In about a year, the Bitcoin halving will take place and miners’ reward per block will decrease by 50 percent. So far, bull seasons have always been blatantly obvious. The short-term sentiment is more bearish in the bear season and more bullish in the bull. But most investors don’t care what happens in the long run.

Bitcoin Halving

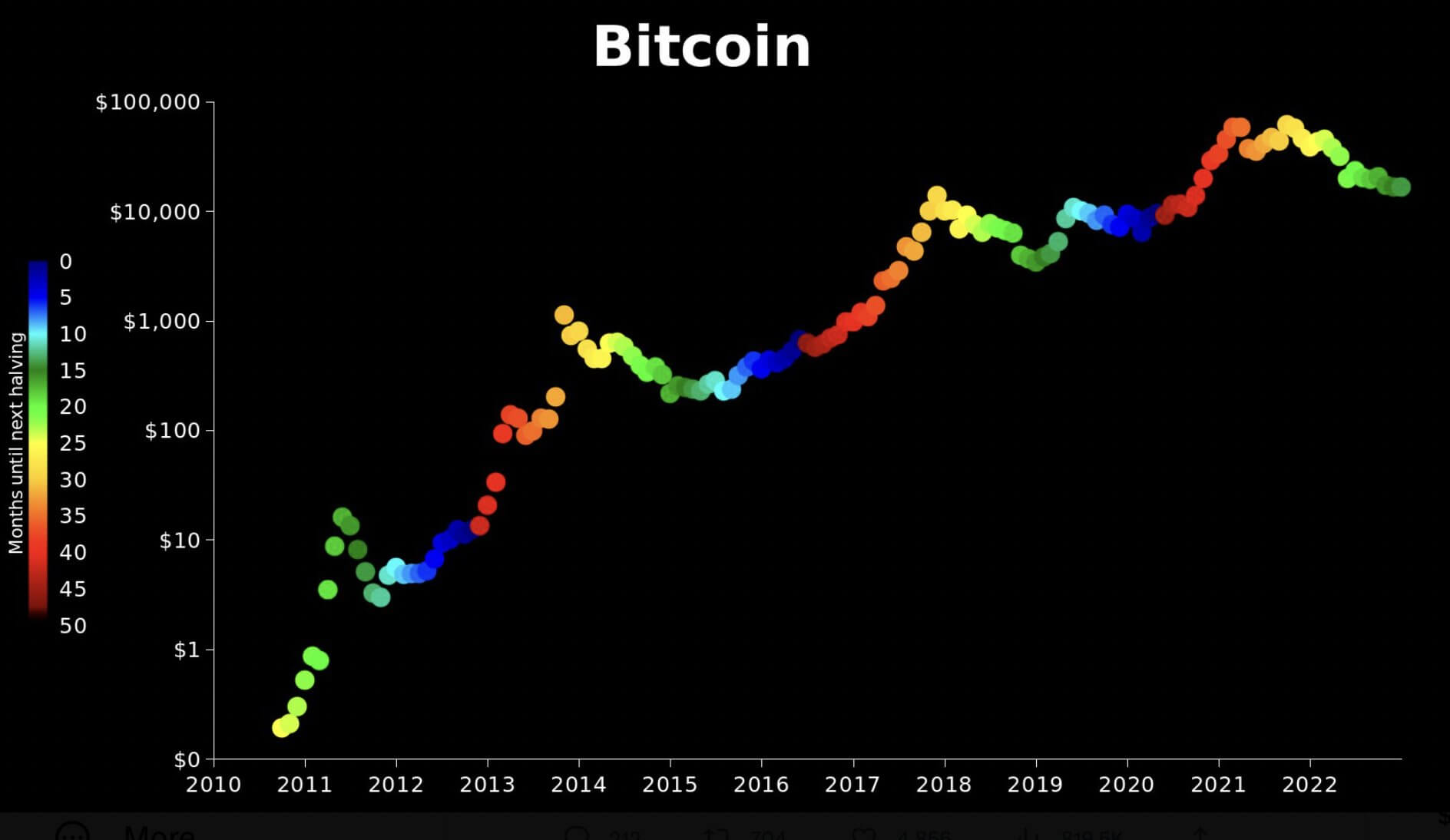

The Bitcoin price has so far stuck to 4-year cycles. In these cycles, we’ve seen lows and highs, as well as long periods of boring sideways price action. We probably reached the bottom of the last cycle in November 2022 and are now entering a period where bullish sentiment can be fueled. The boring sideways movement was experienced by investors last year.

