Known as the Wolf of Wall Street, Jordan Belfort is recognized as a leading figure in the world of finance and investments. In the 1990s, he became famous for his involvement in securities fraud and financial crimes. However, in a recent interview with Benzinga’s CEO Jason Raznick, Belfort drew attention to Bitcoin (BTC) and NFTs.

The Famous Figure’s View on Bitcoin

Initially, Belfort was skeptical about cryptocurrencies, calling them a “mass delusion of madness.” However, his perspective has since shifted, particularly regarding Bitcoin and Ethereum (ETH).

Especially with Bitcoin and Ethereum (ETH), it is noted that he has shown a complete change. Belfort, who previously had a skeptical approach, attributed this to manipulations in the early stages of cryptocurrencies and later referred to Bitcoin particularly as a store of value.

Belfort’s long-term belief in BTC aligns with growing institutional interest, yet he does not overlook the high volatility and uncertainties specific to cryptocurrencies.

NFTs and Uncertainty

When it comes to Non-Fungible Tokens (NFTs), Belfort appears to maintain his skeptical approach. He mentions receiving offers to create his own NFTs but has stayed out of the process due to doubts about their long-term value.

Beyond crypto, Belfort is also known as a knowledgeable individual regarding cheap stocks. He states that many cheap stocks are “trash” and are generally more beneficial to issuers than investors.

Current Situation in Bitcoin

Even a perspective like Belfort’s is considered positive for Bitcoin, placing it at an important point. Setting all this aside, the whole world seems to be turning its eyes towards Bitcoin.

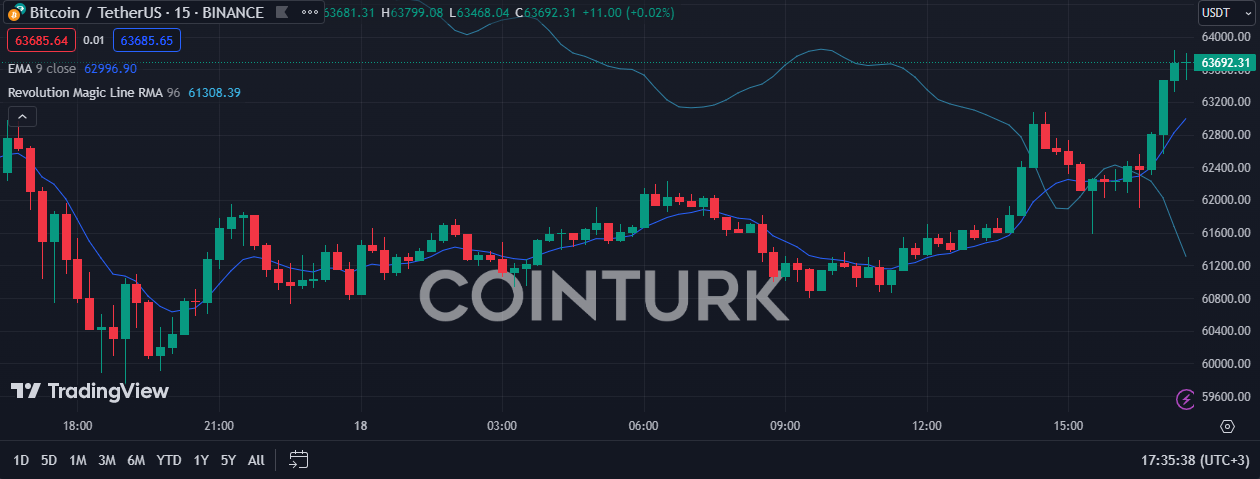

There are only about 1 day and 12 hours left until the Bitcoin halving, indicating that there are 211 blocks remaining. The price seems to have recovered after trying to hold above the $60,000 level.

As of this writing, the BTC price has risen back to $63,630 after a nearly 4% increase. This price movement of BTC raises the question louder whether the decline before the halving has ended.

Türkçe

Türkçe Español

Español