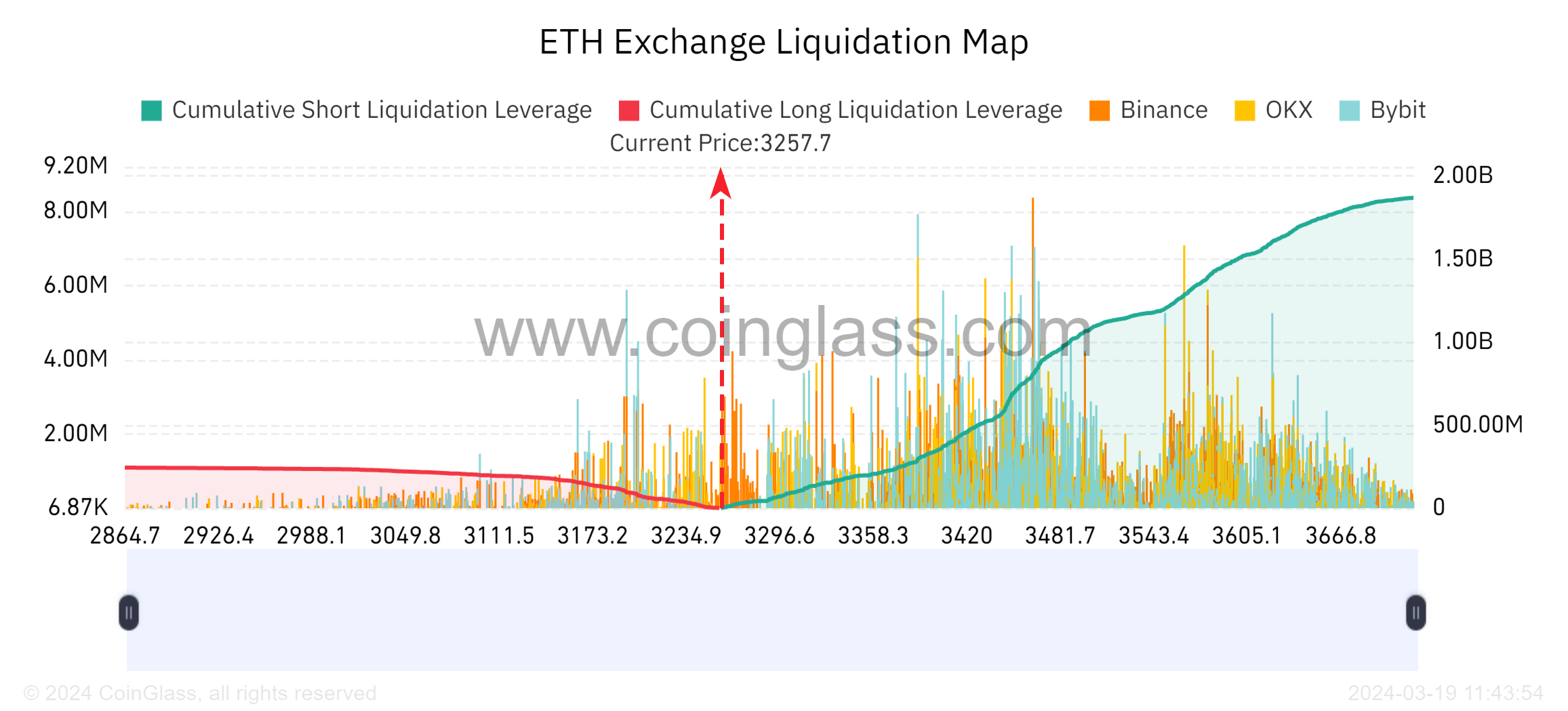

Ethereum could see over $212 million in futures long positions liquidated if its price falls below $3,100. Ethereum dropped by 9.3% to $3,254 in the past 24 hours until 13:40. According to Coinglass data, Ethereum showed a weekly decline of over 18% and falling to $3,100 would erase $212 million worth of long positions.

What’s Happening on the Ethereum Front?

If Ethereum falls below the psychological support level of $3,000 during this period, liquidations could reach $237 million. The mentioned volatility triggered a total of $624.4 million in liquidity in the last 24 hours.

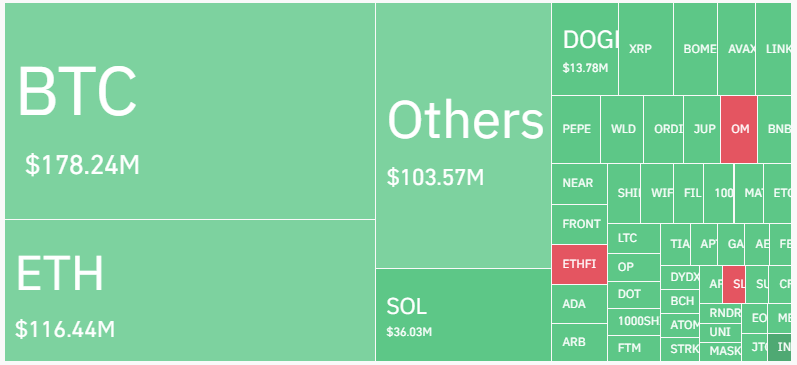

The recent price volatility primarily liquidated long positions, or investors betting on a price increase, erasing $514 million worth of long and $110 million worth of short positions. According to Coinglass data, the OKX exchange witnessed the most liquidation with $90.8 million, followed by Binance with $79.9 million and Bybit with $23.4 million.

