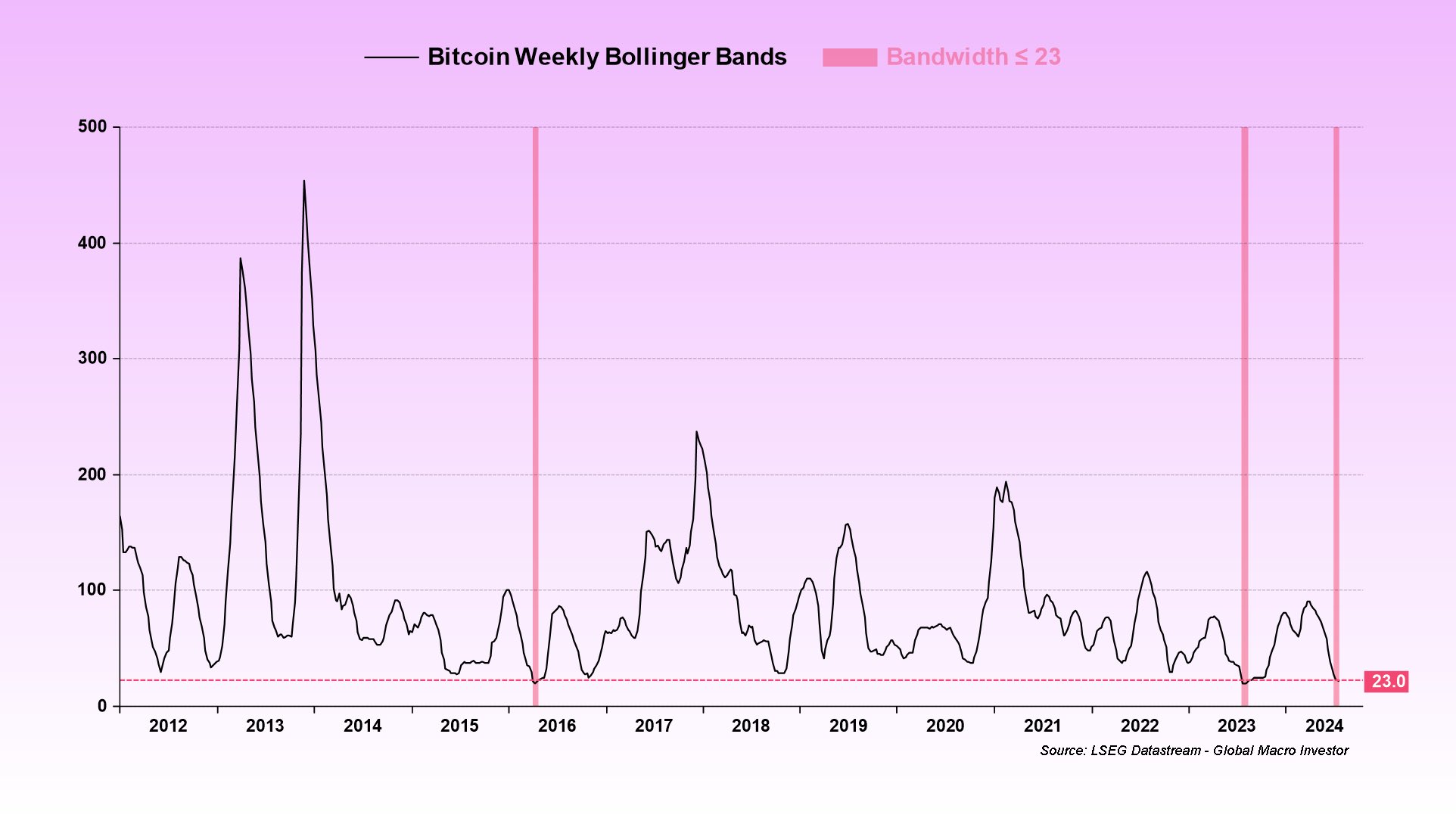

Bitcoin’s volatility has shown an unprecedented level of compression. This situation has led analysts to potentially foresee a significant price increase for BTC up to $190,000. Julien Bittel, the macro research director at Global Macro Investor, highlighted this in a post on X on July 19, indicating that the Bollinger Bands, a significant volatility indicator for Bitcoin, are extremely narrow. Historically, such compression occurs before significant price increases.

Bollinger Bands at Tight Levels for Bitcoin

The Bollinger Bands, which measure volatility and trend strength, are currently at a rare tight level on the weekly BTC/USD chart. Bittel noted that such compression has only been seen twice before, in April 2016 and July 2023: In both instances, Bitcoin’s price experienced significant increases in the following twelve months. This suggests that a similar outcome could be expected now. If these patterns hold, the potential target range for Bitcoin is between $140,000 and $190,000.

