Bitcoin (BTC)  $94,207 has finally started to stabilize at higher levels, hovering just below its all-time high. The good news is that strong signals indicate a return is underway after a prolonged nightmare in the last two quarters. This week’s JOLTS data exemplifies this trend, highlighting the need for the Fed to lower interest rates more aggressively as inflation declines.

$94,207 has finally started to stabilize at higher levels, hovering just below its all-time high. The good news is that strong signals indicate a return is underway after a prolonged nightmare in the last two quarters. This week’s JOLTS data exemplifies this trend, highlighting the need for the Fed to lower interest rates more aggressively as inflation declines.

U.S. Data and Cryptocurrencies

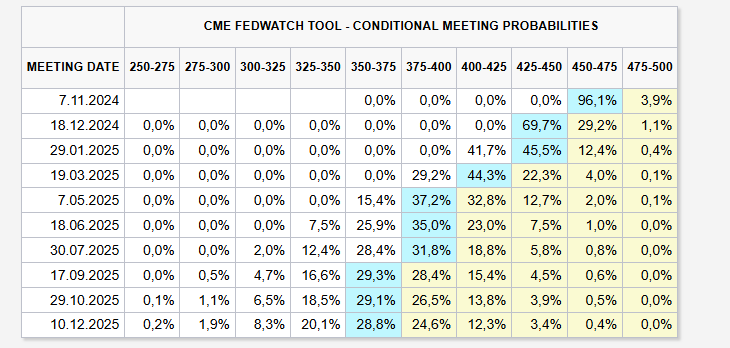

The challenging phase appears to be over. The Fed has commenced interest rate cuts, and unless a significant event occurs, rates are expected to continue decreasing. At this stage, the critical factor is the pace of these rate reductions. The market anticipates a total of 100 basis points in cuts over the year, and current data supports this as the Fed likely continues to lower rates to reach a neutral interest rate in multiple meetings next year.

Key Economic Indicators

What’s the problem? The concern is that the neutral interest rate may rise as inflation declines, which could halt rate cuts. The Personal Consumption Expenditures (PCE) data serves as a leading indicator for the Fed’s monitored inflation metrics, making today’s release crucial. Additionally, the unemployment claims data reflects the employment landscape, adding significance to the figures.

What do we need? A decrease in PCE combined with unemployment claims exceeding expectations would bode well for cryptocurrencies.

- PCE Reported: 2.1% (Expectation: 2.1%, Previous: 2.2%)

- Unemployment Claims Reported: 216K (Expectation: 230K, Previous: 227K)

While the unemployment figure falling short of expectations is not entirely positive, the PCE being in line with expectations can be interpreted favorably.

Türkçe

Türkçe Español

Español