On December 19, spot Bitcoin  $104,372 and Ethereum

$104,372 and Ethereum  $2,516 ETFs experienced remarkable movements. A total of 680 million dollars was withdrawn from spot Bitcoin ETFs in a single day, marking the highest single-day outflow in history. Additionally, spot Ethereum ETFs saw a net outflow of 60.4677 million dollars on the same date, ending an 18-day streak of continuous net inflows.

$2,516 ETFs experienced remarkable movements. A total of 680 million dollars was withdrawn from spot Bitcoin ETFs in a single day, marking the highest single-day outflow in history. Additionally, spot Ethereum ETFs saw a net outflow of 60.4677 million dollars on the same date, ending an 18-day streak of continuous net inflows.

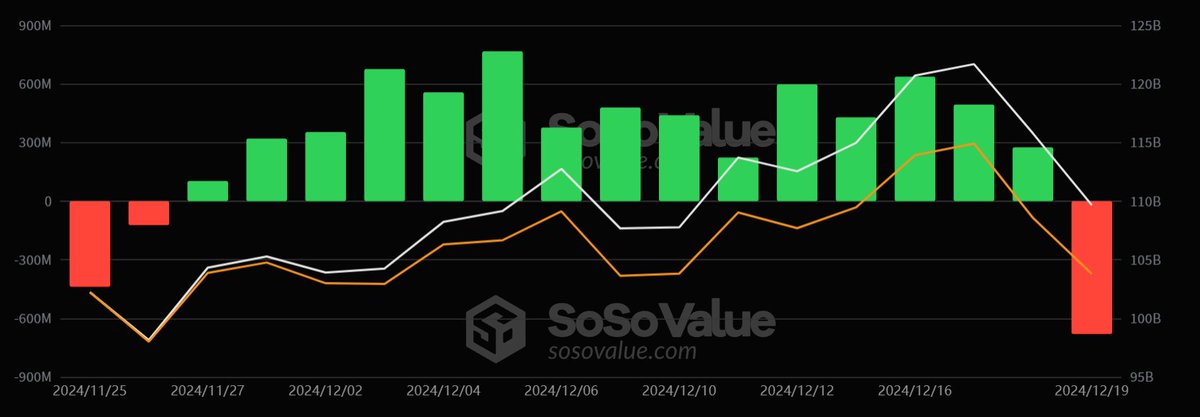

Record Outflows from Spot Bitcoin ETFs

The date of December 19 became a significant turning point for spot Bitcoin ETFs. The net outflow of 680 million dollars signals widespread activity among investors. Previous outflows were recorded at 563 million dollars on May 1 and 541 million dollars on November 4, but this recent outflow far surpassed those earlier records.

Market conditions, including global economic uncertainties and market volatility, are believed to have influenced this movement. Furthermore, this outflow followed a 15-day period of uninterrupted inflows into spot Bitcoin ETFs.

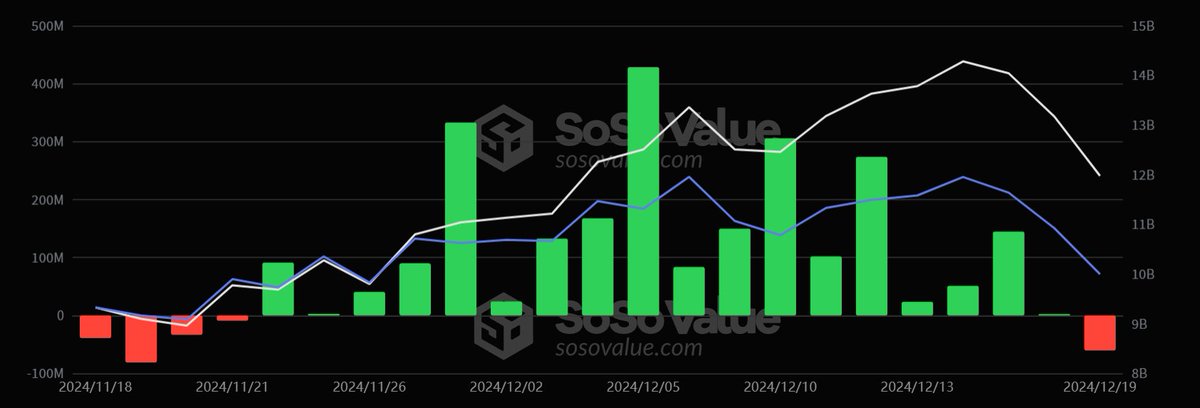

End of Inflow Period for Ethereum ETFs

Spot Ethereum ETFs also underwent a notable shift. The net outflow of 60.4677 million dollars indicates that investors are making strategic changes. This development concluded an 18-day period of continuous inflows.

The recent steady performance of Ethereum is now being questioned due to this outflow. Experts suggest that this situation may be related to volatility in the Ethereum market. Additionally, year-end balance sheet adjustments by investors might have triggered this movement.

Overall, the outflows from spot Bitcoin and Ethereum ETFs highlight investor behaviors within the cryptocurrency market. These developments clearly showcase the fluctuating nature of trends in the sector and the impact of global markets.

Türkçe

Türkçe Español

Español