Bitcoin has completed its fourth block reward halving, pushing the king of cryptocurrencies back above $65,000. This historic event was distinguished by several significant details. Bitcoin is no longer the same, and the investor profile is definitely starting to change. So why was this halving exceptionally perfect?

Bitcoin Halving Day

Bloomberg Intelligence ETF analyst Eric Balchunas commented on X (formerly Twitter) that this cycle’s block reward halving was different from others and was overly perfect. On the early hours of April 20th, the 840,000th block was mined, reducing the reward per block to 3.125 BTC.

This significant event took place on April 20th, a date also known as DOGE day, which mocks the traditional structure of finance. More importantly, on this day, as Bitcoin’s new supply issuance rate halved, the financial giant BlackRock’s ETF celebrated its 69th entry day.

Balchunas summarized the situation by saying, “This is a bit too perfect.” The convergence of these events created a contrast that led to other contrasts. For instance, Bitcoin, once called a store of value and a tool for libertarian finance, has transformed into something highly dependent on macroeconomic developments, affected by wars, and suffering significant losses in corporate bankruptcies. Moreover, we are moving towards interesting days for the DeFi space, including mandatory KYC requirements. Perhaps if Nakamoto were alive (or if he is), April 20th (from the standpoint of the blockchain-based free money narrative) might not have been as amusing to him.

Spot Bitcoin ETFs

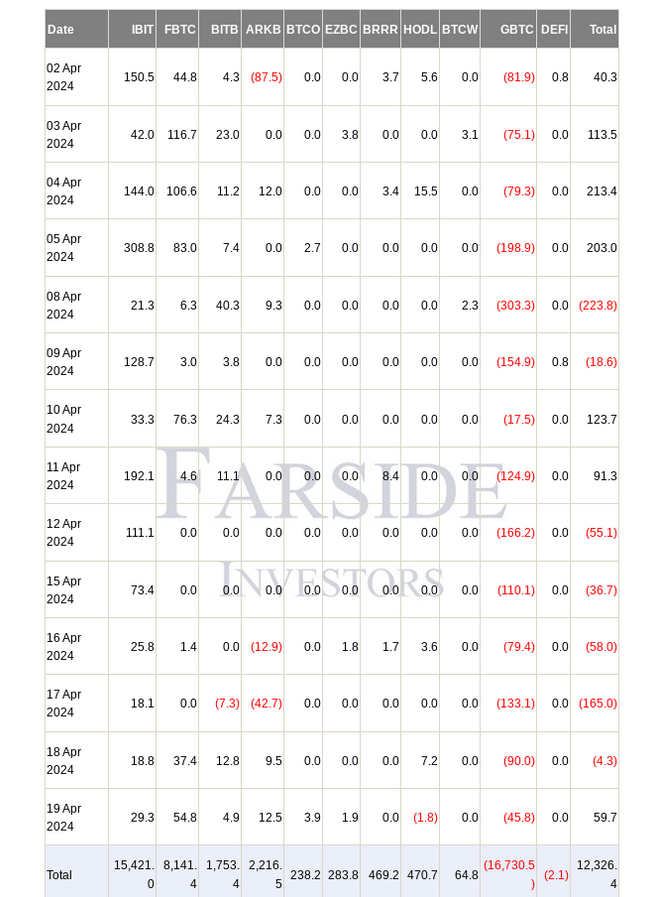

Following major entries in March, the train went off the tracks in the ETF channel with sales by Genesis. There was a noticeable slowdown in entries, yet IBIT remained strong. According to Farside Invest data, even on the toughest days, BlackRock’s Bitcoin ETF did not experience a net outflow day. On April 19th, there was a net entry of $29.3 million.

Meanwhile, the latest Form 13F filings raise concerns that Bitcoin ETFs have not yet penetrated the mainstream majority. Jim Bianco, founder of Bianco Research, described the first quarter allocation data as a “disappointment.” While institutional investors have shown little interest, there still exists the potential for another FOMO wave.