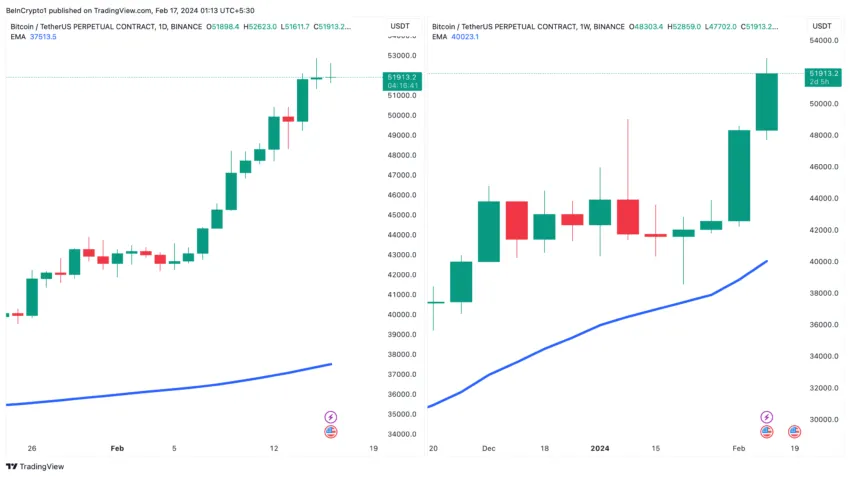

Bitcoin price continues to fluctuate above $50,000 at the time of writing, maintaining a positive outlook. Although it dropped to $50,625 yesterday, it attempted to surpass $52,000 again but encountered profit-taking at that level. Despite short-term price volatility, Dennis Liu recently made significant predictions.

Bitcoin Price and Peak Challenges

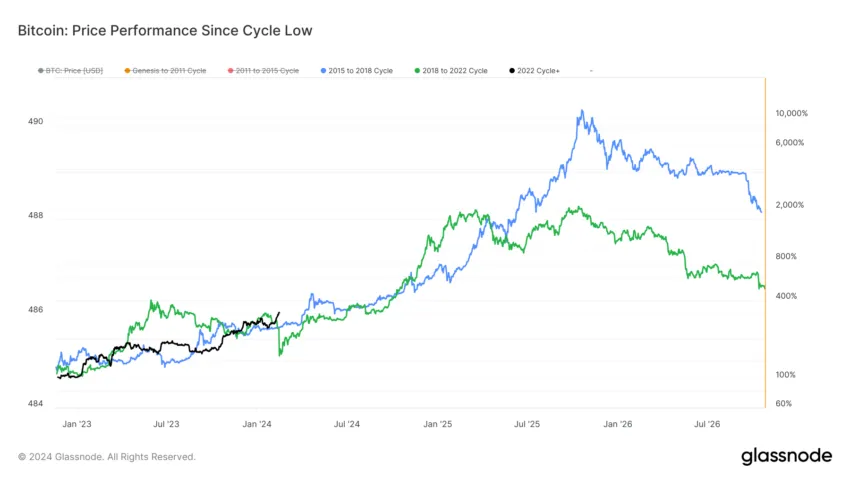

Identifying lows and highs is challenging. Each period has its unique environment; for instance, the major crash in November produced results that contradicted historical data. This is because historical data may not yield accurate results in extremely abnormal conditions. Turning to today, a popular analyst has significant predictions about the markets. Known as Virtual Bacon, Dennis Liu shared his expectations for the BTC peak, citing three reasons in the current conditions.

Price Targets

Historical data gives him two targets for BTC and ETH. The analyst, who has targets of $200,000 and $15,000, says he will be determined to convert to cash at these levels when prices approach, without waiting for more or the exact peak.

This criterion is based on historical market cycles and diminishing returns.

Time Targets

Those who failed to sell due to greed at the peak regretted it during the last bear market. Some even sold at a loss. Dennis points to the time target as the second signal to avoid being one of them in the future. For him, exiting by the end of 2025 is essential. He says he makes this decision by benefiting from Bitcoin halving cycles.

By setting a time limit, Liu brings a disciplined approach to investing and encourages investors to avoid the pitfalls of overexpansion.

Price Patterns

Finally, he will monitor Bitcoin’s relationship with the 200-day and 21-week Exponential Moving Averages (EMAs). Why does Dennis do this? These are significant support levels, and breaks below them have the potential to yield devastating results.

This approach, based on technical analysis, does not predict the future but warns about the past.

“This is my exit plan. If any of the three conditions are met, make a full exit and never look back.”

Those who follow Dennis and his strategy will face two paths. They will either regret selling early and miss out on subsequent rises, or they will exit at the right time and relax comfortably in their chairs. Only time will tell which will happen.

Türkçe

Türkçe Español

Español