While weekly net inflows and trading volumes for US spot bitcoin exchange-traded funds (ETFs) reached record levels last week, Bitcoin hit all-time highs before experiencing a sharp pullback. According to data from BitMEX Research and Farside Investors, the total net inflow into spot Bitcoin ETF funds reached $2.57 billion last week, a 15% increase compared to the previous week’s $2.24 billion.

What’s the Current State of ETF Funds?

BlackRock’s IBIT fund continued its dominance with an inflow of $2.48 billion. Fidelity’s FBTC fund was second with $717.9 million, and VanEck’s HODL fund third with $247.8 million. Meanwhile, Grayscale’s converted GBTC fund witnessed an outflow of $1.25 billion, with Invesco’s BTCO fund contributing to an outflow of $29.4 million.

Since the start of spot Bitcoin ETF transactions on January 11, the total net inflow has exceeded $12 billion. Bloomberg ETF analyst Eric Balchunas commented on March 16:

“ETF funds closed a week with net inflows of $2.5 billion and a volume of $35 billion with an 8% sell-off overnight as if it was nobody’s business.”

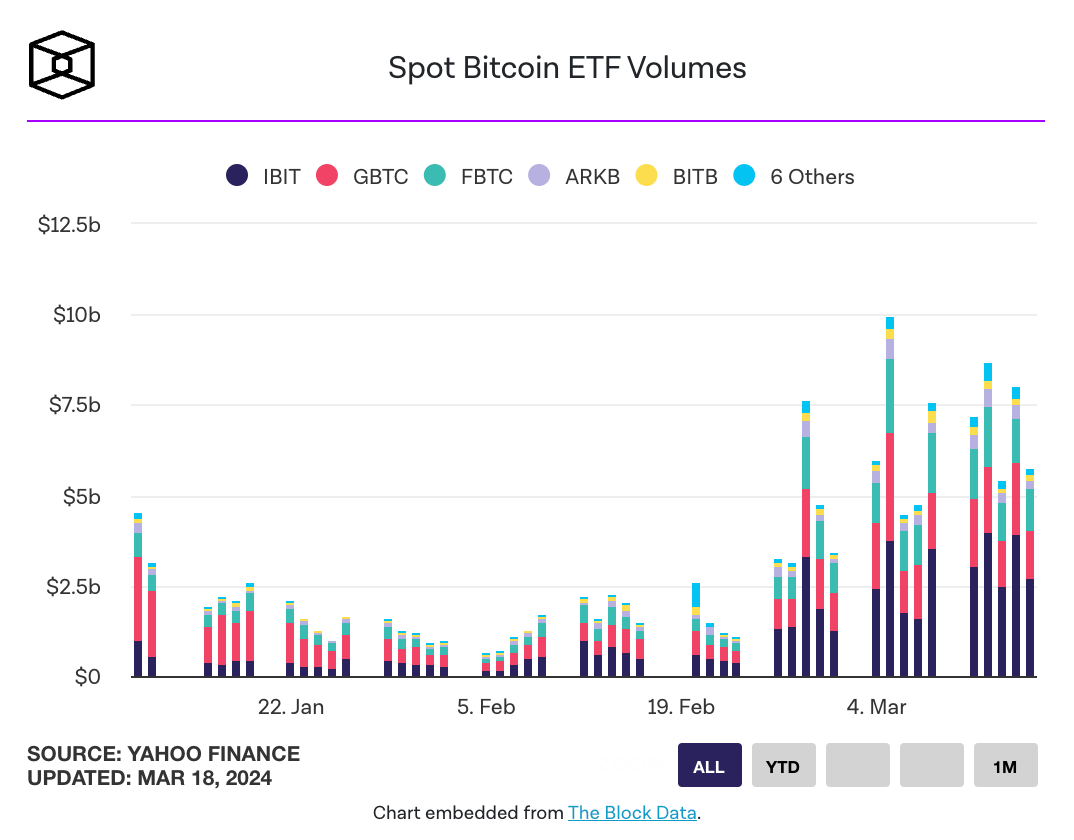

The weekly trading volume for US spot bitcoin ETF funds broke a record last week, reaching $35.1 billion amidst Bitcoin’s volatile price movements. The trading volume for ETF funds last week was 15% higher than the previous week’s $2.24 billion.

BlackRock’s IBIT ETF fund led the way throughout the week, generating a trading volume of $16.17 billion. According to The Block’s Data Dashboard, Grayscale’s GBTC fund and Fidelity’s FBTC fund generated $8.24 billion and $6.5 billion in trading volumes, respectively.

