In recent weeks, Bitcoin (BTC) has been the main focus of both individual and whale investors, drawing significant attention with its rising prices. However, the latest data indicates a shift in sentiment as Ethereum (ETH) enters the radar of whale investors.

Whale Activity in ETH

Lookonchain’s data reveals a significant move as a whale shifted from a bullish position in BTC to ETH. This strategic change included the exchange of 1,500 ETH for 88.68 WBTC on February 26, aiming to open a short position in the ETH/BTC pair, amounting to a total of $4.58 million. Following this initial transaction, the whale converted the acquired 88.68 WBTC back to 1,597 ETH worth $5.57 million, resulting in another swap. This resulted in a net gain of 97 ETH, worth $338,000.

Ethereum’s transition could align with increasing expectations for Ethereum ETF approvals and the growing excitement surrounding the Dencun upgrade. These factors could potentially draw more interest and investment to Ethereum, positioning it as an advantageous token for both individual and institutional investors. Despite this positive sentiment, Ethereum continues to face challenges, including persistently high gas fees on its network.

Long-Term Expectations for Ethereum

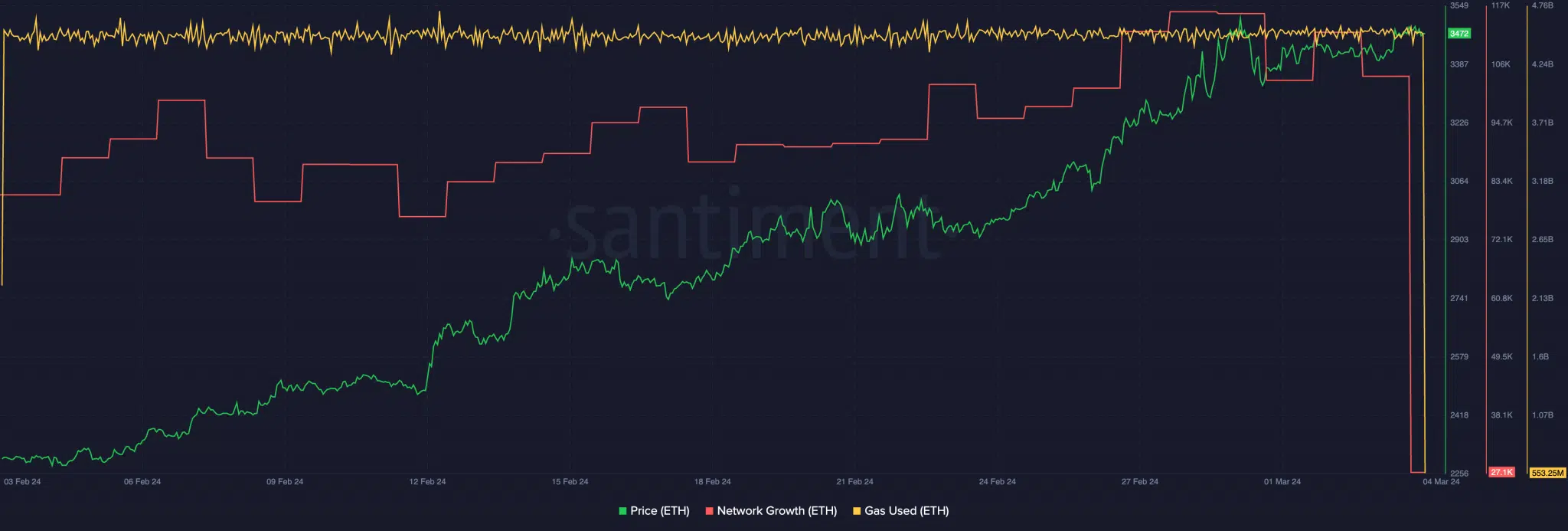

These fees could be a source of concern potentially affecting investor sentiment negatively, especially for small investors looking to transact. High fees may push users to seek lower-cost alternatives like Solana (SOL), which could impact Ethereum in the long run. Nevertheless, gas usage on the Ethereum network has remained relatively stable in the past few days. Looking at price movements, Ethereum was trading at $3,469.49 at the time of writing, showing a growth of 1.56% in the last 24 hours.

Although the positive price movement is encouraging, other worrying issues have also emerged. In particular, Ethereum’s network growth has seen a decline, indicating a decrease in interest from new addresses. This could pose a challenge to Ethereum’s sustainable growth and raise questions about the broader market sentiment surrounding the altcoin.

Türkçe

Türkçe Español

Español