Bitcoin is expected to have a relatively calm macroeconomic data week, but surprises are already possible. This time, China is at the center of volatility due to stock prices reaching their lowest levels in five years and the CSI 1000 index dropping by 8%, halting the trading of 30% of stocks.

Macroeconomic Data and Bitcoin

This situation follows liquidity injections from Beijing and the bankruptcy of China’s second-largest real estate giant, Evergrande. On February 4, as reported by Reuters, the China Securities Regulatory Commission or CSRC announced it would maintain expectations and confidence and resolutely prevent abnormal market fluctuations.

As of the writing of this article, the CSI 1000’s loss since the beginning of the year was approximately 27%. The Kobeissi Letter, a trade source, included the following statement in part of its report:

“China’s stock markets seem to be finally joining the collapsing real estate market. China’s HY real estate index has dropped over 85% from its peak just two years ago. The real question is: has this crisis been contained?”

This situation unfolded as Wall Street eagerly anticipated its opening during a period when there were speculations about how the US would proceed with quantitative tightening (QT). Following last week’s non-farm payroll data significantly exceeding expectations, predictions for a rate cut at the Fed’s March meeting have decreased. This week, unemployment figures will be in focus.

Meanwhile, concerns about the health of the regional banking sector continue. As for the impact on Bitcoin and crypto, former CEO of the BitMEX exchange Arthur Hayes sees a potential initial capitulation in March followed by a dramatic Bitcoin price recovery. The downward Bitcoin price target is at the $30,000 level.

Notable Decline in Bitcoin Whale Numbers

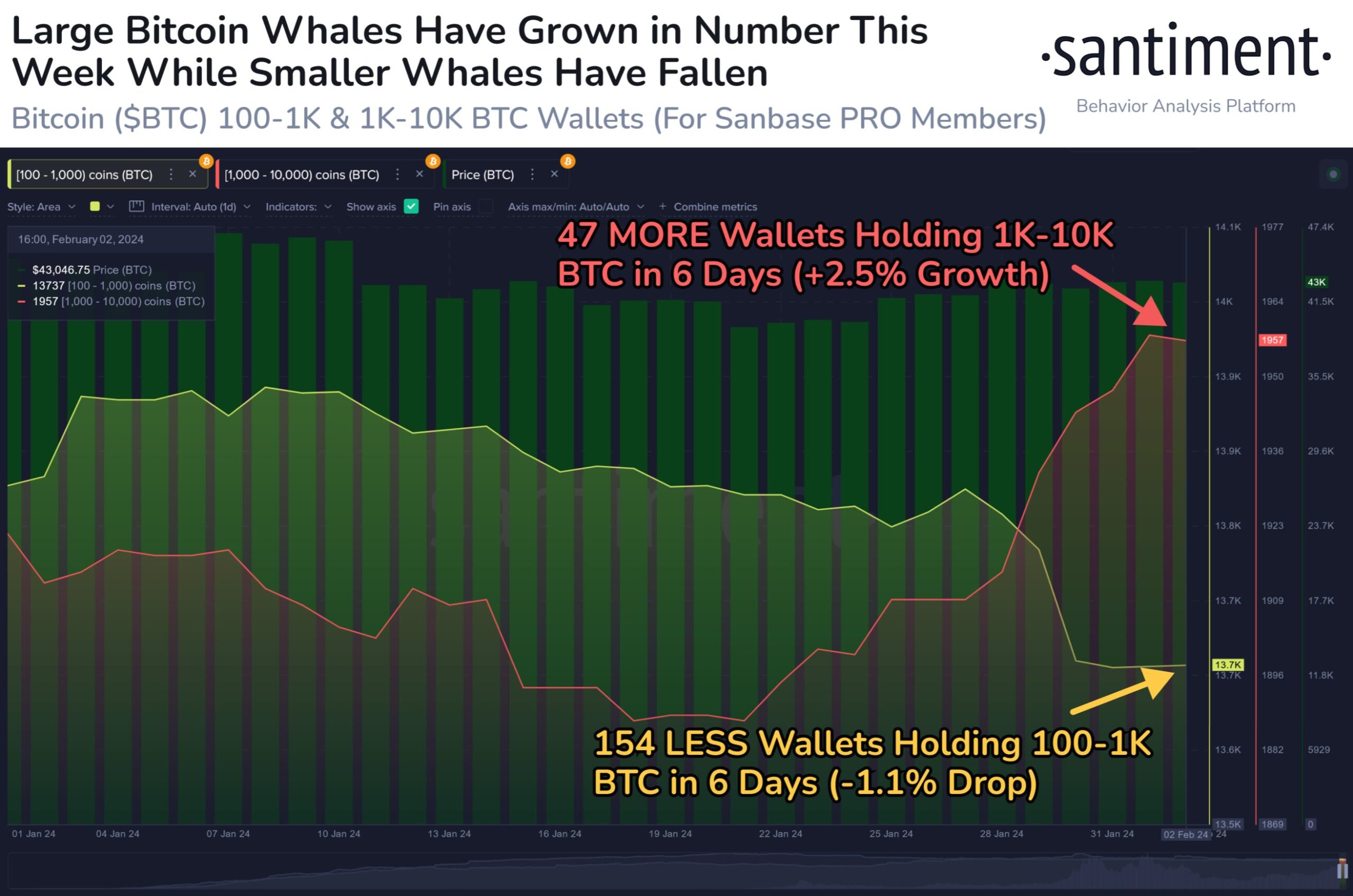

Despite the ongoing process behind the scenes and the volatility in Bitcoin’s price, whales seem to be preparing for change. Blockchain data analytics platform Santiment noted significant changes in the whale population over the past week in its latest review.

Currently, the number of wallets holding between 1,000 and 10,000 Bitcoin has reached its highest level since November 2022, while the number of wallets holding between 100 and 1,000 Bitcoin has fallen to its lowest level since that time. The number of wallets holding 100 Bitcoin dropped to 1,958, and the number holding 1,000 Bitcoin dropped to 13,735. The report included the following statement:

“Bitcoin is fluctuating between $41,000 and $44,000, but whale wallets are making big moves this week.”

Türkçe

Türkçe Español

Español