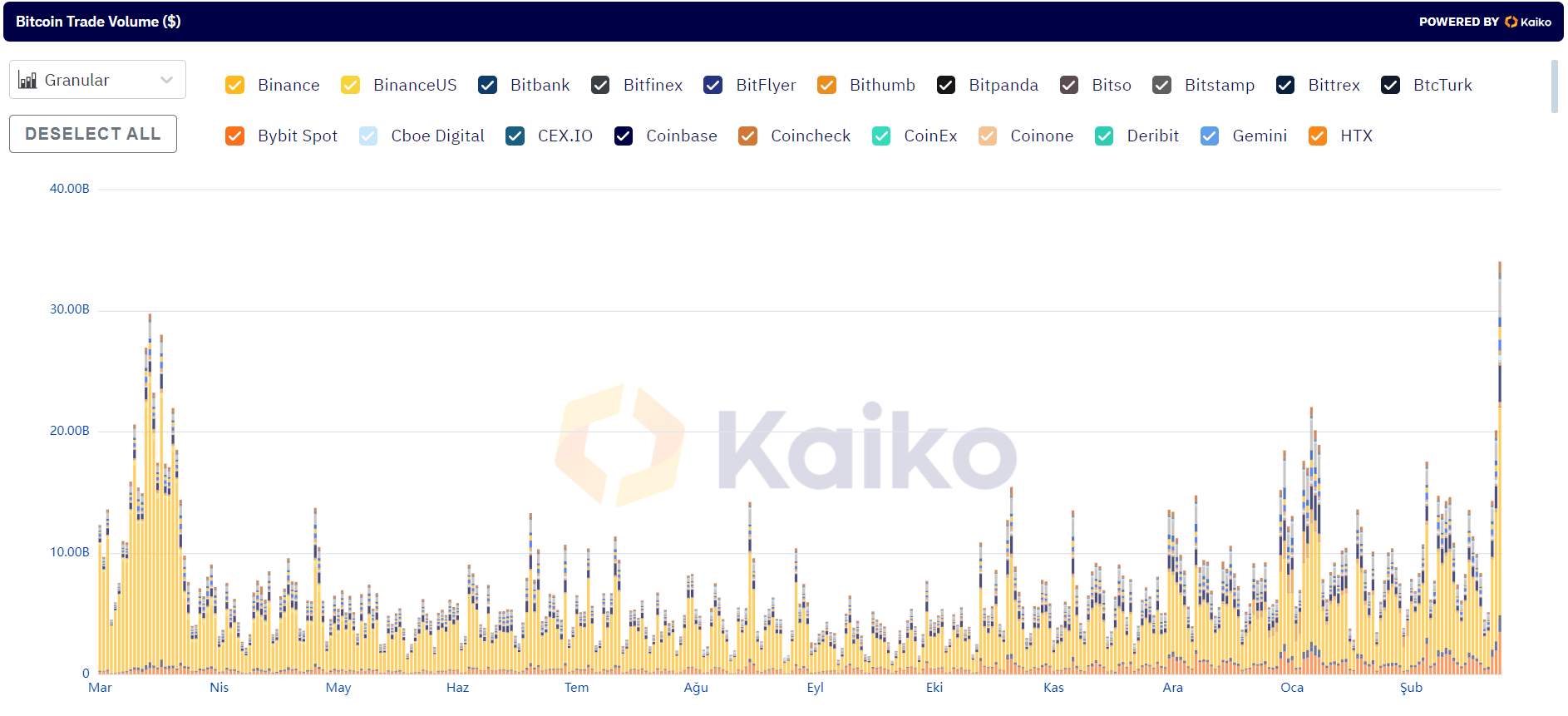

Cryptocurrency markets are still under the influence of the volatility from last night. The movements happened so quickly that we once again realize we are in a bullish phase. The indicators pointing to a bull market are not only related to yesterday’s volatility. There are other data points as well. Since the collapse of the cryptocurrency exchange FTX, there has been a significant increase in spot BTC trading volume. Let’s look into this development.

Massive Surge in Bitcoin Transaction Volume

The world of cryptocurrency is always a dynamic and volatile environment. Particularly since the collapse of FTX, there has been a significant increase in spot BTC trading volume. According to Kaiko, the spot trading volume on CEX, or centralized cryptocurrency platforms, has notably risen to $34.05 billion, indicating a high level of activity in the market.

In particular, leading cryptocurrency exchange Binance accounted for a significant portion of this volume, executing $17.09 billion in transactions. Other exchanges like Bybit, Coinbase, and OKX also saw substantial amounts of trading.

According to the figures, the cryptocurrency exchange Bybit had a spot trading volume of $3.5 billion, Coinbase had $2.98 billion, OKX had $2.92 billion, and Kraken had $1.05 billion.

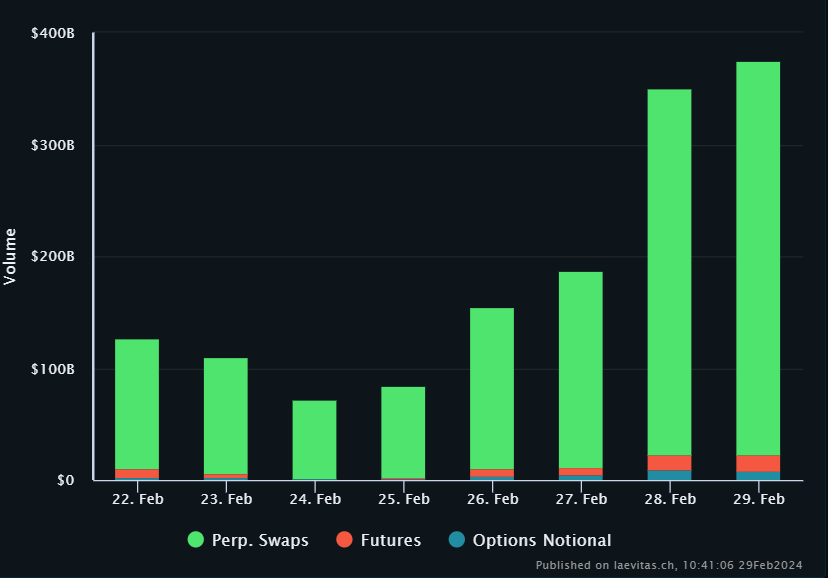

Increase in Derivative Trading Volumes as Well

The increase is not limited to spot trading. According to Laevitas data, across CEX platforms, there has been an unprecedented increase in total derivative trading volume, which includes perpetual contracts, futures, and options. The total derivative trading volume exceeded $380 billion, reaching the highest level since November 2021. This figure can be considered indicative of the increasing complexity and risk appetite in the cryptocurrency market.

This increase in derivative trading suggests that investors’ desire to capitalize on market movements is growing. In the last 24 hours, the BTC derivative trading volume has risen above $182 billion, while the cryptocurrency ETH has surpassed a derivative trading volume of $72 billion.

I consider these increases in the cryptocurrency market as a reflection of the sector’s dynamic nature. As institutional interest grows and individual investors continue to seek market opportunities, I believe cryptocurrency exchanges will reach unprecedented levels of trading volumes.

Türkçe

Türkçe Español

Español