Mt. Gox, years ago, gained significant attention in the cryptocurrency world with its collapse. Recently, it transferred 47,229 BTC to a new wallet address, drawing attention. This transfer, valued at approximately $2.71 billion at current market prices, was the first major move by the exchange since May. On the other hand, this move is seen as potentially affecting the cryptocurrency market, causing some fear in the market. This situation indicates typical selling pressure.

Beginning of the Repayment Process

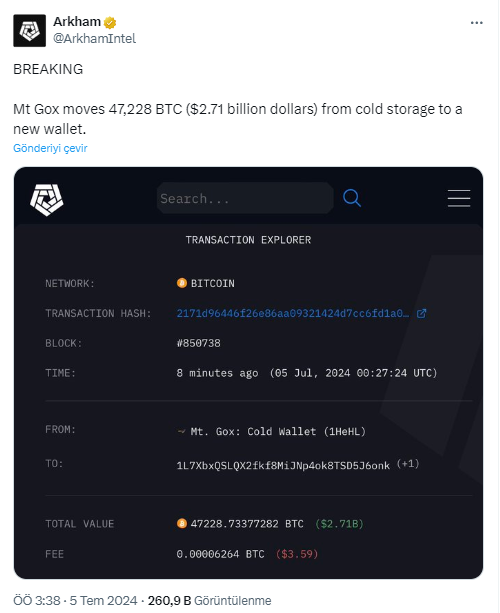

According to blockchain analysis platform Arkham Intelligence, this large transfer occurred on July 5 at 03:30. Before this transaction, Mt. Gox conducted several small test transactions. These tests were preparatory for the large transfer and upcoming repayments.

Repayments to creditors are part of a process starting this month. The total repayment amount is estimated to be $8.5 billion in Bitcoin. This large-scale repayment plan has raised concerns about its potential impact on the Bitcoin market. Some market commentators fear that selling such a large amount of Bitcoin could lower the market price due to the sudden increase in supply.

Cryptocurrency Market Concerned

Concerns are high among market observers. It is believed that the flow of Bitcoin sold by creditors could significantly lower the price. However, some analysts are trying to downplay expectations of a serious selling wave. They claim that the actual amount of Bitcoin to be sold will be less than the total repayment amount. This amount is estimated to be close to $4.5 billion.

Previously, on May 28, Mt. Gox transferred Bitcoin worth approximately $7.3 billion to an unknown wallet address. This transfer caused the Bitcoin price to drop by up to 2%. This historical context raises concerns about potential reactions to the recent transfer.

The flagship of cryptocurrencies, Bitcoin, has experienced significant fluctuations recently. On July 4, Bitcoin saw a sharp decline and continued to fall in the hours following the transfer. At the time of writing, Bitcoin had dropped below $57,000. Last week, Bitcoin’s price fell by 6.9%, but it has gained 35.6% since the beginning of the year.

Türkçe

Türkçe Español

Español