Bitcoin (BTC), after showing volatility around previous peaks over the weekend, made a determined move by surpassing $70,000, potentially marking the first of many new highs in the coming months. Here are the detailed current data on the cryptocurrency!

Coinglass Data on BTC

According to the 21.million.com website, the cryptocurrency is trading at around $72,000 with approximately a 4% gain in the last 24 hours. The rise continues to build on the strong and rapidly growing institutional interest in cryptocurrencies. According to Coinglass data, the open interest (OI) on the world’s largest Bitcoin futures exchange, CME, has increased by 3.89% in the last 24 hours, surpassing $10 billion for the first time.

CME’s standard futures contract is valued at five BTC and is considered a barometer of institutional interest in cryptocurrencies. At the time of writing, it accounted for more than 30% of all investments in Bitcoin derivatives, with Binance in second place at 22%. High speculative interest is emerging as institutional investors gain easier access to Bitcoin through recently launched spot ETFs. According to the analysis related to SoSo Value data, the new ETFs have witnessed a cumulative trading volume of $7.69 billion since their listing.

Bitcoin Whales on the Move

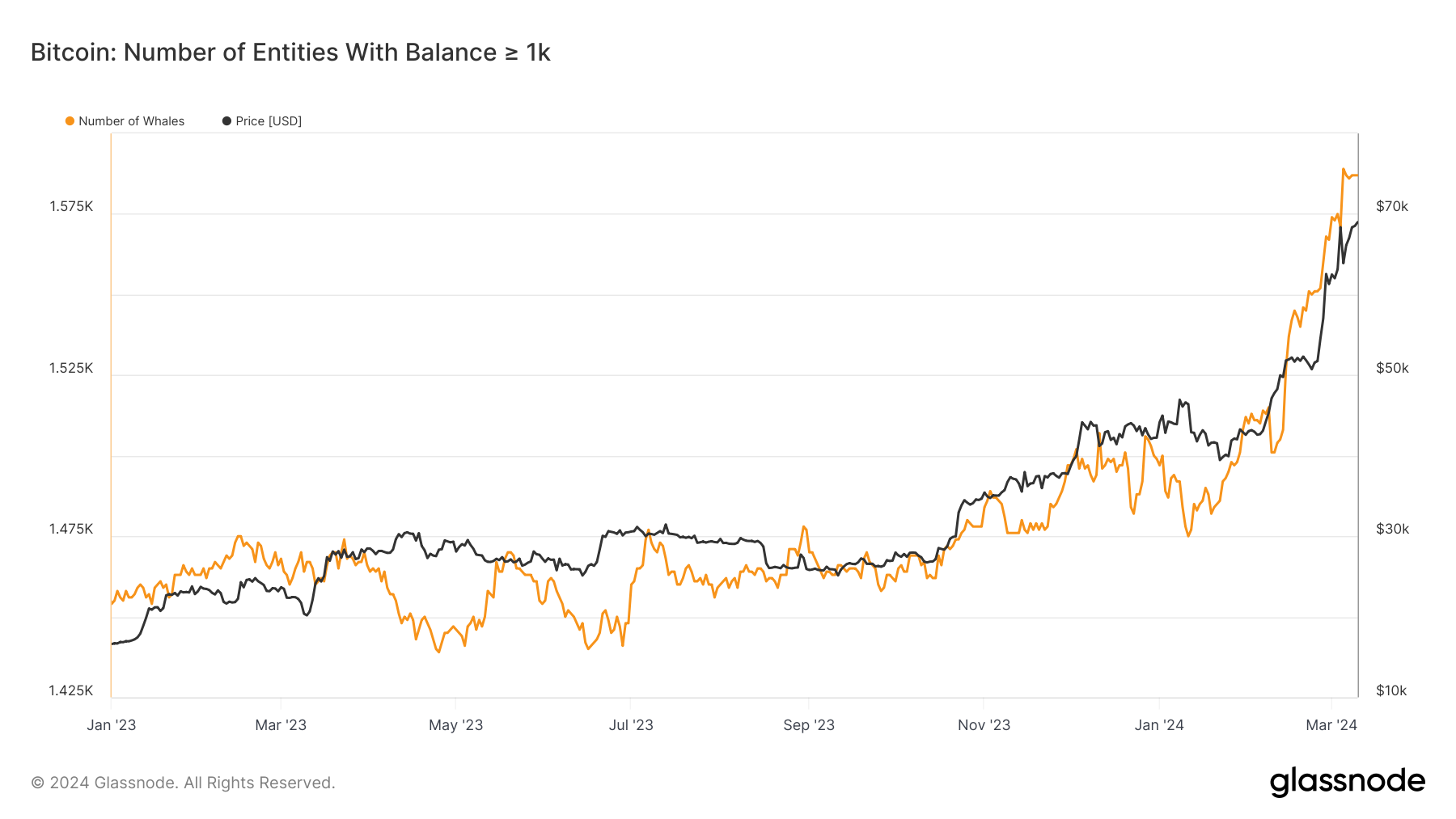

Moreover, as of March 8, these ETFs are supported by approximately $9.59 billion worth of Bitcoin. A steady increase in whale entities also clearly shows the growing institutional interest. According to an analysis based on Glassnode data, organizations with at least 1,000 tokens have grown by 6% since the beginning of the year. This accumulation has helped the price of Bitcoin rise. Additionally, according to data from Hyblock Capital, about 60% of all whale positions on Binance were in long positions at the time of the news release. This suggests that most institutional investors believe the spot price of Bitcoin will continue to rise in the coming days.