In late 2023, a similar compression was observed just before the launch of spot Bitcoin ETFs in the United States, which led to price increases at that time. Bittel’s current analysis strengthens his previous predictions, which called for patience during the deepest price drops of the bull market and indicated a significant rise ahead.

September 2024 Could Be Crucial for Bitcoin

As of July 19, Bitcoin’s price was around $64,000, an 11% increase from the previous week. While this upward movement has renewed confidence among investors, some doubts persist due to the absence of mainstream individual investor interest, a typical feature of previous bull markets. Instead, institutional investors and large-scale holders, known as whales, are leading the current accumulation phase.

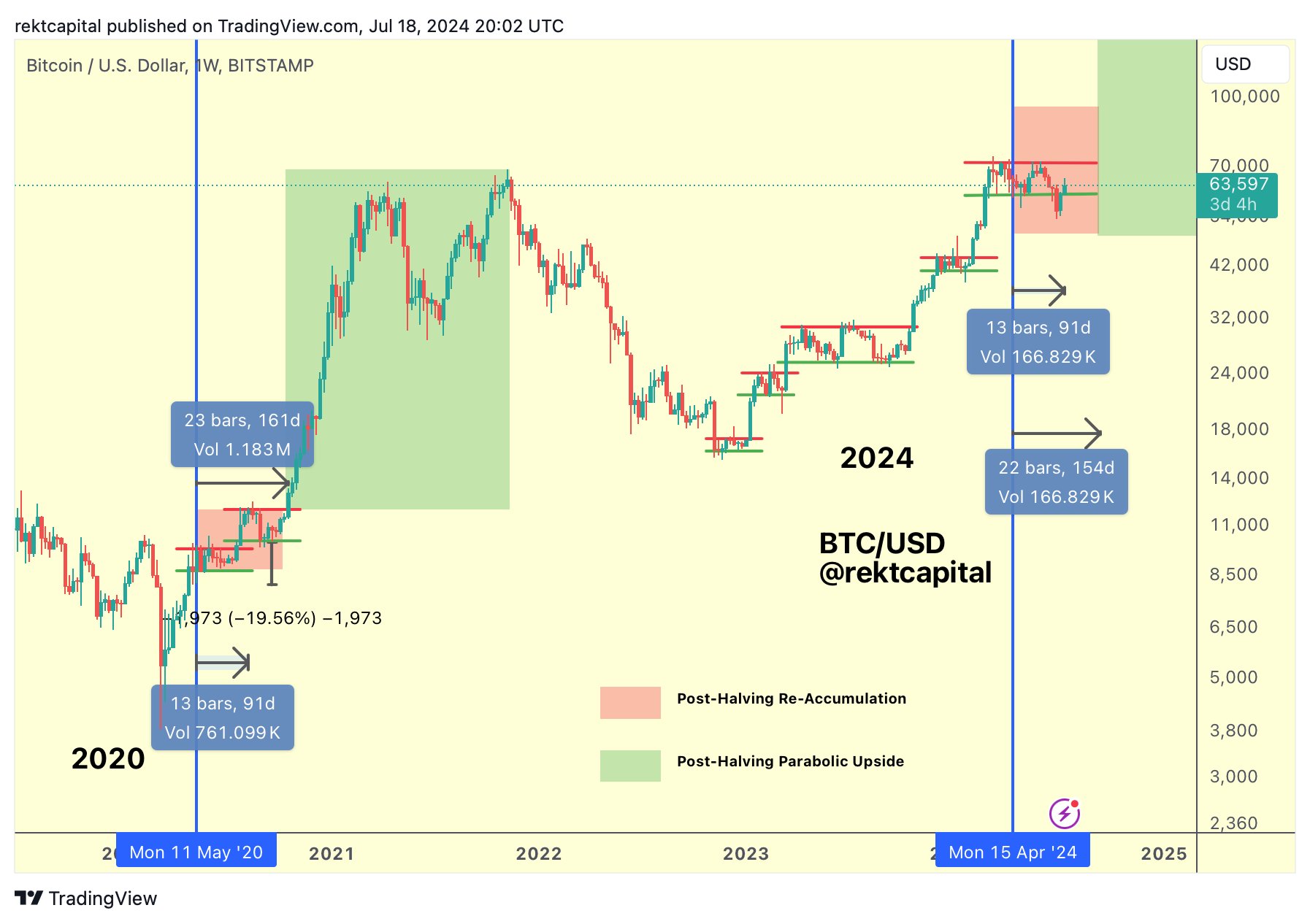

On the other hand, September 2024 is seen as a crucial period for Bitcoin’s price trajectory. Popular trader Rekt Capital suggested that if historical patterns repeat, Bitcoin could break out of its current accumulation range around these dates. This approach aligns with the broader view that, while current indicators are bullish, the market’s ultimate direction will depend on various factors, including broader investor behavior and market dynamics.

Türkçe

Türkçe Español

Español