In these cycles, the bottom was usually marked at least a year before the halving occurred. For longtime Bitcoin followers, including crypto guru Pete Rizzo, there’s little reason to believe the future will be drastically different.

“Just a reminder, the world’s most valuable coin is only designed to get scarcer. Plan accordingly.”

Rizzo pointed out the consequences of the previous halving on the price with the chart below.

The Future of Cryptocurrencies

The bottom is in, we’ve had most of the boring sideways days and everyone is hopeful for 2024. Investor and entrepreneur Alistair Milne goes even further, saying that now is the right time to invest in BTC. So he has more faith than hope.

“Don’t short sell when it’s dark green and own it all before it turns blue…”

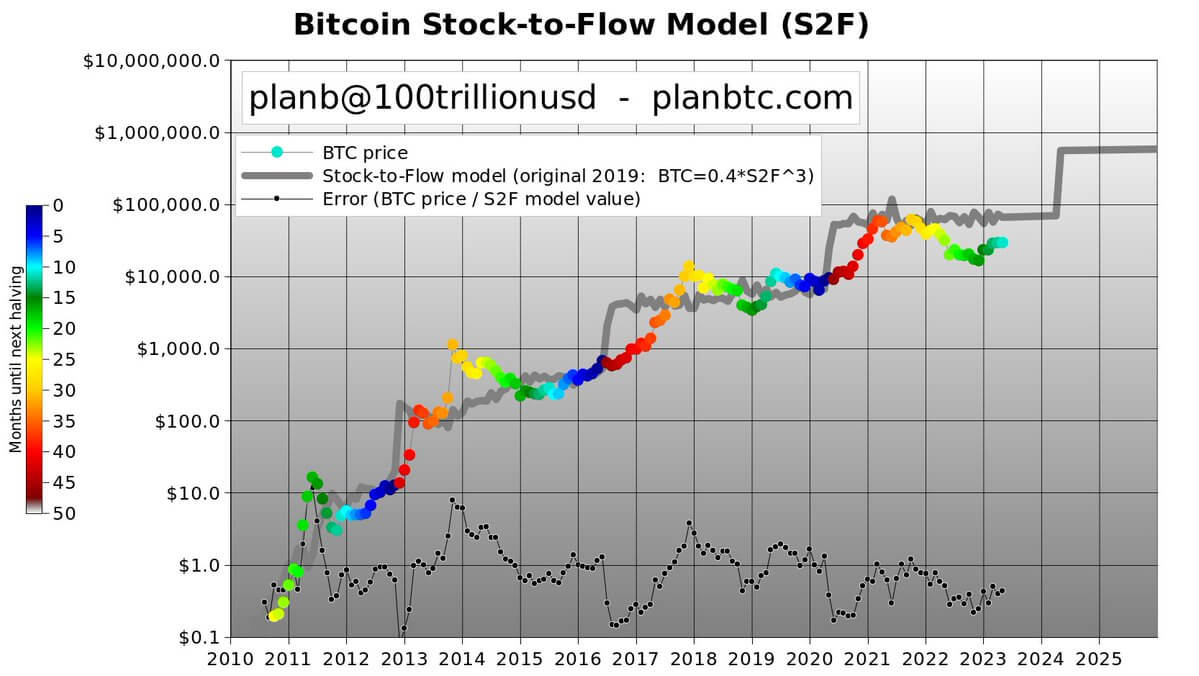

Meanwhile, earlier in the month, another popular but controversial name in the Bitcoin industry used the same halving rhetoric to insist that price cycles are not a matter of luck. PlanB, the inventor of Stock-to-Flow (S2F) Bitcoin price prediction models, claimed in his post that half of market participants think the relationship between halving and price is random.

“Why isn’t Bitcoin S2F/halving priced in? Because ~50% think the jumps in BTC price after the last 3 halvings (red) are coincidence”.

We know that his $100k Bitcoin price target at the end of 2021 has significantly damaged his reputation. But what if he’s not wrong about halving again? The S2F model worked great during the bull season, so maybe we’re entering the days when he’ll be back among the favorite analysts.

Türkçe

Türkçe Español

Español