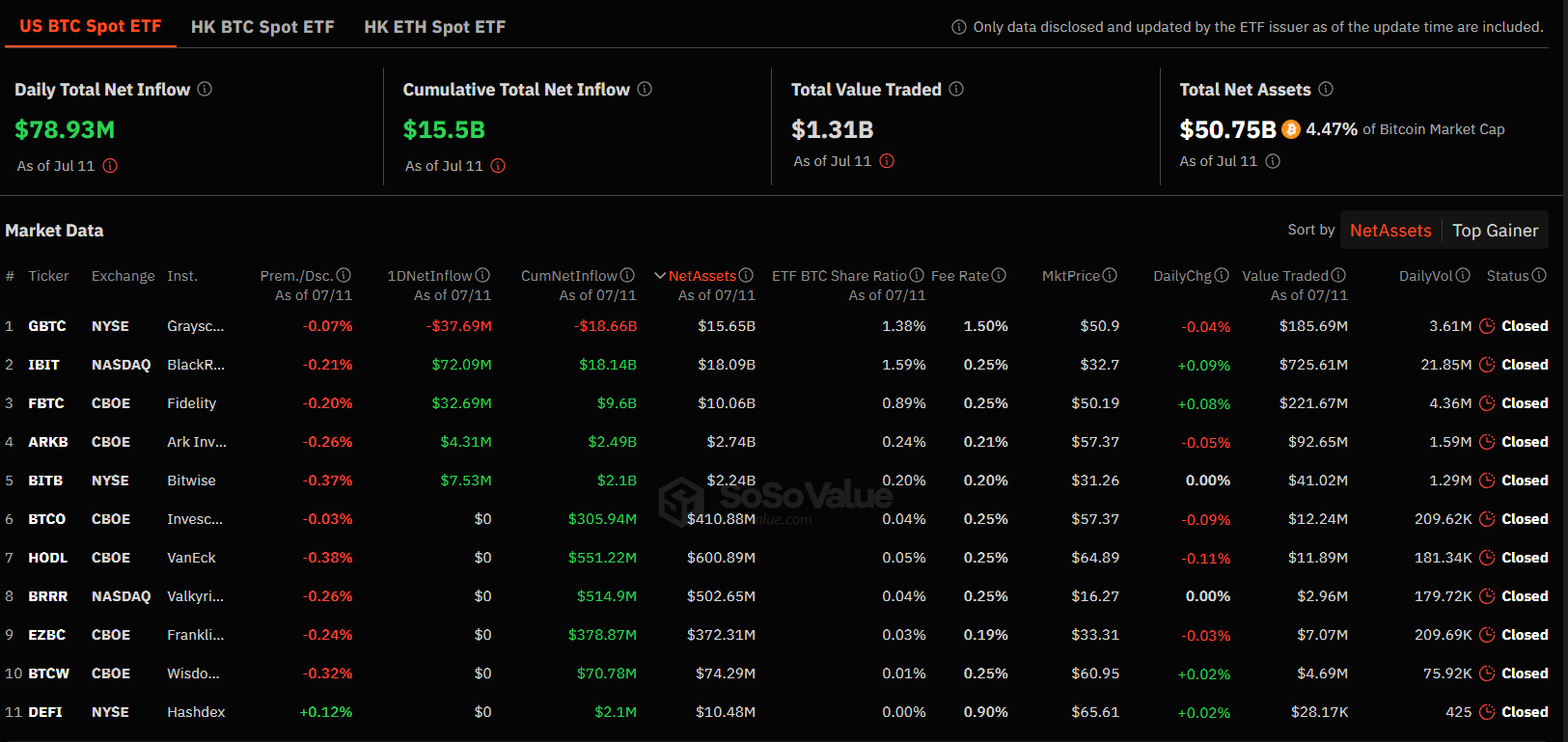

On July 11, 2024, net inflows in the Bitcoin ETF market reached $79 million, indicating sustained investor interest in these investment vehicles. This positive trend marked the fifth consecutive day of positive net inflows, reflecting ongoing investor interest in Bitcoin ETFs. Despite the positive inflows, total volume decreased, falling below the $100 million threshold. This decline in volume may suggest that investors are taking a more cautious approach or that the market is experiencing a consolidation period.

Strong Performance by BlackRock and Fidelity

Among Bitcoin ETFs, BlackRock’s IBIT fund recorded the highest inflow of the day with $72.1 million. This significant investment underscored the confidence and interest in BlackRock’s Bitcoin ETF offering. Fidelity’s FBTC fund also saw a notable inflow of $32.7 million, reinforcing the strength and appeal of its Bitcoin ETF product. These inflows demonstrate that both BlackRock and Fidelity are attracting significant investor interest and capital.

On the other hand, Grayscale’s GBTC fund experienced a significant outflow of $37.7 million, which was 4.6 times higher than the previous day’s outflow. This sharp increase in outflows from Grayscale’s GBTC could be attributed to various factors such as investors reallocating their assets, taking profits, or preferring other Bitcoin ETF products. Significant outflows from Grayscale may indicate a shift in investor sentiment or a response to recent market dynamics. Ark Invest saw an inflow of $4.31 million, while Bitwise received an inflow of $7.53 million.

Differences in Investor Strategies

The contrasting performance of these major Bitcoin ETFs highlighted the different strategies and responses of investors in the cryptocurrency market. Despite the decrease in volume, the overall positive net inflow into Bitcoin ETFs indicates continued interest in these investment vehicles.

Investors continue to find value and potential in Bitcoin ETFs, albeit with varying degrees of enthusiasm and strategy. The movements in net inflows and outflows provide insights into market sentiment and investor behavior, offering a snapshot of current trends within the cryptocurrency investment community.

Türkçe

Türkçe Español

Español