Bitfinex’s Ethereum Report

Bitfinex Analyst report suggests that Bitcoin‘s sharp pullback since March 14 could test institutional appetite and lead to a price rebalancing period in the broader crypto market. The report states:

“As investors seek balance amid unprecedented entries into Spot Bitcoin ETF funds, we expect a period of market rebalancing. Conversely, the resilience of the altcoin market, evidenced by increasing investment flows and record outflows from Ethereum, underscores the bullish narrative for Ethereum and Layer-1 blockchain projects. The performance of large-cap altcoins will be influential in determining their trajectory as the market develops.”

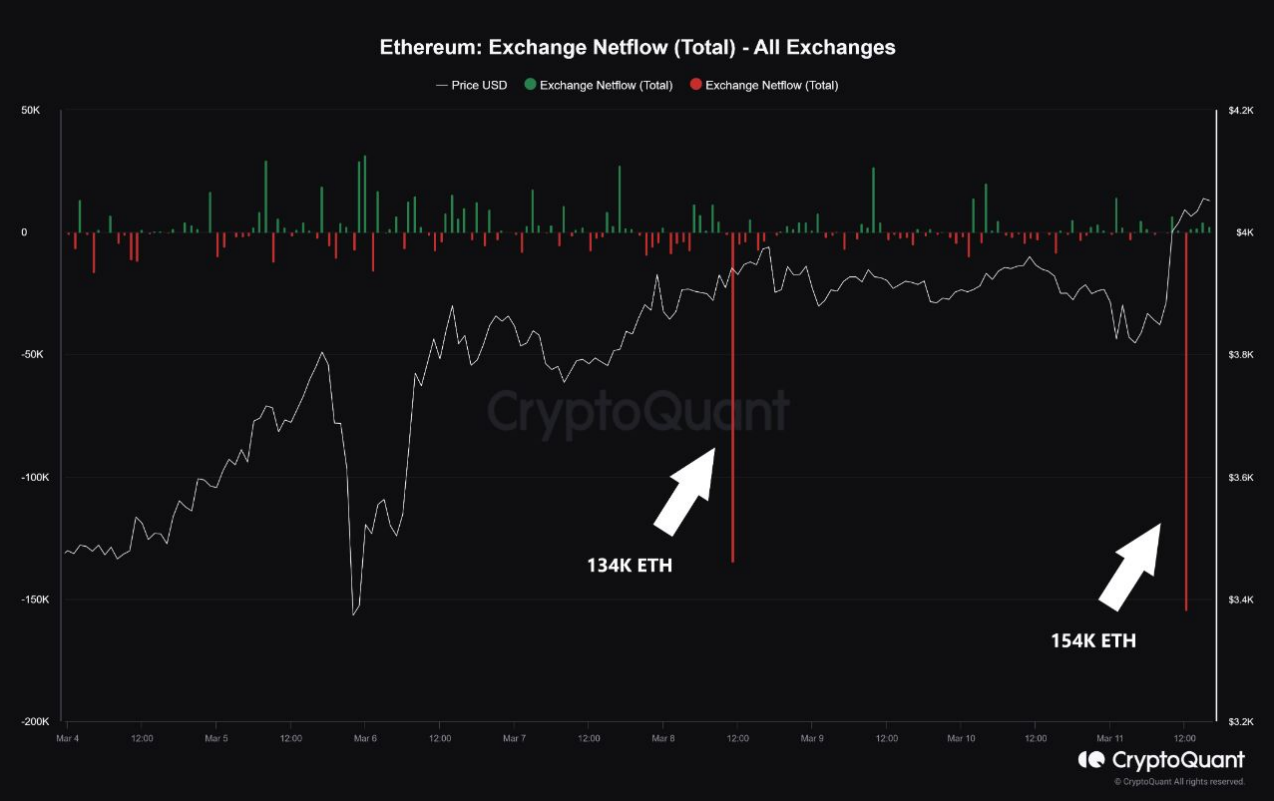

Net Ethereum outflows from exchanges reached a new record level on March 11 with the transfer of 154,000 Ethereum from crypto exchanges. According to Bitfinex, this reduces the current supply on exchanges and could potentially lead to an upward price movement:

“Recent net flow data indicates a potential short-term upward trajectory for Ethereum, but we suspect this could be investors moving their Ethereums from exchanges to engage in token transactions on an ERC-20 protocol or a Layer-2 network like Base mainnet.”

Türkçe

Türkçe Español

Español