Bitcoin  $103,871 has faced a grueling 24 hours for traders, with altcoins suffering even more. The significant erosion of hope and the increase in negativity might seem discouraging, but they can also signal a potential uplift. Such movements often occur during peak fear periods. What insights can a 50-year trading veteran provide in these turbulent times?

$103,871 has faced a grueling 24 hours for traders, with altcoins suffering even more. The significant erosion of hope and the increase in negativity might seem discouraging, but they can also signal a potential uplift. Such movements often occur during peak fear periods. What insights can a 50-year trading veteran provide in these turbulent times?

Famous Trader’s Bitcoin Prediction

Veteran trader Peter Brandt shared his latest assessment of Bitcoin today. Over the years, Peter has generally not offered much optimism regarding BTC. While he often fuels negativity, he occasionally hints at bullish signals as well.

His latest evaluation may further dishearten investors already in despair.

“Charts always change. Thus, we should never fully trust any formation. Intraday charts evolve into daily, weekly, and monthly trends until a working chart emerges.”

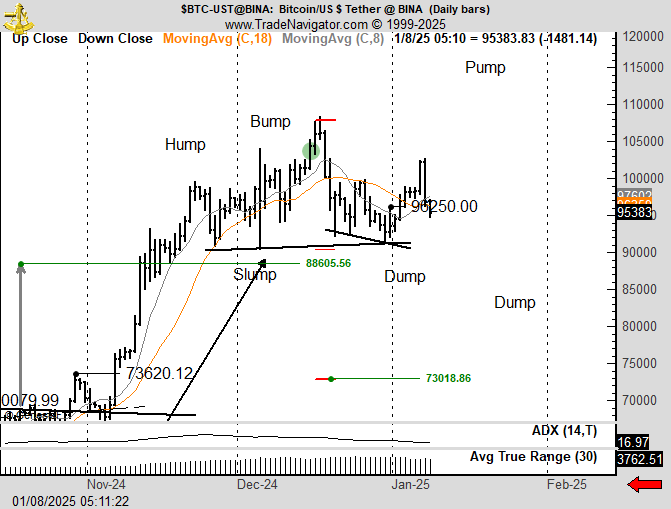

“Bitcoin’s main trend continues to rise, but the daily chart is tracking an H&S peak – this formation could drive prices to $73,000 or transform into something else.”

“Charts do not predict prices or trends. Charts always fail. Their true value lies in timing periodic asymmetric risks.”

“My historical winning rate in trades is 50% and fluctuating. Historically, only 15% of my trades yield income, while the other 85% balance each other out.”

If Peter’s analysis is accurate, altcoin prices might dip to levels seen when BTC fell to $20,000. This could trigger significant panic selling. But does the worst always happen?

Cryptocurrencies Will Rise

Based on historical data, we spoke about seeing a market uptrend in 2024-2025. The surge in BTC following the 2022 crash was remarkable, and the effects of FTX refunds will soon be apparent. However, daily losses of 5-7% in BTC prices are fostering feelings of despair among investors.

If history repeats itself without a different trajectory for cryptocurrencies, we should see new peaks in altcoins before the year ends. The halving event has historically spurred rises in ETH and altcoins every time. Institutions are accumulating billions in BTC, and a crypto-friendly president is on the horizon in the U.S. What more is needed for a genuine uplift by 2025?

Türkçe

Türkçe Español

Español