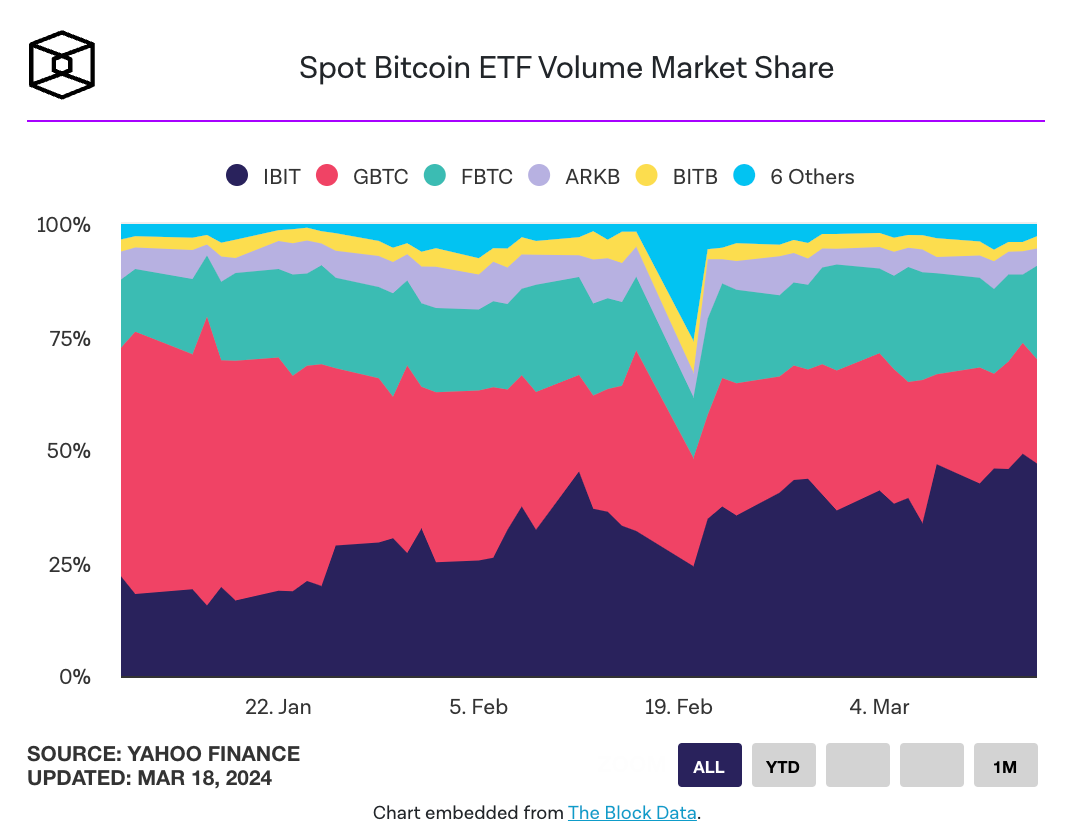

BlackRock’s spot Bitcoin ETF fund is now approaching a 50% market share with a 47% share of trading volume. Meanwhile, Grayscale’s higher-fee GBTC fund has fallen from a 50.5% market share on January 11 to 23.1% as of March 15. The cumulative trading volume for all spot Bitcoin ETF funds is currently at $141.7 billion.

What’s Happening on the Bitcoin Front?

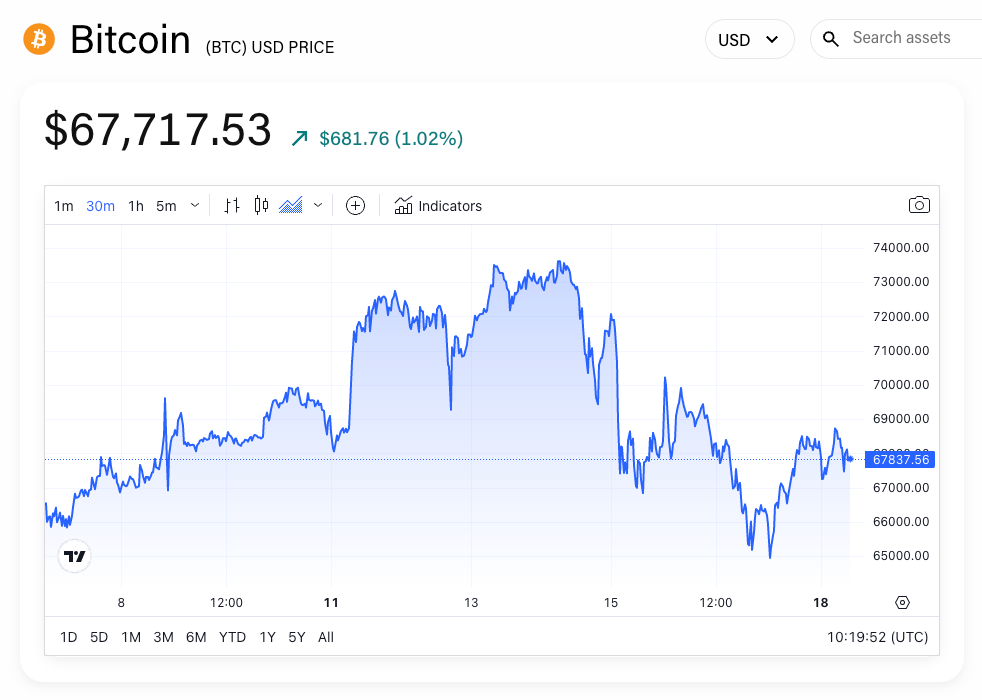

Bitcoin’s price reached an all-time high of $73,836 on March 14 before falling over 12% to $64,505 on March 17, as the largest cryptocurrency by market value. According to Tradingview data, Bitcoin has since recovered somewhat and was trading at $68,134 at the time of writing.

The downturn was also observed in the broader crypto market, with the GM30 index, representing the top 30 cryptocurrencies by market value, falling from a peak of 162.52 last week to 146.52, a 10% decrease. However, the index has significantly risen since the end of last year and is currently trading at 151.85.

Türkçe

Türkçe Español

Español