With a market cap of $525.87 billion, Bitcoin (BTC), the largest cryptocurrency in the world, continues to trade under sell-off pressure, losing 2.26% in value in the last 24 hours. As of the time of writing, Bitcoin, trading at $27,134, would mark its first negative monthly closure in four months if it maintains its current trajectory.

Since the beginning of the year, Bitcoin prepared to close its monthly candle in the red for the first time. Although BTC had successfully increased its value by 68% since New Year’s day, it has experienced a 6.5% loss on a monthly basis. At its peak of $31,000, Bitcoin’s gain from the beginning of the year was at 84%, but due to the sell-off pressure it faced throughout the month, this gain fell to 67%. Despite the trust in the leading cryptocurrency amid the banking crisis that broke out in the U.S. in March, this proved to be a momentary reaction.

Bitcoin climbed above $28,000 on May 30th upon the news of the U.S. raising its debt ceiling. However, this jump was short-lived and Bitcoin’s direction swiftly turned downwards following the fall in the U.S. stock markets. Market observers suggest that if the sell-off pressure persists, Bitcoin’s price could fall to $23,000.

While investors are on the hunt for potential catalysts that could trigger a rise in BTC and altcoins, John Wu, President of Ava Labs, spoke to Bloomberg, stating, “The thing that needs to be done for a new wave of buying in Bitcoin and altcoins is to demonstrate real benefit and growth to entice crypto enthusiasts to enter the ecosystem.”

A notable increase was seen in the network activity of Bitcoin, which had shown strong price movement since the beginning of the year. This rise in network activity was fueled by Bitcoin Ordinals in the form of NFTs, as well as memecoins. Bitcoin Ordinals and NFTs, using the BRC20 standard, garnered so much interest that they caused an increase in BTC transaction fees and network congestion.

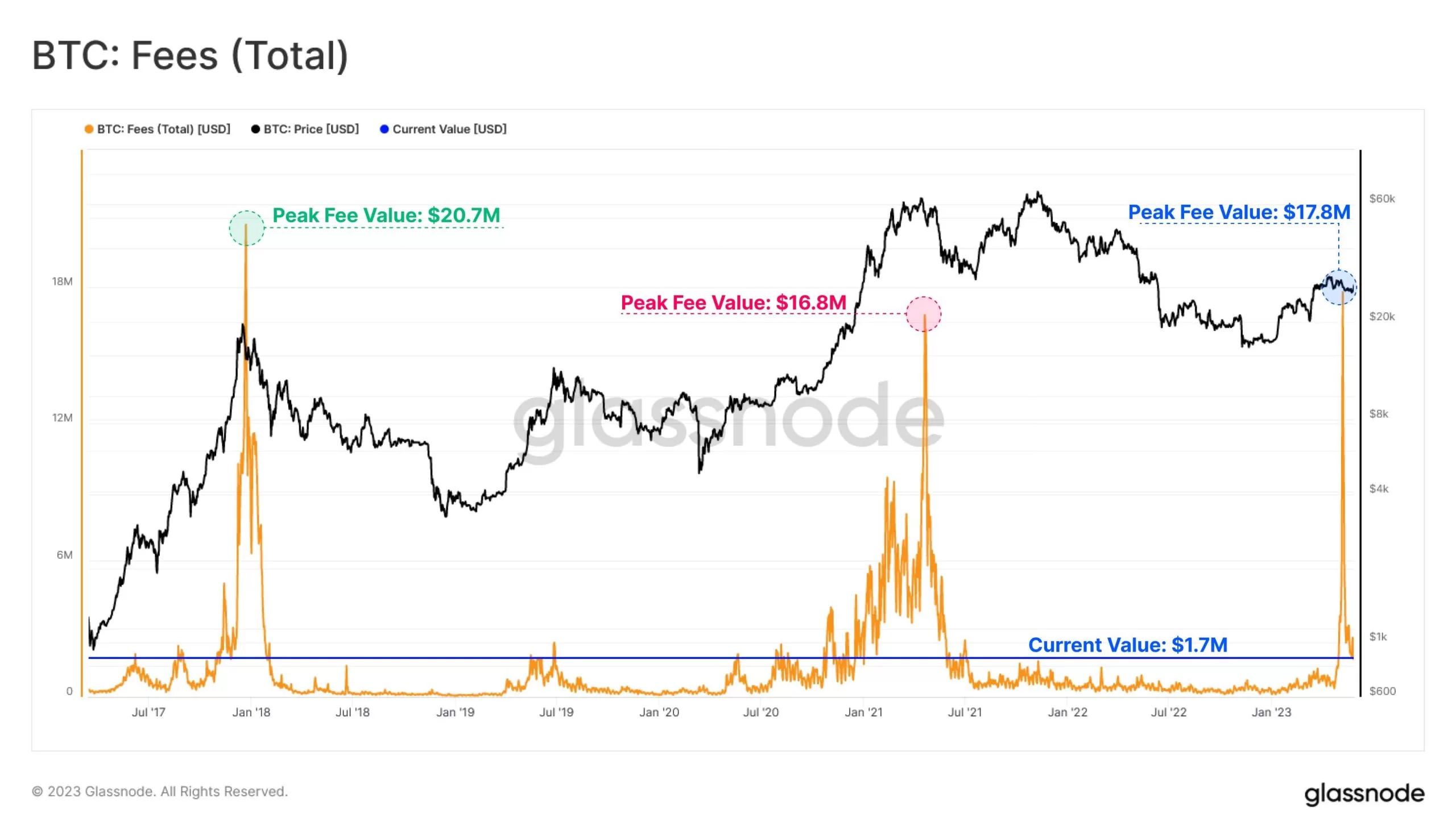

On-chain data provider Glassnode recently commented on BRC20, stating “At the peak of BRC-20 frenzy, Bitcoin miners were earning $17.8 million from transaction fees, and only two trading days during the 2018 peak had higher fee revenue. Currently, miners are earning a fee revenue of $1.7 million, which signifies a drop of $16.1 million from the recent peak. However, this figure is considerably high when compared to past equivalents.”

Türkçe

Türkçe Español

Español