platform CryptoQuant, this is evidenced by Bitcoin accumulation wallets, which currently hold an impressive 1.7 million Bitcoin valued at $68 billion.

Such a trend indicates a strong vote of confidence and increasing trust among investors in the leading cryptocurrency. The tendency to hold Bitcoin as a store of value or a long-term investment is also supported by significant assets in accumulation wallets. In addition to demonstrating investors’ faith, the accumulation model of Bitcoin also points to a decrease in market supply, potentially triggering a rise in price.

Bitcoin Ecosystem and User Interest

Transactions involving services like Coinbase Custody have led to Bitcoin inflows into savings wallets reaching a five-year peak, marking another significant milestone in the crypto journey.

The recent downward pressure can be attributed to increased selling activities by high-profile investors such as sharks and whales, who are looking to increase their profits by liquidating their assets in the trading markets.

However, the steady accumulation by other institutions is expected to further boost Bitcoin’s value, especially with the anticipation of the fourth halving event in April this year. Meanwhile, the number of active Bitcoin addresses has surpassed 1 million, indicating increased participation and usage of the crypto asset. The growing interest in Bitcoin Ordinals is also attracting more users to the Bitcoin ecosystem and helping to increase demand for Bitcoin.