Bitcoin price surged past $61,800 following the release of the CPI data, leading to quick sell-offs. Short-term fluctuations pushed BTC price down to $49,000, offering satisfactory profit margins for bottom evaluators. Therefore, the recent sell-offs at $61,800 are not meaningless.

Will Cryptocurrencies Rise?

The PPI data was extremely good, and the CPI was also released below expectations today. Although not as great as yesterday, we can say that the data confirms a rate cut for September. If we do not see major setbacks in the next 35 days until the meeting, crypto markets will start pricing in the liquidity easing.

QCP Capital analysts shared their market assessment before the inflation data was released and wrote the following:

“- BTC reclaimed $60,000 overnight and fully reversed last Monday’s sell-offs, stabilizing at these levels. BTC rose further when Bitgo moved $2 billion worth of Mt. Gox BTC last night. This may indicate that the market is starting to ignore this supply factor.

– ETH spot ETFs continued to attract inflows, marking a 2-day winning streak with a net inflow of $24.3 million on Tuesday.

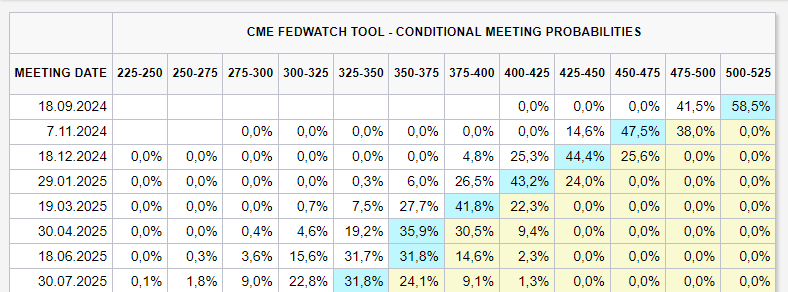

– Last night’s softer US PPI pressure shifted market expectations towards a 50 basis point rate cut by the Fed in September, with a 47.5% probability for 25 basis points and 52.5% for 50 basis points.

– All eyes are on tonight’s US CPI data. A soft CPI could support a recovery in risk assets like stocks and crypto due to expected Fed rate cuts.

Consistent ETF inflows and BlackRock‘s purchase during last week’s dip suggest that crypto is relatively well-supported. However, with no significant catalyst on the horizon, we expect major breakouts to be limited until Q4.”

Cryptocurrency Evaluation

Mt Gox refunds are complete, and many massive sell-off stories are over. The US assets are not being consumed quickly, so they do not pressure the markets much. The good news is that we will start seeing FTX refunds soon. Approximately $12 billion in cash will be returned to creditors. Altcoin prices are favorable, and it would not be surprising if these crypto investors use the refunded balances to buy more crypto.

Moreover, the recovery in the ETF channel, the end of the chaos in the Japanese stock market, and the rapid return of BTC prices suggest that Bitcoin might attempt a new trial at $70,000 by the September meeting.