Ethena (ENA), aiming to reverse the $1 threshold, is sparking debates among investors and analysts with its potential price trajectory. The cryptocurrency is currently maintaining its momentum amidst major trends involving artificial intelligence or memecoins. Based on recent sentiment and market trends, ENA is showing signs of an upward trend.

Continued Interest in Ethena

As Ethena (ENA) approaches the critical price point of $1, the latest market dynamics point to a potential upward trend. The token, currently trading at about $0.90, has seen significant activity in trading volume and investor sentiment.

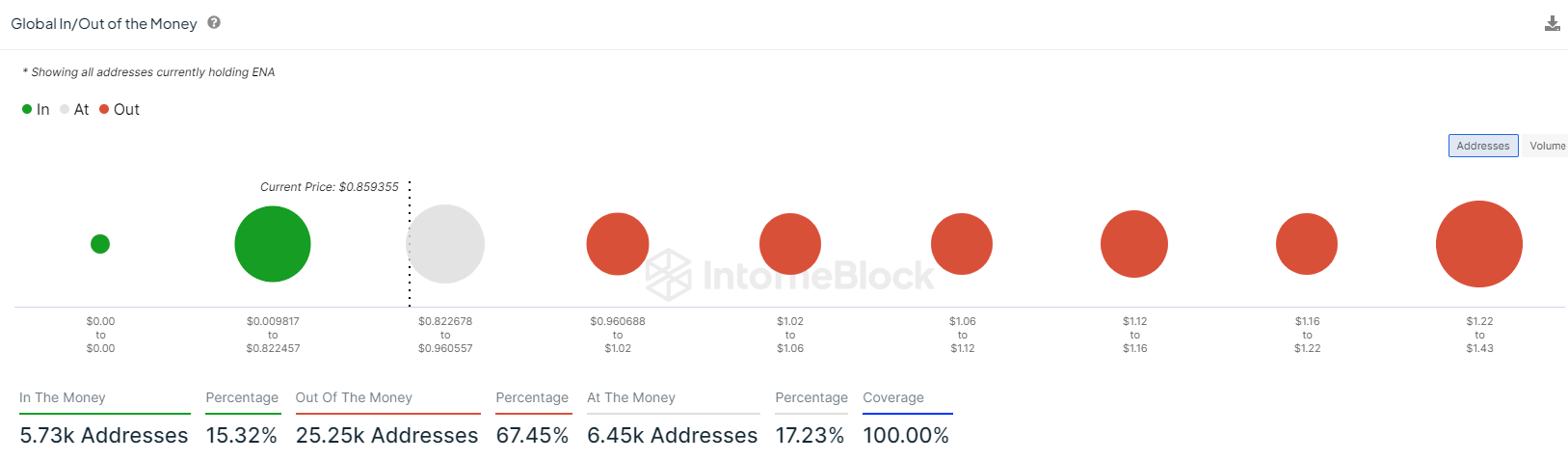

Updated data shows a strong holding model among investors; 67.45% of ENA holders are out of the money, meaning their holding prices are higher than the current market price. This is likely to slow down sales at current levels and cause the majority of shareholders to continue holding their assets until their positions reverse.

Moreover, ENA’s network data reveals a healthy and growing ecosystem despite a slowing market. Despite volatility, the total number of ENA holders has maintained relatively stable growth, with over 36,000 new owners last month. As indicated by the daily creation of new addresses, the network’s growth continues to decline, mirroring the price trend. However, it is still beneficial to note that shareholders are still holding onto the token.

ENA Chart Analysis

ENA price chart’s technical analysis shows a consolidation phase where the price is balanced above key Fibonacci support levels. The Relative Strength Index (RSI), currently at 55, indicates a balanced market condition, neither overbought nor oversold.

This stability, combined with sustainable shareholder growth, presents a situation for potential price increase after a long consolidation period. ENA is currently positioned between the 0.737 and 0.5 Fibonacci levels, representing a strong consolidation area for ENA. A rise towards $1 is likely, and if this psychological resistance area is reversed, the price will likely test $1.12 in the next step.

Türkçe

Türkçe Español

Español