The largest cryptocurrency Bitcoin (BTC) is moving around $68,000 after facing strong resistance at $70,000 last week. Despite this, on-chain metrics for Bitcoin indicate a promising future and suggest healthy developments in the coming days.

Bitcoin’s Consolidation Phase

Leading Bitcoin analyst Willy Woo provided insights into the recent price behaviors of the largest cryptocurrency, noting that the crypto king has been undergoing a 2.5-month consolidation period under bullish demand. Woo expressed that this consolidation period is beneficial and suggested that Bitcoin has more potential to rise before reaching its peak.

The analyst added that the net capital inflow into the Bitcoin network hit its lowest during the consolidation phase but increased steadily throughout May.

An important indicator of this positive trend is the resurgence of inflows into spot Bitcoin ETFs in the US. Over the past two weeks, inflows into ETFs have returned strongly, with BlackRock surpassing Grayscale in terms of inflows. The daily demand from these spot Bitcoin ETFs has significantly exceeded the daily amount of BTC mined. This strong demand from ETFs is a bullish sign for Bitcoin and indicates continued interest from institutional investors.

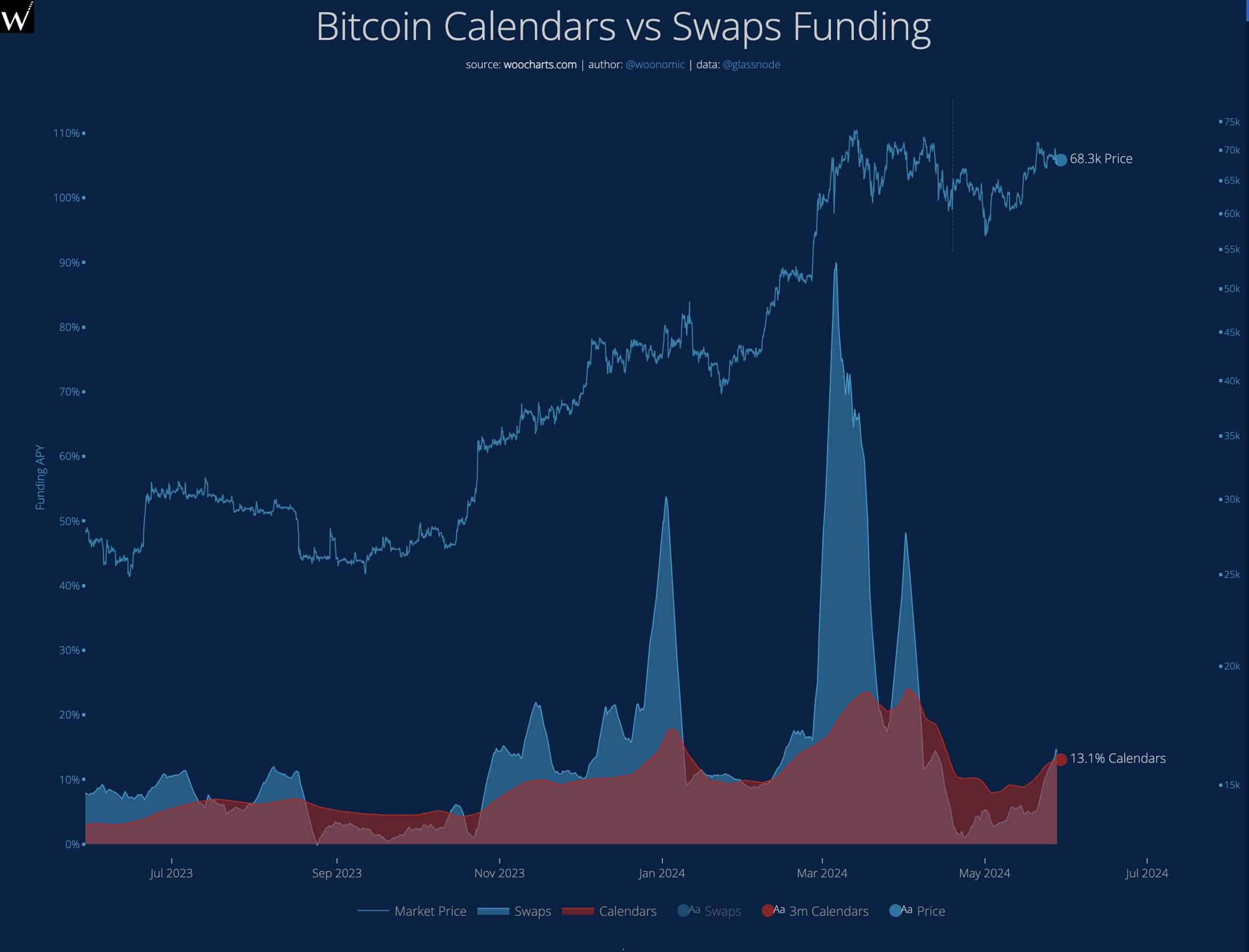

Revival in Futures Markets

Woo also noted a revival in the futures markets, especially among individual traders, in addition to spot ETFs. In his analysis, as shown in the blue-shaded area, the funding rate for perpetual swaps indicated a recovery in demand among individual traders. This demand is increasing steadily without reaching dangerously high levels that could indicate fear of missing out (FOMO), signaling a stable and healthy market environment.

Another critical development during the consolidation phase highlighted by the analyst is the significant withdrawal of BTC from cryptocurrency exchanges by Bitcoin whales due to strong accumulation. This trend could lead to a supply shock for BTC, creating upward pressure on its price in the future. When large amounts of BTC are withdrawn from exchanges, the available supply for trading decreases, and if demand remains strong, it could potentially lead to higher prices.

Woo also emphasized that $73,000 remains a significant resistance level for Bitcoin’s upward movement. However, if Bitcoin manages to surpass $72,000, it could trigger substantial liquidations and potentially cause a short squeeze. This scenario could push the price of the largest cryptocurrency above $75,000 and potentially set new records.

Türkçe

Türkçe Español

Español